How to Obtain, Download a Tax Return Copy

Keeping a copy of your tax return has many benefits. Your IRS and state tax return(s) are stored on eFile.com if you prepared your return(s) via eFile.com. As an existing eFile.com user, you can access your previous year's tax returns for up to 7 years - your latest three returns are stored directly in your account for your convenience.

Attention: Depending on why you need a tax return copy, you might be able to get a tax transcript instead as it's easier to obtain and the IRS provides these for free.

Why to Save a Copy of Your Return?

Tax return copies serve as proof of your income for:

Having last year's return can also be helpful to figure out your tax withholding. When you plan your W-4 Form or tax withholding, refer to your previous year's return to balance your tax withholding accurately. Use our free W-4 tools to help you keep your money during the year.

In case you receive a letter from the IRS or you get audited by the IRS and/or state, you will need to refer to last year's return.

Use the steps below to find and store a copy of your latest income tax return(s).

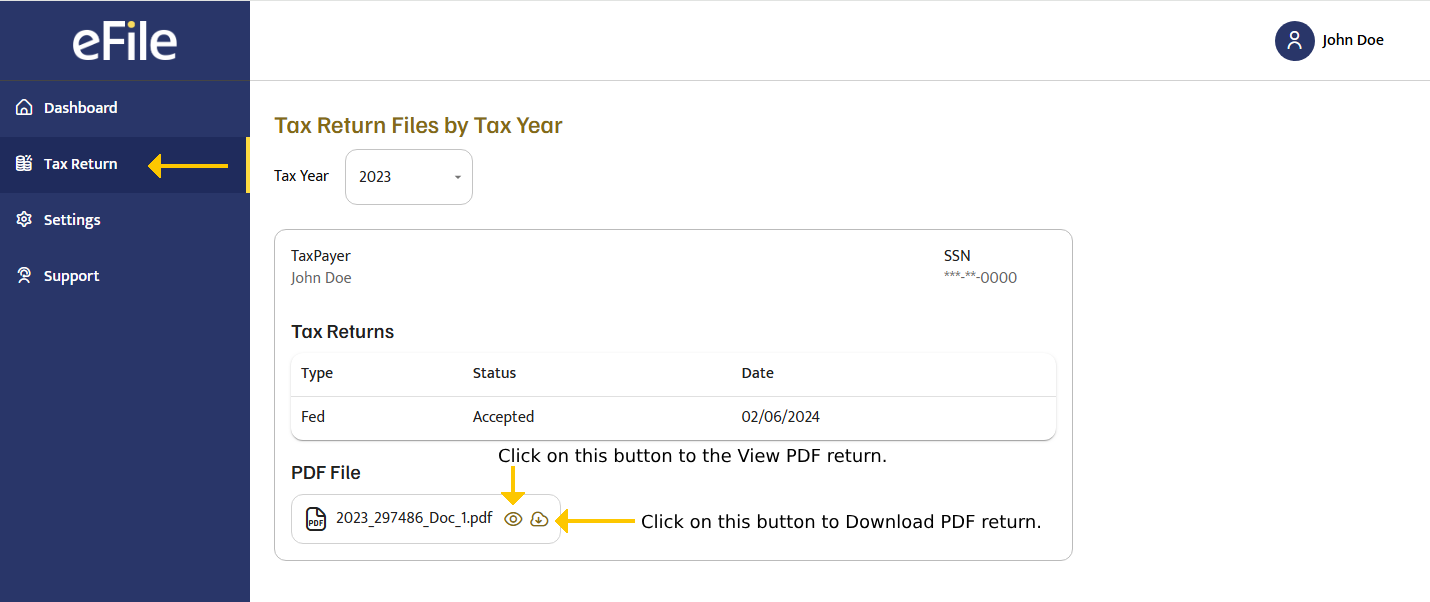

1. Tax Return Copies of Returns PREPARED Via eFile.com

2. Your My Account and a List of PDF files

The last three years of your returns

are stored here for free. Select the PDF icon for the respective tax year; based on your browser settings, the PDF will either open in a tab or prompt you to download the file.

Android and iPhone users: select the three dots in the upper-right corner of your device or follow these

mobile user download instructions.

3. Returns Older Than 3 Years

Contact us for returns prepared on eFile.com that are older than three years. Generally, for existing 2025 tax year customers, returns may be free up to the last 5 years. For previous customers who are not using eFile.com during the 2025 tax year, a small fee might apply, which is contingent on account history.

Archived eFile.com return copies can be obtained at $14.95/per tax year return copy or $9.95/per multiple tax year return copies for the last 7 years. Returns 8 years or older can be obtained for $29.00 per copy electronically via eFile.com.

In comparison, the IRS charges $43.00/per return copy, plus you need to complete a form and mail it in. When you do this, the IRS will send the tax return copy via postal mail to you which takes considerably longer. If the IRS does not find the return, they will return the fee.

4. State Tax Return

State tax returns are stored together with the federal tax return under My Account as outlined above and are included in the PDF file.

2. Tax Returns Copies of Returns NOT PREPARED Via eFile.com

1. Get a Copy NOT Prepared on eFile.com

Contact the online platform, tax app provider, or professional office where you prepared or had your tax returns prepared.

C: IRS Return Copy/Paid IRS Copy

If you cannot download your return from eFile or the other platform you used, complete

Form 4506 now and download, print, and mail it to the address on the form. The IRS fee is over $40 per tax return copy for ANY year's return.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.