How to Enter Form 1099-DIV?

A taxpayer should receive Form 1099-DIV - Dividends and Distributions- by January 31 following the 2024 tax year. When you receive a 1099-DIV reporting dividends and distributions, you will likely need to add it to your tax return. When you add this form to your eFile account, the tax app will determine any income taxes based on your entries. Follow the steps below to add your 1099-DIV to your federal and state tax return.

Step 1: Sign in to eFile.com and select Federal Taxes on the left menu.

Step 2: Then select Income below and on the right side, scroll to Interest and Dividends and select Tell us about your Interest and Dividends.

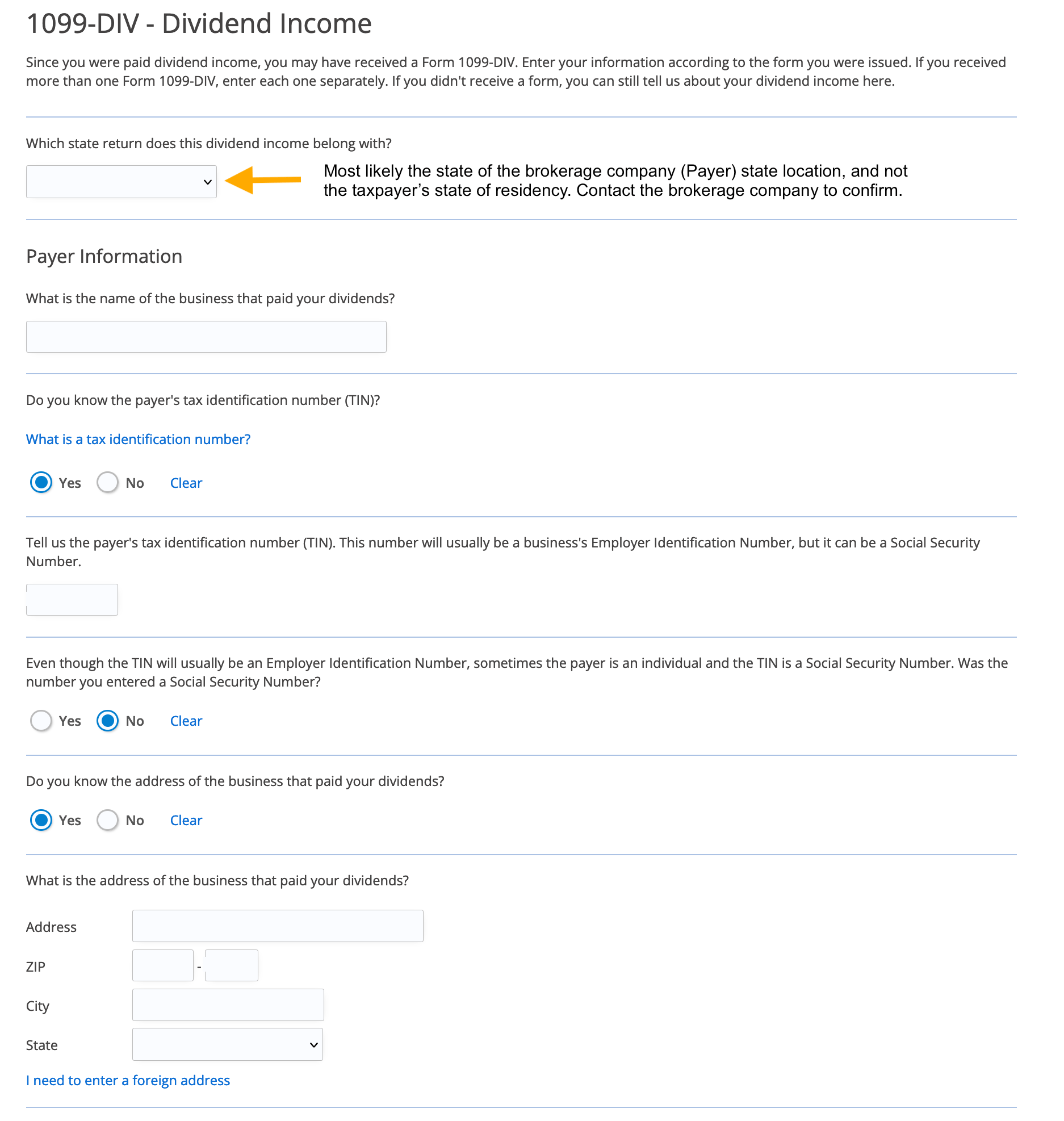

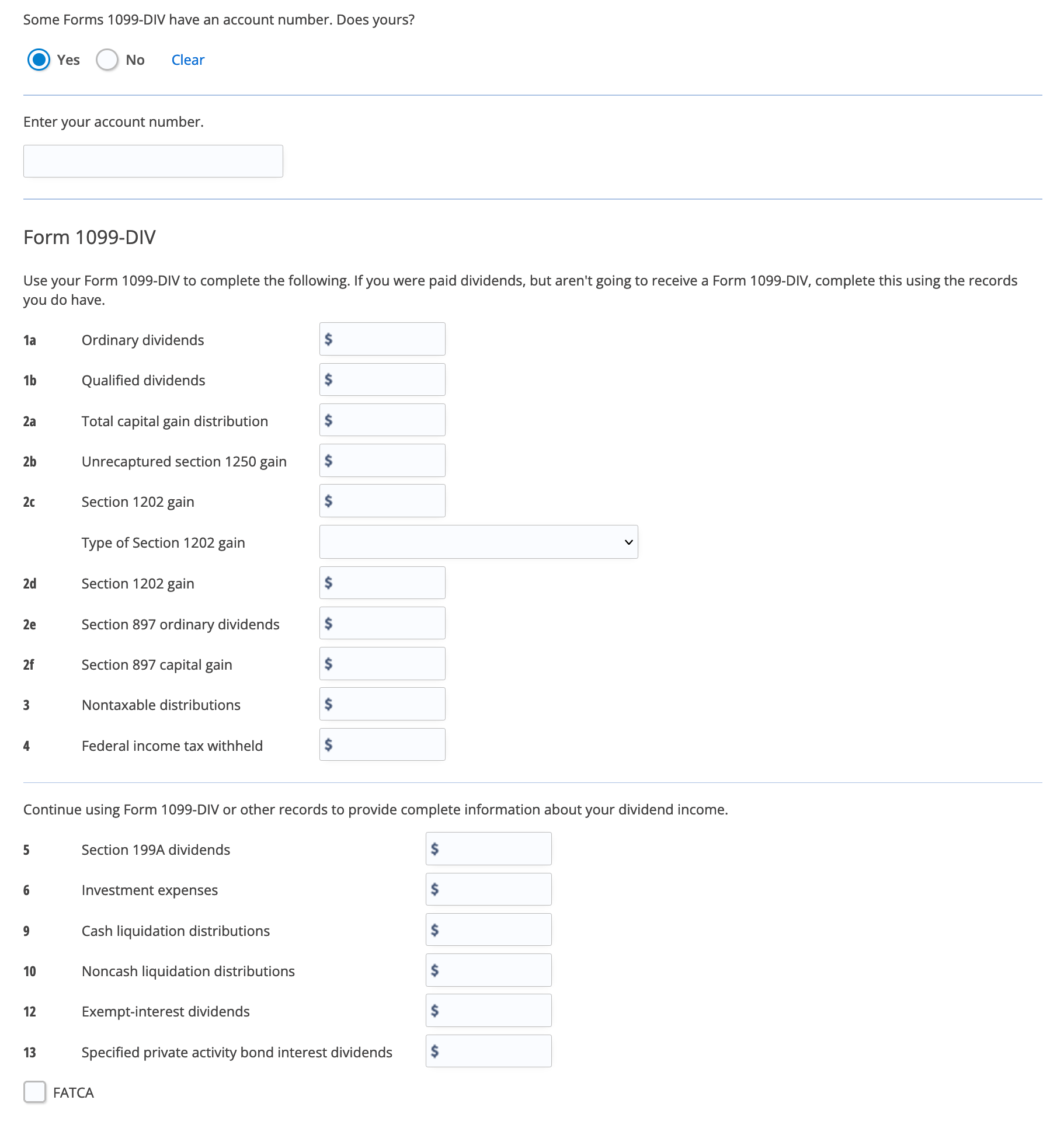

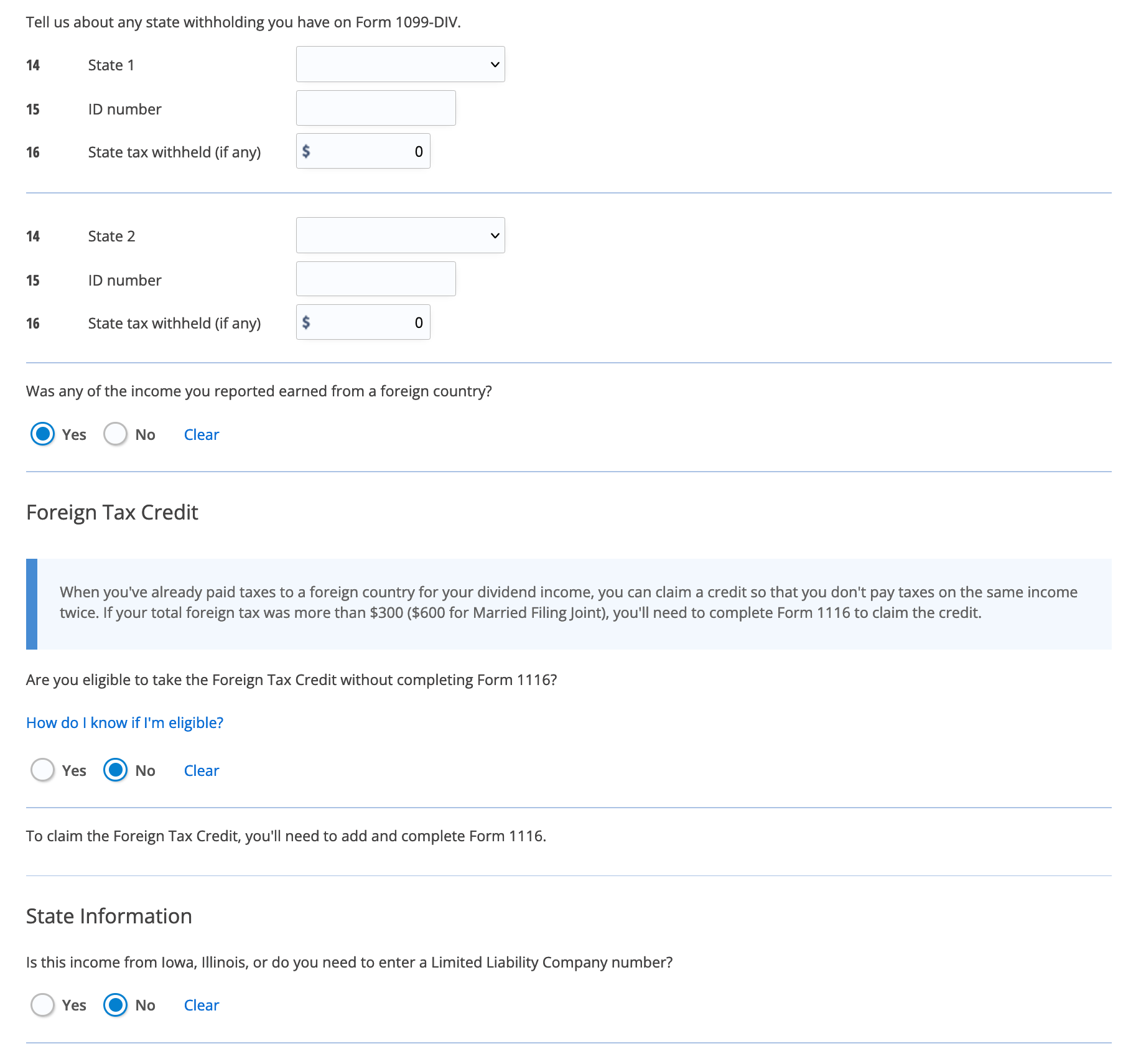

