AGI OR PIN and IP-PIN, IPPIN eFile Checkout Instructions

If you are preparing to file your taxes electronically, understanding AGI (Adjusted Gross Income), PIN (Personal Identification Number), and IP-PIN (Identity Protection PIN) is crucial for a smooth process. This page will walk you through how to use these security features and complete your eFile checkout effortlessly. Follow these simple instructions to ensure your tax return is filed accurately and securely.

A. AGI (Adjusted Gross Income)

When you're filing your taxes electronically, the IRS needs to confirm your identity using your previous year's Adjusted Gross Income (AGI). For example, if you are e-filing your 2024 tax return in 2025, you will need the AGI from your 2022 tax return. This AGI is stored in your My Account section on eFile.com. So, be sure to have this information handy to complete your filing.

B. Previous Tax Year PIN

Another way to verify your identity is by using the Personal Identification Number (PIN) from your previous year's tax return. If you filed your last year's return using eFile.com, you should enter this PIN when prompted. This PIN was used to sign your return electronically. Keep in mind, if you used a different service to file last year, you can NOT use that PIN on eFile.com. Make sure you use the PIN associated with your eFile.com account for a smooth filing experience.

C. IP-PIN (Identity Protection Personal Identification Number)

The IP-PIN is a special 6-digit code given by the IRS to protect your identity. Each year, the IRS issues a new IP-PIN, and it is required for e-filing your tax return. If you have an IP-PIN, you must enter it correctly during the eFile.com checkout process. The IRS will check this IP-PIN against their records. If they don’t match, your e-filed return will be rejected. You might have an IP-PIN if:

D. Current Tax Year PIN

When you file your current year's tax return electronically, you'll create and use a new 5-digit PIN to sign your return. This PIN is different from the IP-PIN issued by the IRS. Be sure not to use "00000" as your PIN. Next year, when you file again, you can use this new PIN for verification, as explained in Section B.

If the AGI (Adjusted Gross Income), IP-PIN (Identity Protection PIN), or signature PIN you enter while e-filing does not match the information the IRS has on file, your tax return will be rejected. If this happens, you'll need to correct the incorrect information and re-submit your return. Don’t worry—re-filing is free of charge. Keep adjusting and re-filing until the IRS accepts your return.

AGI, PIN or IP-PIN entry during checkout

1. Sign in to eFile.com

Step 1: Sign in to eFile.com

Step 2: Click on File or File Now on the lower left menu or on the My Return page at the bottom and proceed with the checkout process.

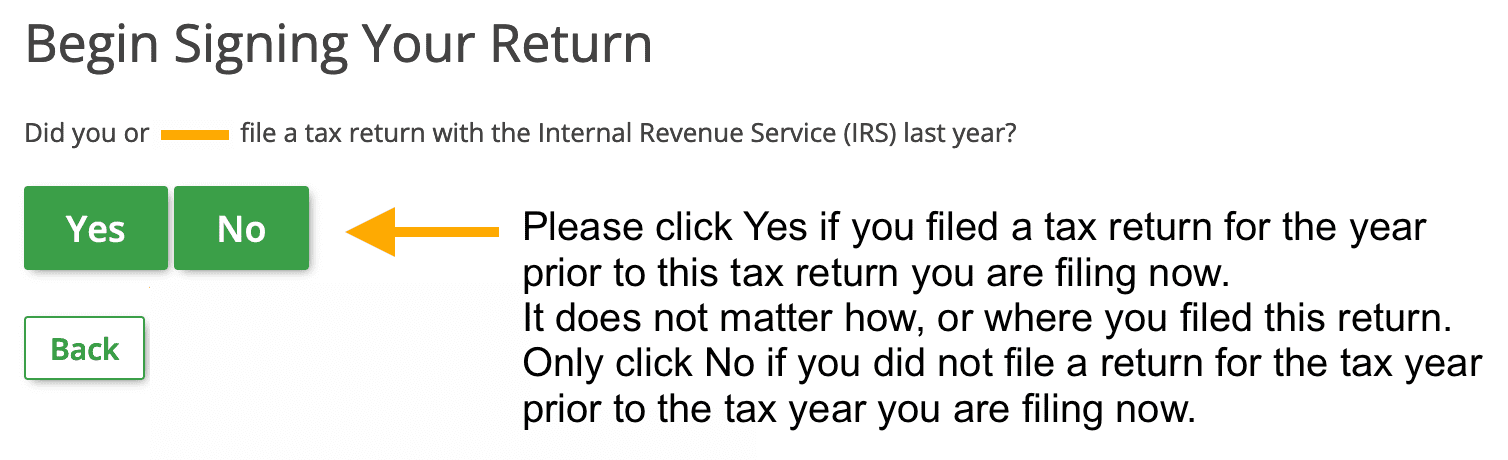

2. Did You File A Previous

Tax Year Return?

