2020 Earned Income Tax Credit - EITC or EIC

The Earned Income Tax Credit or EITC is a federal government program that helps low to moderate-income working people get more money back on their taxes. If you qualify, you could get a bigger tax refund or even money back even if you don't owe taxes.

The amount you get depends on your income, family size, and other factors. In 2019, over 27 million people claimed the EITC, receiving a total of around $63 billion.

How Do You File a 2020 Return Now?

You can no longer file and claim a 2020 refund, but you can and should file 2020 taxes if you owe money.

If you still need to file a 2020 Tax Return, you can access the 2020 Federal IRS 1040 Forms here. You can complete previous tax year forms here on eFile.com and sign them online electronically before you download, print, and mail them to the IRS based on your state residency. You can calculate the EIC using the information below, the free calculator, the EITC worksheet, and the free 2020 forms linked on this page. When you use tax software like the eFile Tax App, this is all done for you - only 2024 year returns can be prepared and filed electronically.

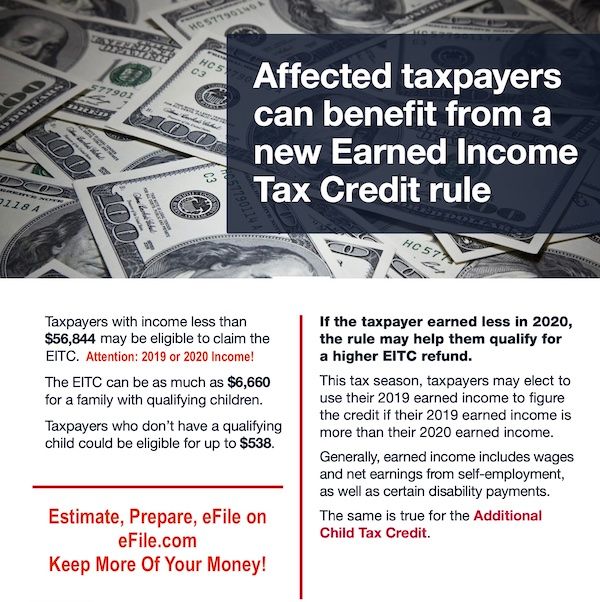

Attention: If your earned income was higher in Tax Year 2019 than in Tax Year 2020, you can use the 2019 amount to calculate your EITC for 2020. This temporary relief was provided through Tax Relief Act of 2020. These same income rules apply in 2020 for the Additional Child Tax Credit. This was also used for 2021 Returns.

Use this simple EITC worksheet to get an easy overview if you qualify or not.

- If your 2019 or 2020 income (W-2 income wages and/or net earnings from self-employment, etc.) was less than $56,844, you might qualify for the Earned Income Tax Credit. Remember, on your 2020 Return, you can use the 2019 or 2020 income to determine your EITC.

- The EITC can be as much as $6,660 for a family with qualifying children.

- Taxpayers who don’t have a qualifying child might qualify for up to $538.

- Review the EITC tables below the tool for more information or simply use to the tool to get personalized information.

You may qualify for the EITC if your 2020 taxable income was at a certain level and you had at least one dependent or qualified child - or if you don't have children but are between the ages of 25 and 65. Let the Earned Income Tax Credit work for you when you prepare and eFile your current year taxes on eFile.com! If you can claim the EITC or EIC, it would reduce the taxes you might owe or increase your tax refund. The credit lifts over 6 million people - including over 3 million children - out of poverty each year.

The easiest way to find out if you are eligible or qualify is by starting the EITCucator below and getting your personal answer about the Earned Income Credit on your 2020 Return. Simply answer the "Yes" or "No" questions and the EITCucator will show you the result.

Tax plan with eFile.com so you are able to e-file your taxes when they are due:

Prepare and e-file your taxes with eFile.com! The Tax App will check if you qualify for tax credits and automatically report them on your Form 1040. It also helps you find and claim all applicable tax credits and deductions. File today and maximize your refund!

Only about 80% of taxpayers who are eligible for the Earned Income Tax Credit claim it. Don't miss out on the money you deserve! Read more about the Earned Income Tax Credit and see how much you may be refunded.

Once you have determined your EITC eligibility, we suggest you use the 2020 Tax Calculator, or TAXstimator, to calculate and estimate your tax refund (or taxes owed) for the 2020 Tax Year.

2020 EITC Qualifications: Dependents, AGI, and Filing Status

Below, find the limits outlined to qualify for the EITC. The table is organized by filing status, number of children or dependents, and your maximum adjusted gross income or AGI shown in the Limit column. These three factors are key in determining your eligibility for claiming the EITC. As stated above, the amount in the Limit column can be your 2019 AGI or your 2020 AGI, whichever is higher.

Single, Head of Household, or Widowed

Zero

$15,820

Single, Head of Household, or Widowed

One

$41,756

Single, Head of Household, or Widowed

Two

$47,440

Single, Head of Household, or Widowed

Three or More

$50,954

Married Filing Jointly

Zero

$21,710

Married Filing Jointly

One

$47,646

Married Filing Jointly

Two

$53,330

Married Filing Jointly

Three or More

$56,844

The investment income can not exceed $3,650.

Tax Year 2020 Maximum EITC Amounts by Number of Children Claimed

This table displays the maximum credit amount when claiming the EITC. The amount is directly related to number of children.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.