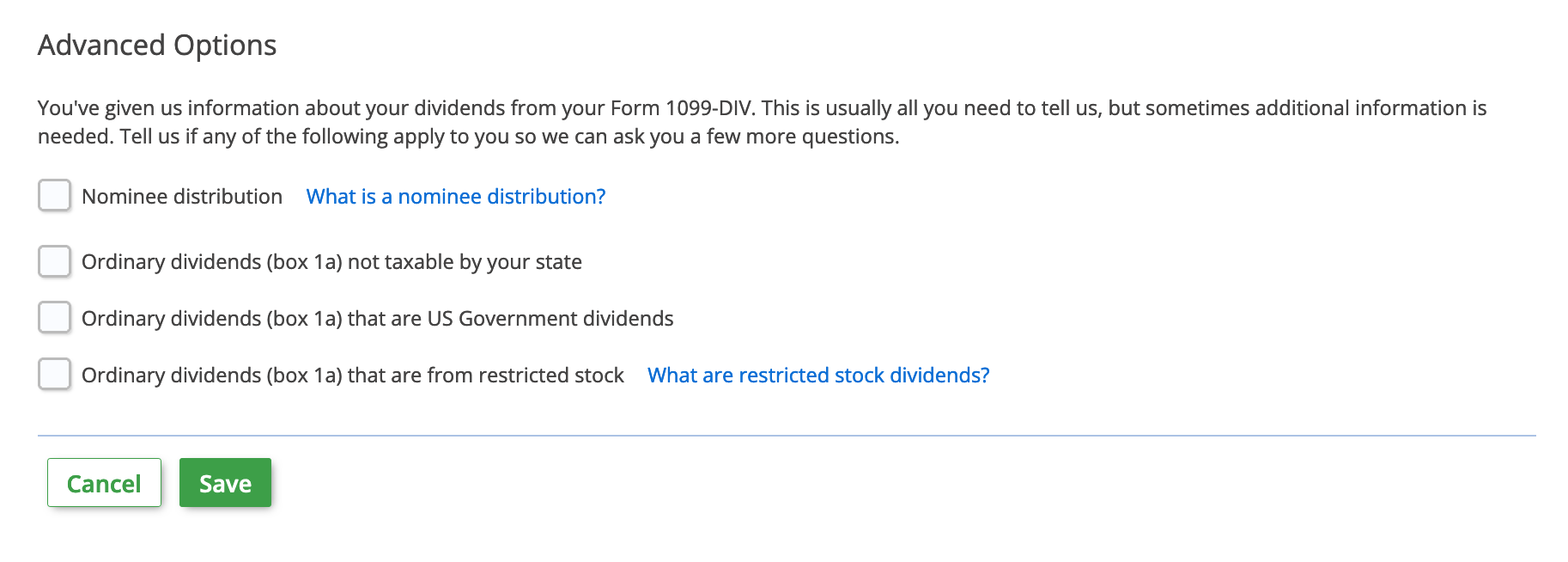

Step 3: Have your 1099-DIV handy while you take the 1099-DIV interview. The tax app will create the correct tax return form for you based on your entries on this page.

Other 1099 forms

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.