Begin signing your Tax Return by verifying your identity online with the IRS. If you filed or e-filed a previous year federal tax return (and/or your spouse if you're married filing jointly) by any method (online via eFile.com, on paper, on another website, or with a tax preparer), then select the green Yes "button.

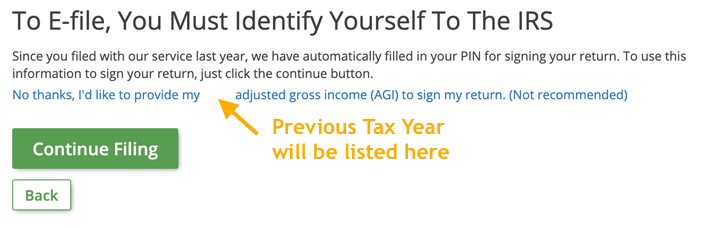

3. AGI or PIN?

If you filed a previous year tax return and answered Yes above, you now have the option to enter your previous tax year return PIN or AGI - Adjusted Gross Income.

You can ONLY ENTER THE PIN if you e-filed via eFile.com last year, otherwise you MUST select the AGI option.

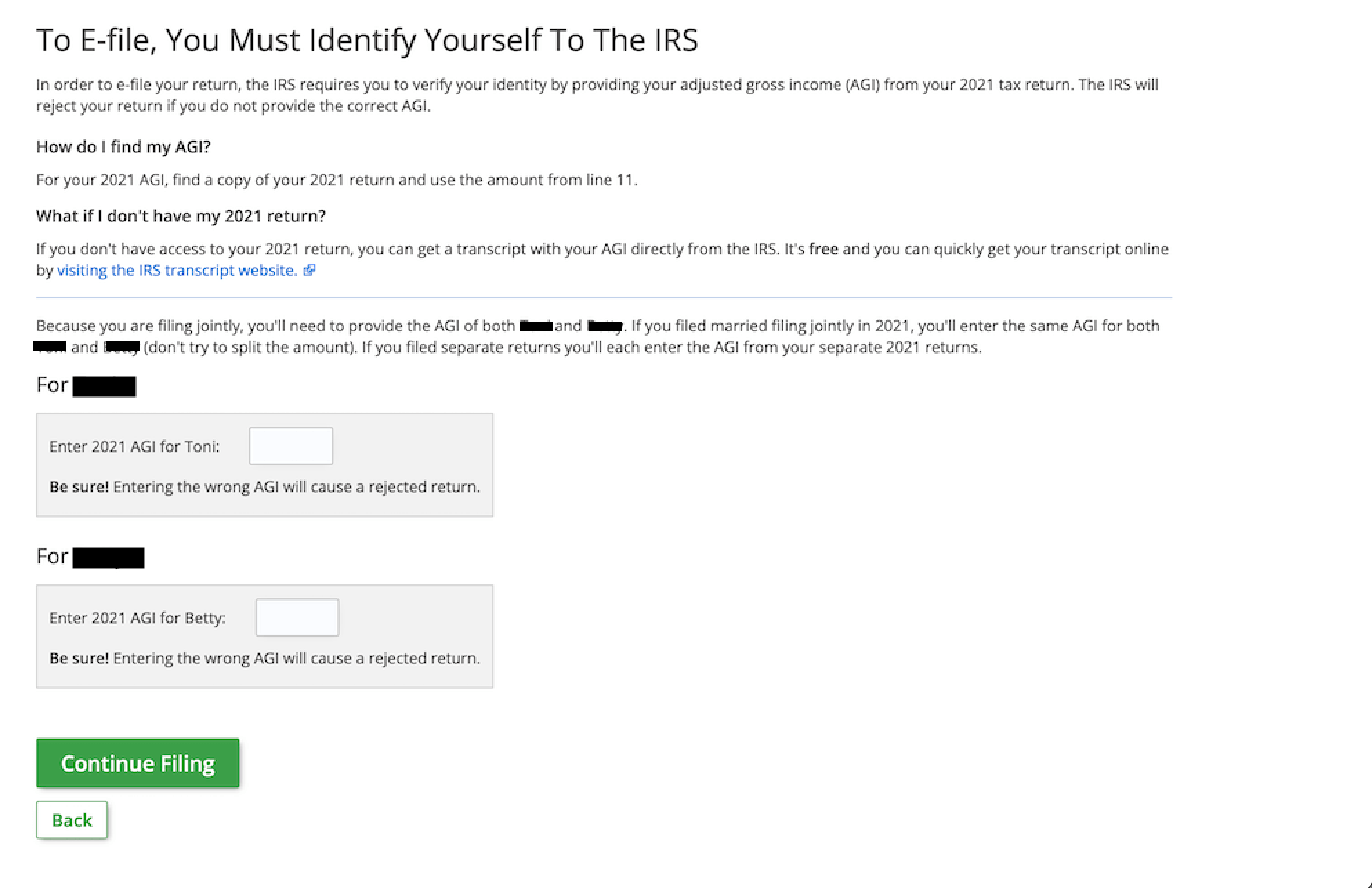

4.1 AGI Entry

See instructions on

how to obtain your previous tax return year AGI. See Form 1040 and Line 11 of your previous year return for your AGI amount.

In the case of Married Filing Joint, enter your spouse's AGI as reported on the previous year tax return.

