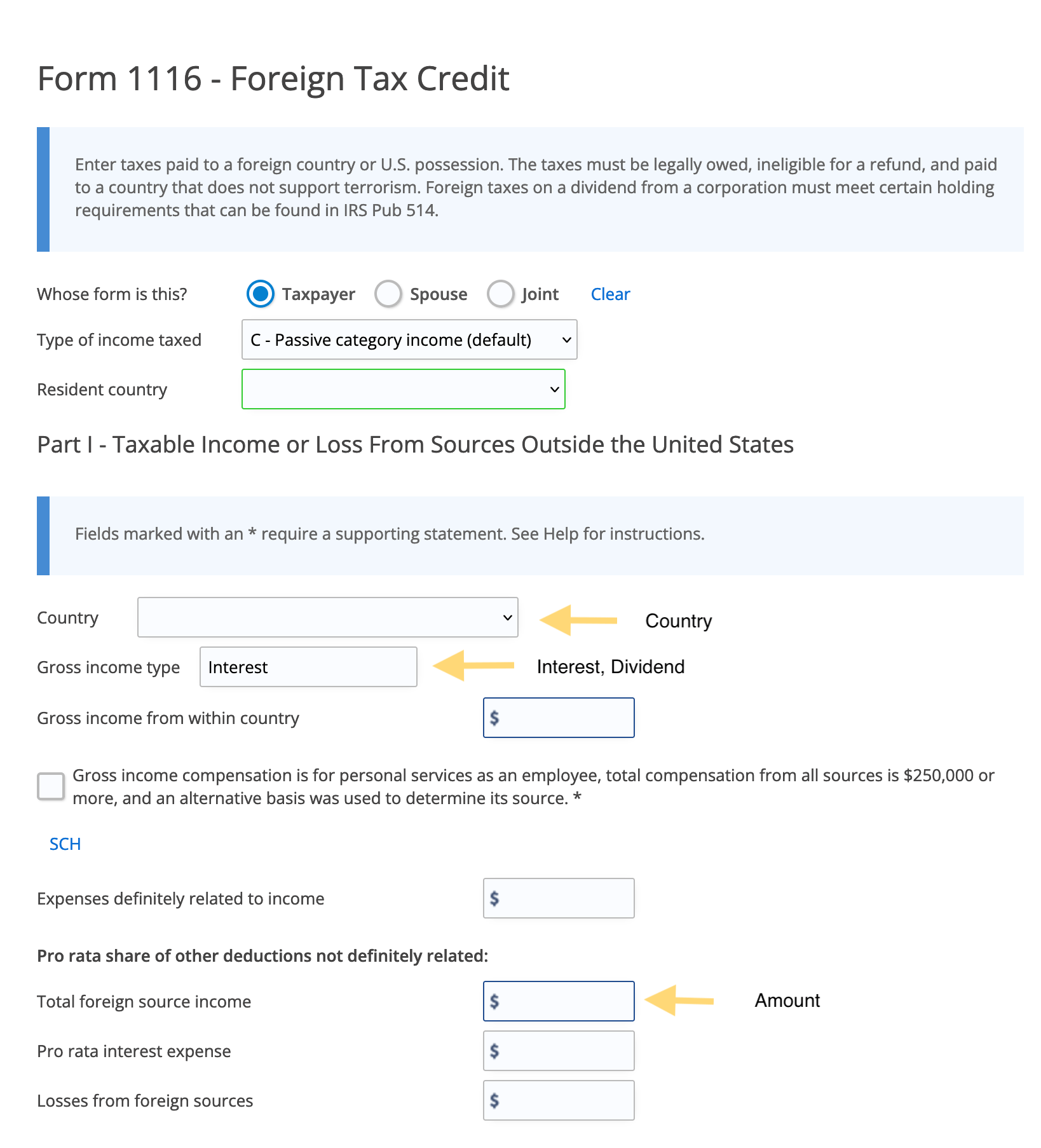

Once you add information that may qualify you to claim the Foreign Tax Credit, eFile will prompt you to add this form. You can also add it manually; select

Federal Taxes -> Review on the left side green menu.

On the right-side menu, select the link

I'd like to see the forms I've filled out or search for a form, enter "1116" in the search box, and select

Add Form next to Foreign Tax Credit.