How to Enter Form 1099-R

Are distributions from retirement or profit-sharing plans, pensions, annuities, IRAs, or other account taxable? How do you add 1099-R to your return?

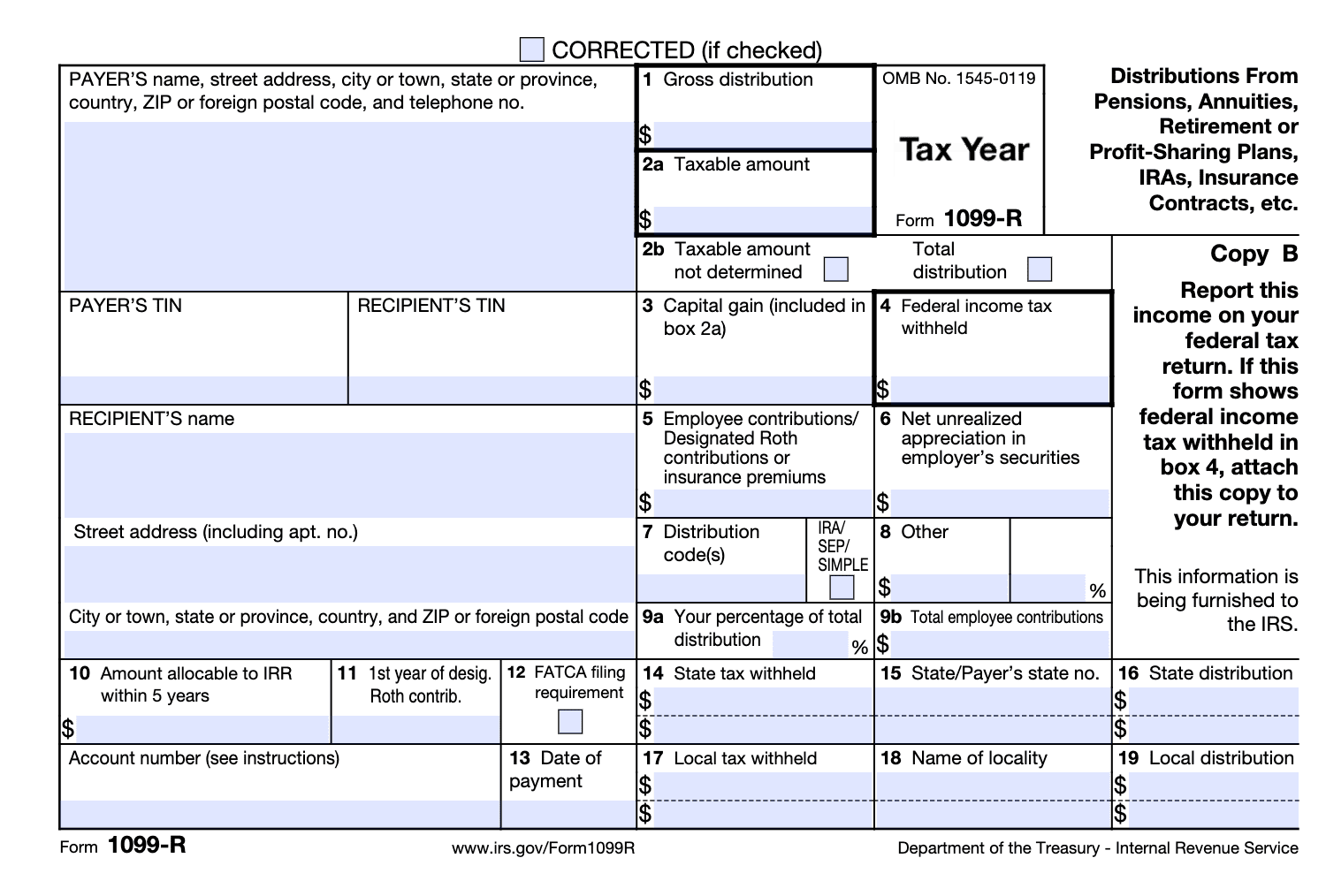

Step-by-Step Instructions for Form 1099-R

When you receive a 1099-R reporting retirement income, you will likely need to add it to your tax return. When you add this form to your eFile account, the tax app will determine any income taxes based on your entries. Follow the steps below to add your 1099-R.

Step 1: Sign in to eFile.com and select Federal Taxes on the left menu.

Step 2a: If you have not previously created and entered Form 1099-R, then select Income below and on the right side, scroll to Retirement, and select Tell us about your Retirement.

Step 2b: If you have previously created and entered Form 1099-R and wish to review/edit it, follow these steps to search, view, edit an IRS form. You can find all your forms under the Review tab.