Note: The IRS might reject your tax return return due to an incorrect AGI amount even if you have entered in the correct amount here. In this case,

follow these AGI correction and re-file instructions.

4.2 PIN Entry

You will only be prompted to enter your previous year PIN if you selected this option and if you e-filed your last year's return via eFile.com. Enter your 5 digit PIN and if applicable the PIN for your spouse. This PIN is NOT Listed on your last year's return. If you do not remember last year's PIN, enter your last year AGI.

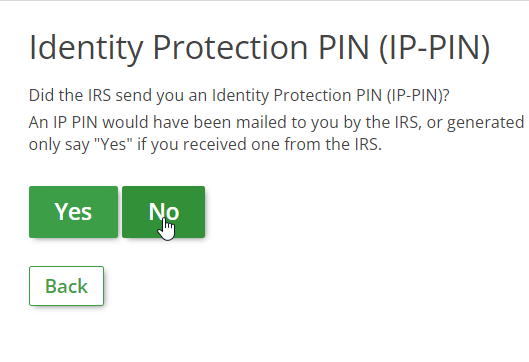

5. IP-PIN

Press

Yes only if you have either received an IP-PIN from the IRS in the mail or if you registered an IP-PIN via

your IRS account . If you do not have an IP-PIN, press

No.

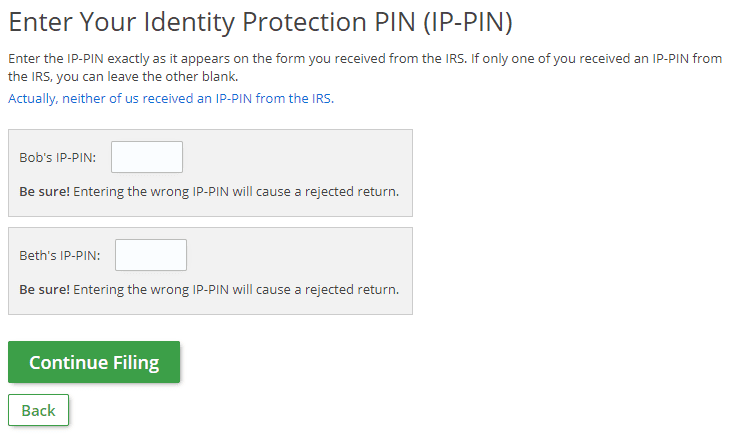

6. Enter IP-PIN

This screen will only show if you pressed

Yes in the above step. Enter the IRS IP-PIN here for you and/or your spouse. If one of you DID NOT receive an IP-PIN, leave the respective field blank. You can

get a new IP-PIN from your IRS account .

