There are many boxes on the form, but below are the most common that will be filled in.

1: Gross long-term care benefits paid

2: Accelerate death benefits paid

3: Per diem or reimbursement amount

4. If the insurance contract is tax qualified or not.

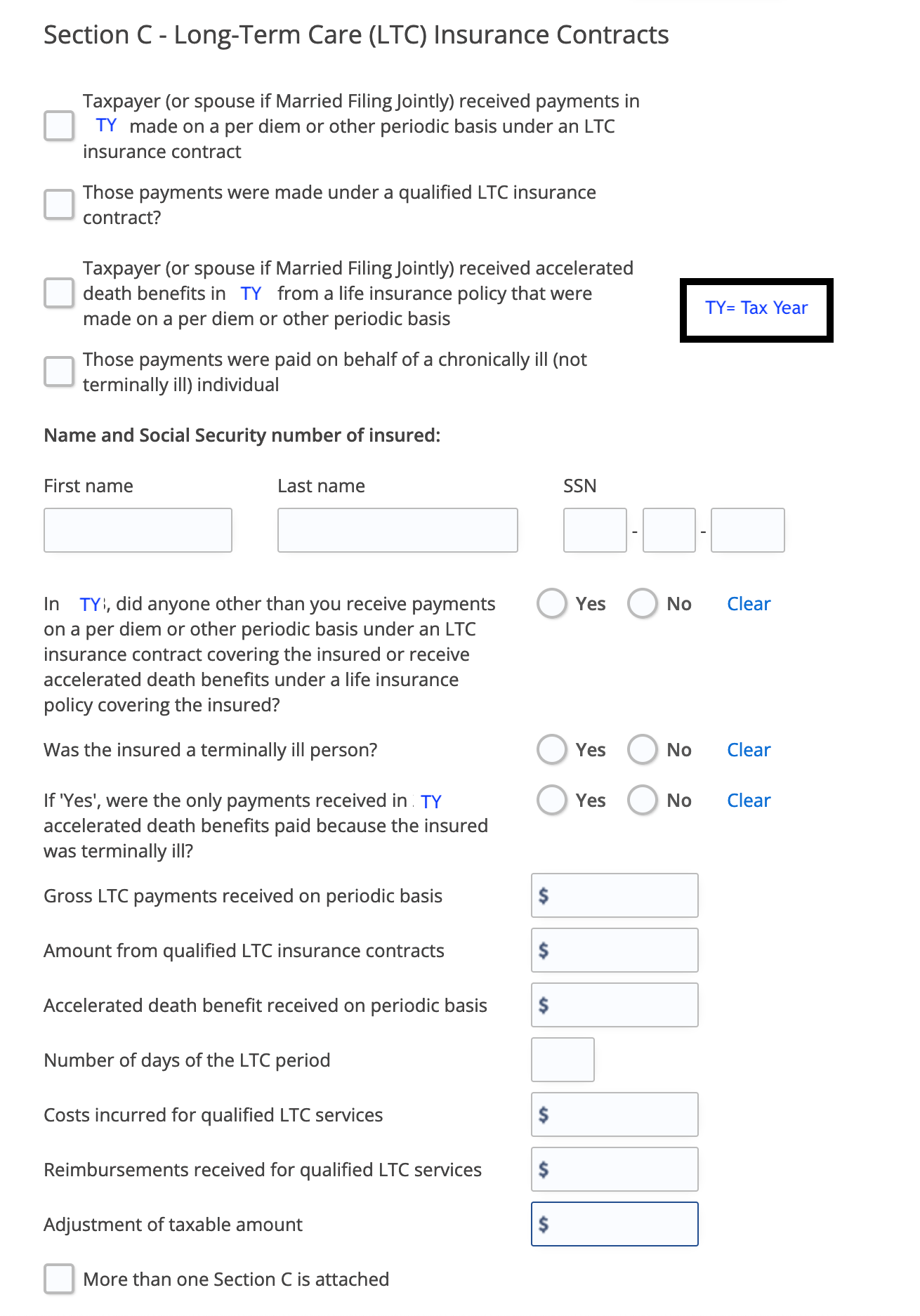

Below is a screenshot of the entry page on eFile.com