How to Pay IRS, State Taxes on eFile.com

As long as the return or extension that you e-filed was on or before the

April 15 Tax Day deadline and your payment date was scheduled before then for the full amount, you should not face any

IRS late payment penalties. Keep an eye on the bank account you provided when you filed your return; if the funds are not taken by the IRS by the date you set or

Tax Day, double check the bank account information you gave and consider

contacting the IRS. If you cannot locate your bank information or have further concerns with this,

contact us so we can help you verify if and how your payment information was submitted.

During the e-filing your return or checkout process on eFile.com, you can pay your taxes owed via electronic fund withdrawal or EFW from a bank account (direct debit) or check/money order. You can only submit tax payments for the current tax year, not previous or future tax years. See alternative IRS and state tax payment options if you decide not to use the payment options below.

Pay Taxes Online: IRS or Federal | State(s)

If you are concerned about not paying your taxes owed, find out what to do if you owe taxes and cannot pay. Even if you cannot pay the taxes you owe, prepare and e-file your next tax return as soon as you can. If you miss the April 15 deadline, to avoid or reduce higher IRS late filing penalties and interest, file as soon as possible. Filing a tax extension does not give you more time to pay.

Immediate IRS Tax Payment Options

When it comes to paying the IRS and or state taxes, there are essentially three scenarios. When e-filing your taxes via the eFile Tax App, you have the direct bank transfer and check or money order payment methods available. Taxpayers who owe typically fall into the following categories:

1. Ready to pay now: A taxpayer has the funds required or is okay with paying taxes by credit/debit card now.

2. Not ready to pay now but over time: A taxpayer does not have the funds now to pay taxes on time, but does want to pay over time via tax payment plans.

3. Doesn't want to pay taxes now or later: A taxpayer does not have the funds and/or does have the funds, but does not want to pay taxes now nor over time in the future.

This page focuses on how to pay taxes - see how to set up a payment plan if you do not yet have the funds.

Electronic Fund Withdrawal from Bank Account (Direct Debit)

Note: the images below are for informational purposes and are not interactive.

1. Sign into your eFile.com account.

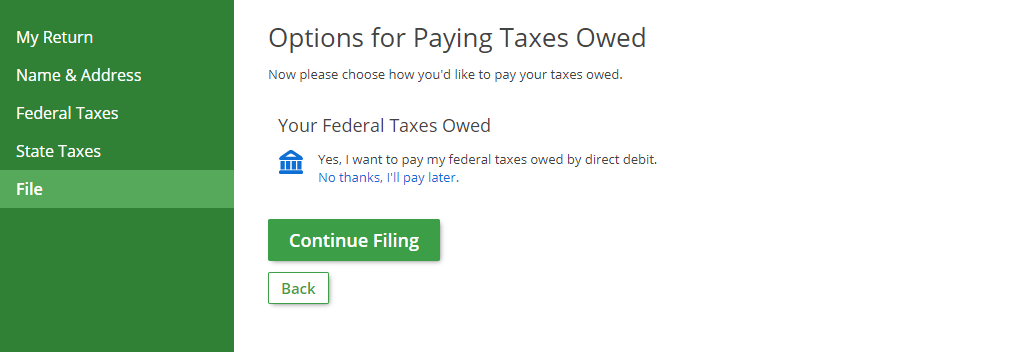

2. Select "File" in the green menu box on your eFile.com account screen and follow the on-screen prompts until you reach this screen:

Since "Yes, I want to pay my federal taxes owed by direct debit" is automatically selected for you, select "Continue Filing".

Note: If you owe state taxes, you will see your state tax payment options on your "Options for Paying Taxes Owed" screen.