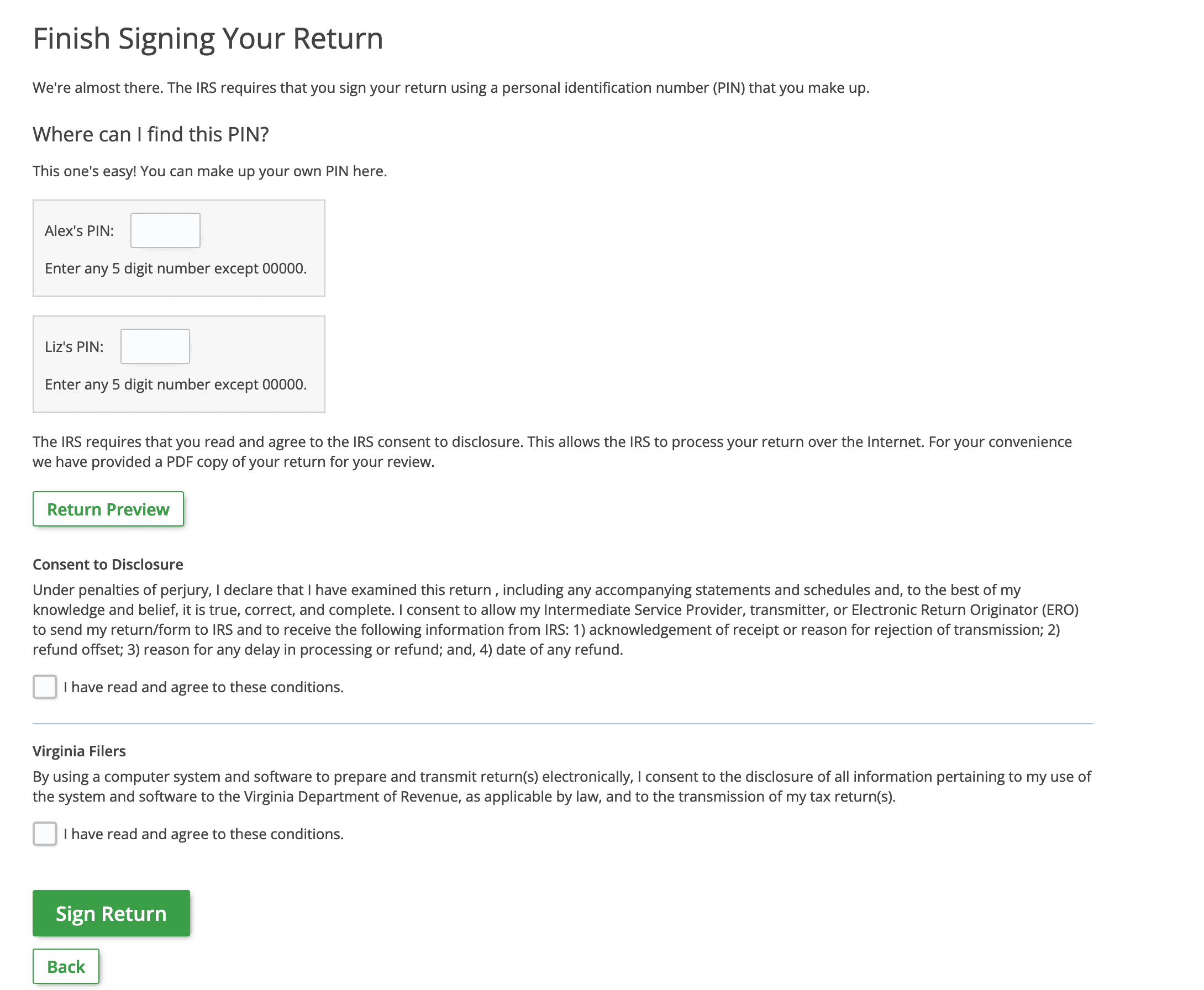

7. Sign Return

Enter New PIN

Here, you sign your return by creating and entering a PIN for this year's tax return. Make sure you keep this PIN stored in a safe place as you can use this PIN again next year. You will not need this PIN for any other purpose.

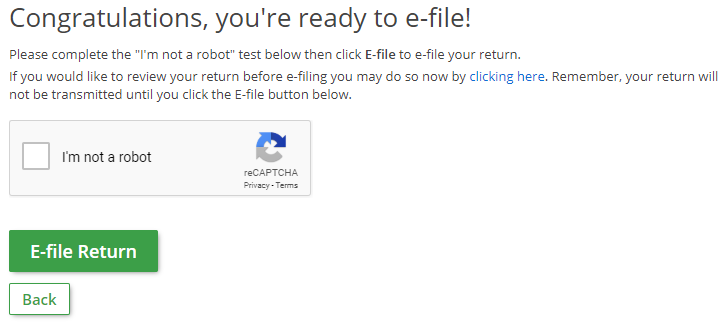

8. Completed

After entering all your identifying information, reviewing your return, and signing it, you are now ready to file. Be sure to officially e-file your return by completing the reCAPTCHA prompt and selecting the green

E-file Return button -

your return is not e-filed until you complete this. See

what to do if the "I'm not a robot" test does not appear.

