To add your payment details, select

Federal Taxes -> Review on the left green menu, then select

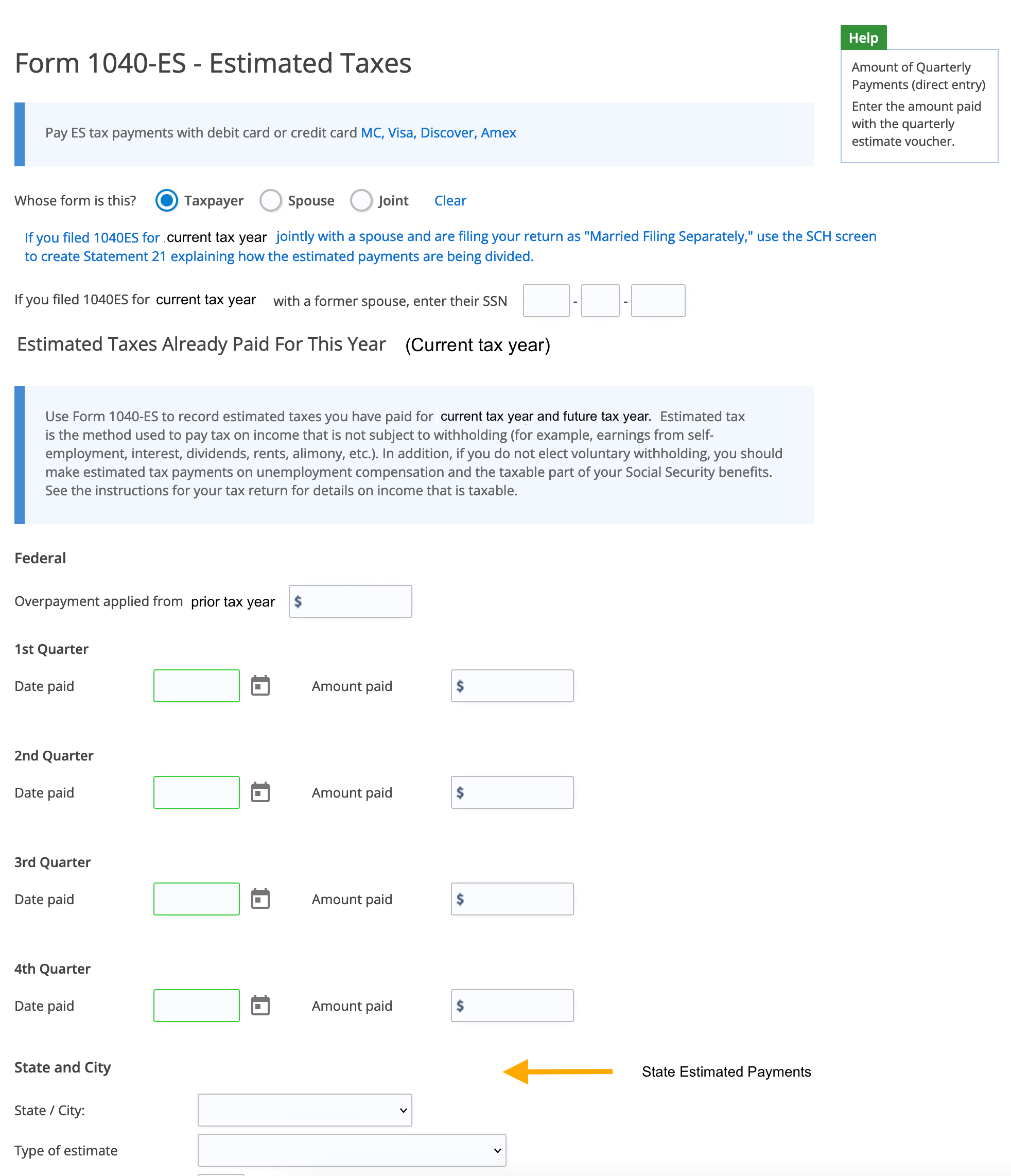

I'd like to see the forms I've filled out or search for a form. Here, you can review or edit forms you have entered, browse various forms by category, and search for a form. You can enter a form number or a key word for the form or schedule. For example, enter "Estimate" or "Extension" to find where to report your IRS and state tax estimate payments and extension payments. Either click the "+ Add form" button to add a specific form or edit the existing form.