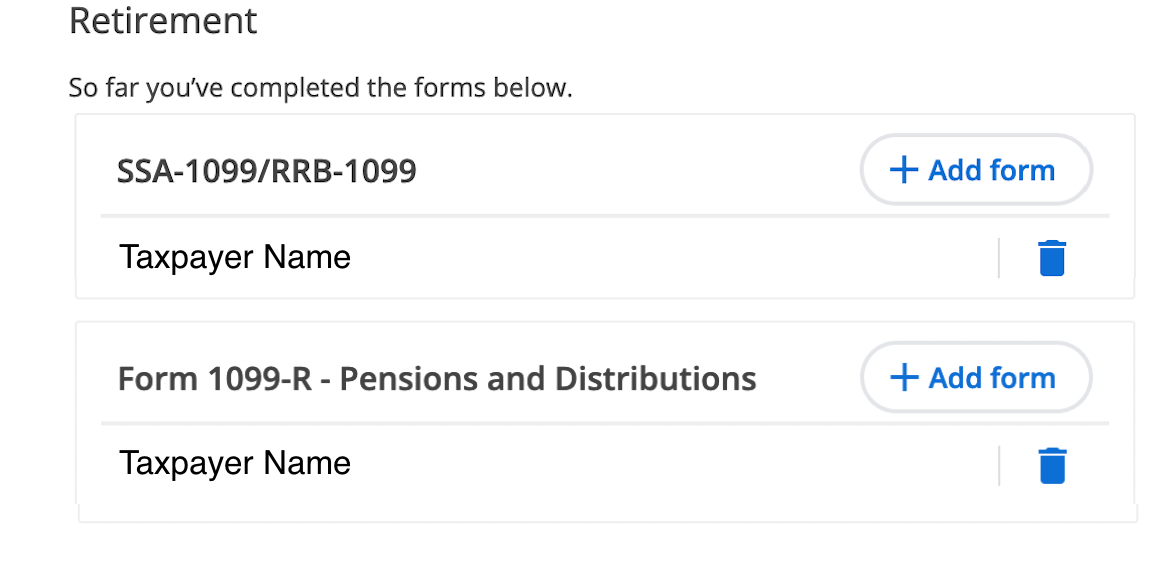

Step 3: Take the retirement interview and have your Form 1099-R handy. You will be asked about Form SSA-1099 which you can add if you have it. Be sure you answer "Yes" to the question regarding the form you have so you can enter all your information correctly.

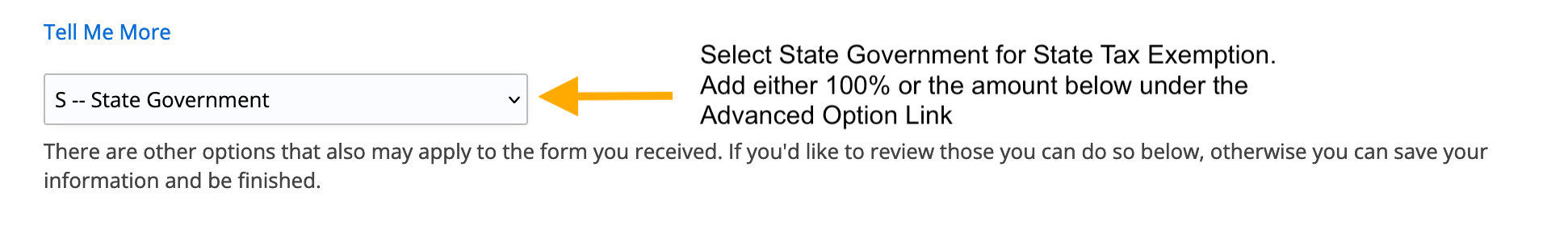

State Government, Teachers etc. Employee State Tax Exemption

Under the Tell Me More section, select State Government if you need to exempt some or all of your income from state taxes.

Exceptions or Additional Information

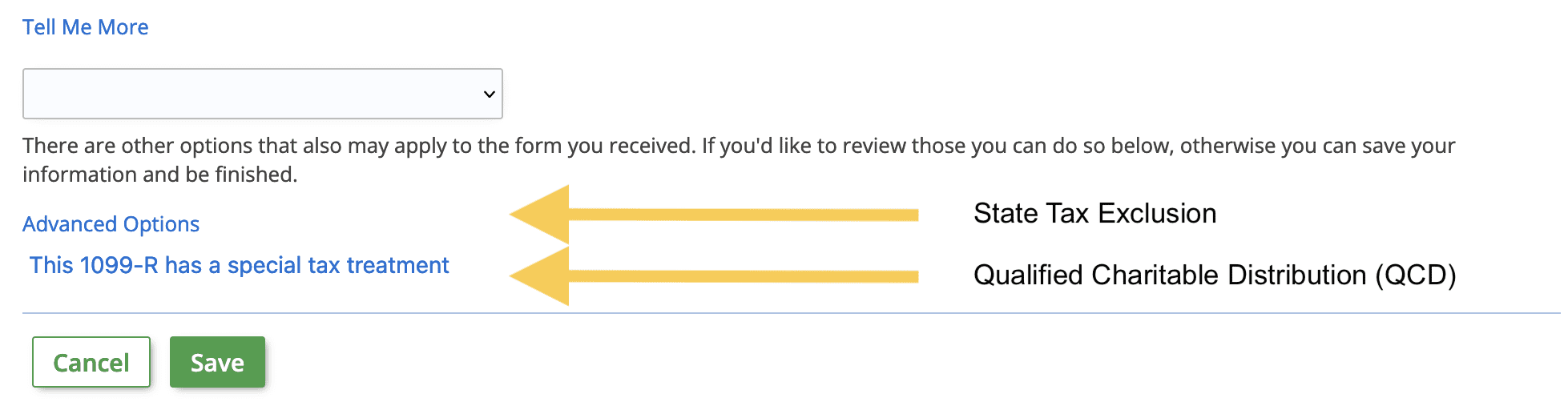

You may need additional options for entries based on your 1099-R. Use these two paths to add more information to your 1099-R:

A: Qualified Charitable Distribution (QCD) - click on the Special Tax Treatment link at the bottom of Form 1099-R - Pensions and Distributions and enter your QCD there. There are several options here as well, which you may need for your 1099-R.

B: Exclude State Taxes - click on Advanced Options

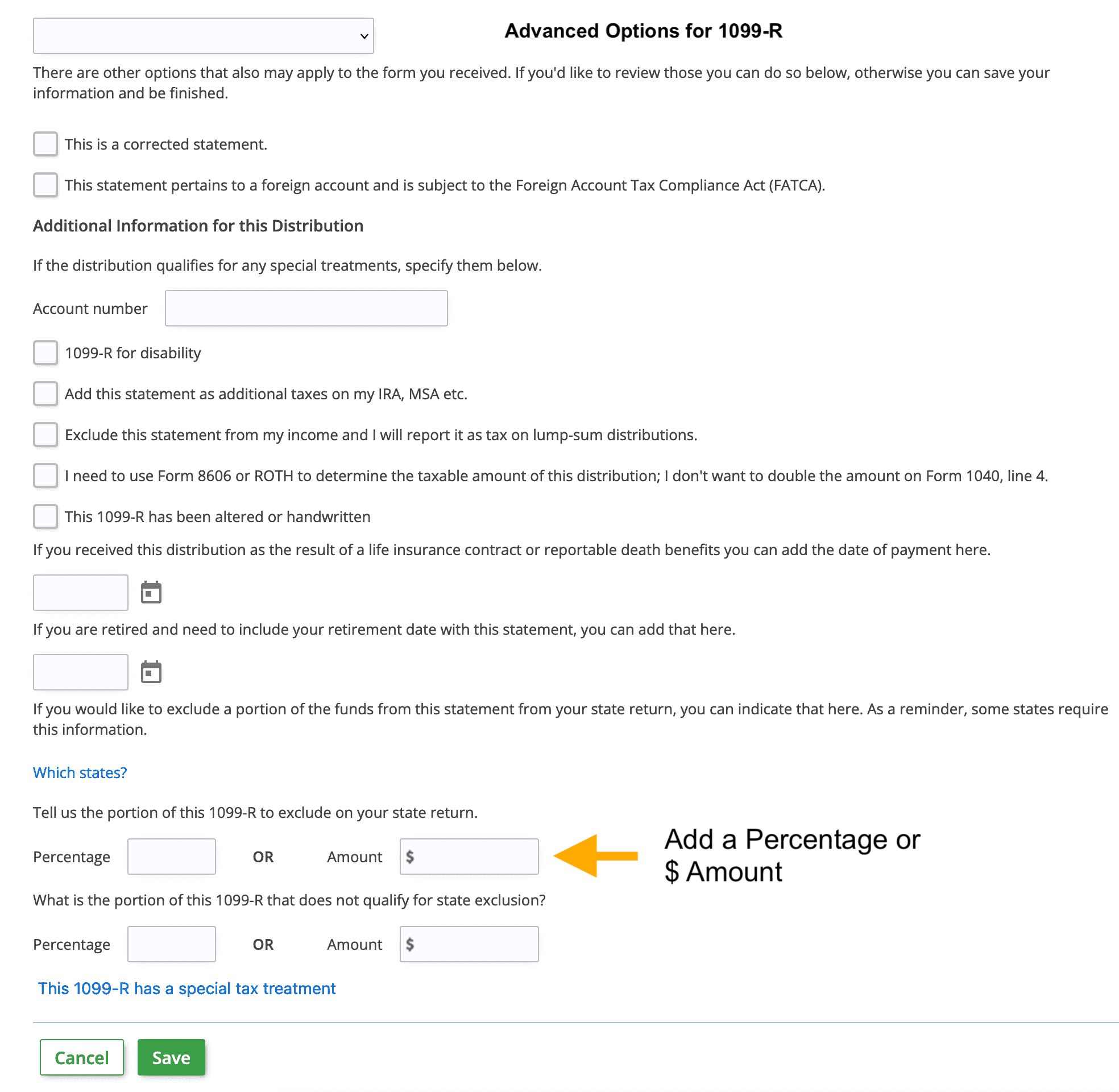

Advanced Options and Special Treatment Links on Form 1099-R:

Once in the Advanced Options screen, make the required selections and entries so that your 1099-R is entered correctly.

Advanced Options Page for Form 1099-R:

Add your retirement income, W-2 income, and all other taxable income to your eFile account, and your full return will be generated.

See also:

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.