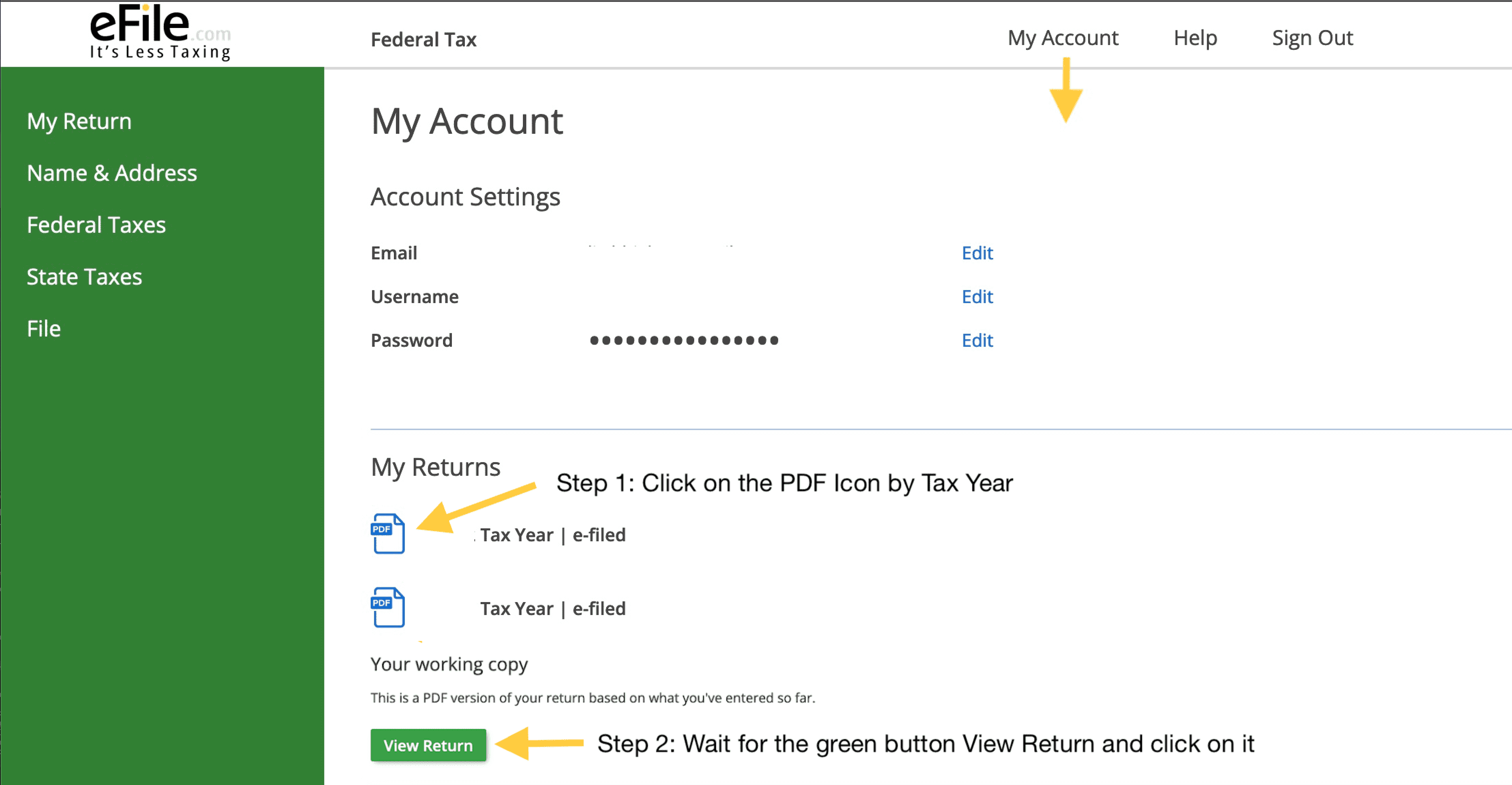

10. Download PDF Return

At any time, download and store your tax returns via your My Account page. Once they are accepted, download and keep copies for your own records and

start tax planning for next year.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.