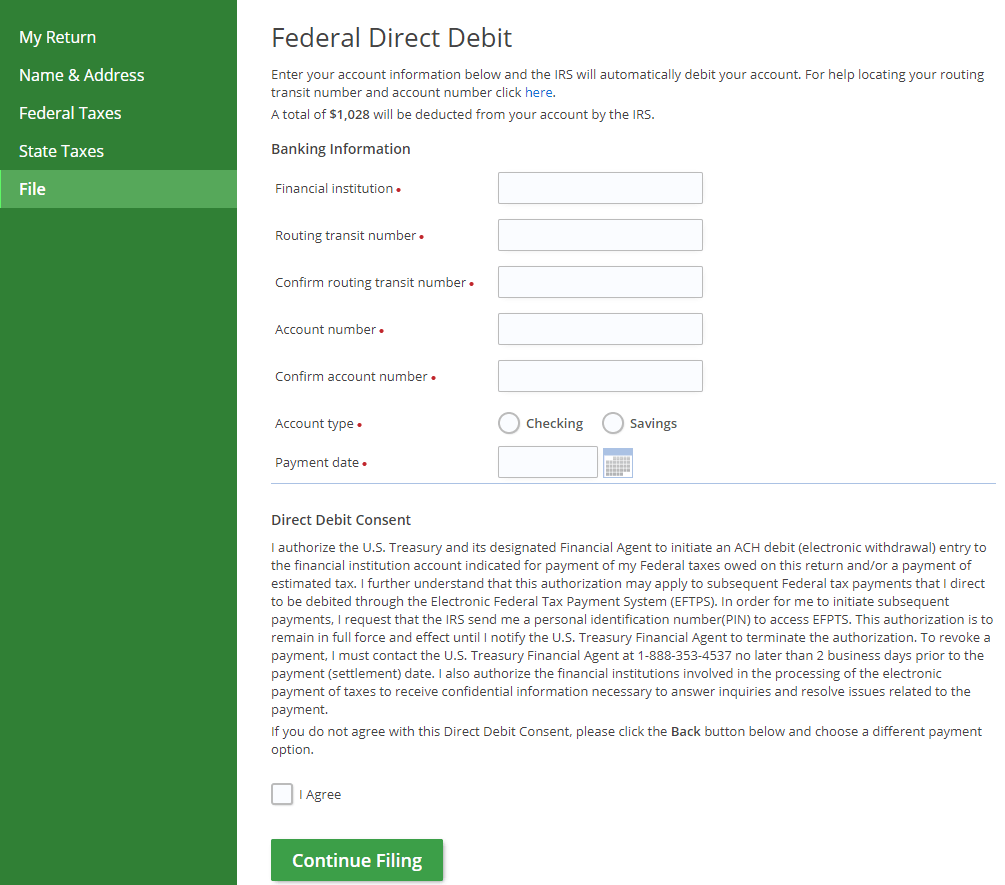

3. Enter your federal direct debit payment information on this screen:

If you are filing your tax return after Tax Day, you will see this message instead of the "Payment date" field: After the filing deadline, your direct debit payment will be authorized on the day you file your return.” Important: Make sure that you double-check the bank information you entered before selecting "Continue" and submitting your tax payment with your tax return. If the information is incorrect or the account is closed, your payment will not be processed by the IRS. Additionally, this cannot be changed until you file again the following tax year.

4. If you owe state taxes (and only if your state accepts tax payments via direct debit), you will go to a screen similar to the one in Step 3.

5. Follow the rest of the on-screen prompts to file your tax return and submit your payment(s). Your bank statement will list “US Treasury” and a PIN or access code to reference the transaction(s). The PDF copy of your return includes an ACH payment page with your direct debit information.

Pay Later: Online or Mail a Check/Money Order

Note: the images below are for informational purposes and are not interactive.

1. Login to your eFile.com account.

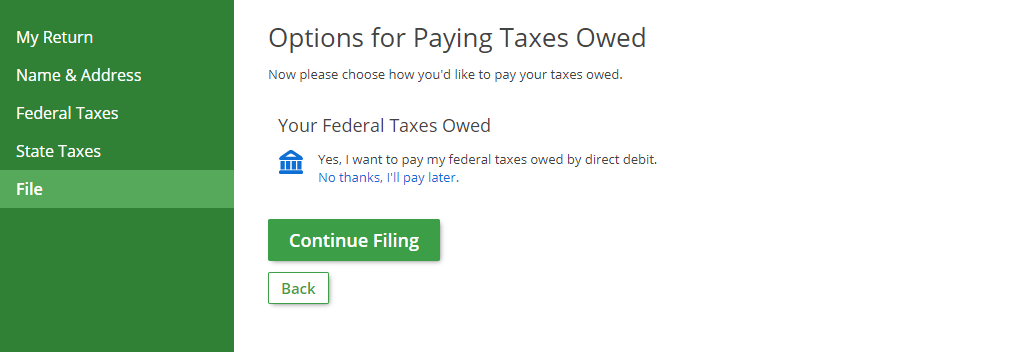

2. Select "File" in the green menu box on your eFile.com account screen and follow the on-screen prompts until you reach this screen:

Select the blue "No thanks, I'll pay later" link to select the check/money order payment option. After you select the link, you will see this message:

"You have chosen to pay your federal taxes later. (Check your return PDF for a payment voucher.)"

Select "Continue Filing" and follow the rest of the on-screen prompts to e-file your tax return.

If you owe state taxes, you will see your payment options on your "Options for Paying Taxes Owed" screen.

3. Select "My Account" on the upper right corner of your eFile.com account screen. Under "My Returns," you will see a PDF icon link next to each tax return you prepared and filed with us. Select the tax year return link you wish to download and print out.

Recommended: 4.1 Keep a copy for your records. Take note of your taxes owed and go to the IRS payment page to submit your payment online using the amount from Form 1040, Line 37, Amount You Owe. Pay as little or as much as you can to reduce or eliminate IRS penalties. If you do not pay the full amount, you can return to this page later to submit more money to the IRS.

4.2 If you do not wish to pay online or cannot for any reason, then print out payment voucher Form 1040-V which contains all the necessary instructions on how to pay your federal taxes owed. You should see the payment voucher in your return PDF if you qualify for the form based on the information you enter as it is generated for you. If you owe state taxes, you will also see a payment voucher form in your state return.

5. On your check or money order, make the payment to "United States Treasury" and write your Social Security number, phone number, tax year, and the tax return form you filed on the front. Do not paperclip or staple the check or money order to Form 1040-V.

6. Mail your check/money order and payment voucher to the correct IRS mailing address based on your state residence. You can also find the appropriate mailing address on Form 1040-V.

Any questions about paying your taxes? Contact us and we can help you.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.