What to Do With 1099-K

If you used a third-party app to send or receive money during the tax year, you may have received a Form 1099-K. The 1099-K reports to you and the IRS the income transactions you completed via credit card. You can add this to your eFile account to generate the needed forms and add it to your tax return.

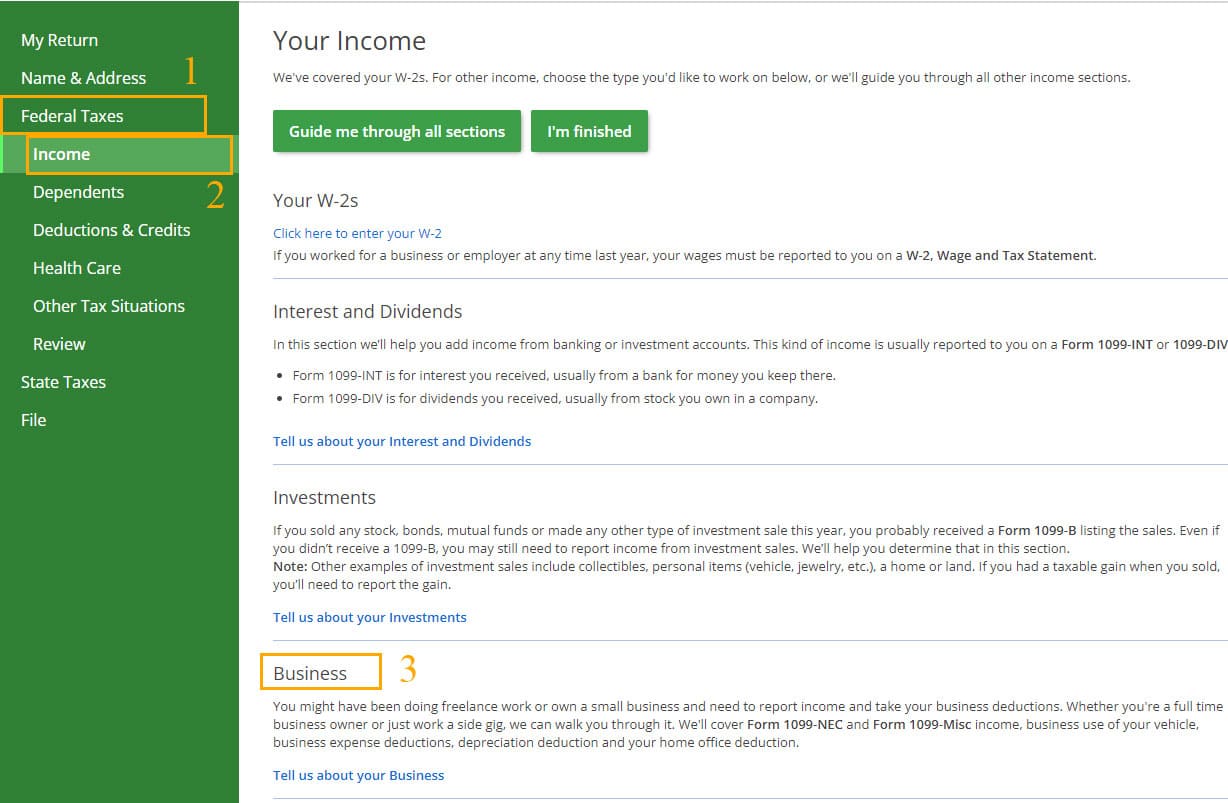

2. Where Do I Enter Data?

eFile will guide you through entering all types of income. Most of the time, these transactions are for your business or if you are self-employed. Under Income,

work through the Business section and add the income from your 1099-K under the section that reads

Do you have business income to enter that's not reported on a Form 1099-NEC or 1099-Misc?

Click to enlarge image

3. How to Manually Add Data

To manually add your form, navigate to Federal Taxes > Review > I'd like to see the forms I've filled out or search for a form and enter "Schedule C." You can then fill out the details based on your information and add the 1099-K income under the Business Income section.

4. Box Descriptions

There are many boxes on the form, but below are the most common that will be filled in.

1a: Gross amount of payment card/third party network transactions

1b: Card Not Present transactions

3: Number of payment transactions

4: Federal income tax withheld

6-8: State details.

5. How to Add, Delete a Form or Page

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.