e-File Your Tax Return By October

Everyone knows that the deadline to file your tax return typically arrives around mid-April each year. However, if you miss this deadline, you can actually e-file until a different day in October. This deadline applies regardless of whether you filed or e-filed a tax extension by Tax Day in April.

You may still file or e-file by October if you did not file a tax extension. Late filing penalties will apply if you do not file your tax return by October and you owe taxes. Payment penalties and interest will also apply if you do not pay your taxes owed by Tax Day. The penalties for not filing a return are higher than the penalties for not paying taxes owed. Find out if late penalties apply to you.

Important: If you have an accepted tax extension in your eFile.com account, you can use promo code ext40efile to save 40% when you complete and e-file your tax return(s) after Tax Day.

If you are expecting a refund, you will not face any penalties. However, you must file your return within three years after the original return deadline to claim your refund. After three years, the refund is gone. If you owe tax, submit your extension to give you more time to file, not pay.

I Filed My Tax Extension. Now What?

Once you have filed your tax extension and the IRS and/or state has accepted it - see state tax extensions - you now have until the October deadline to file. If you indicated that you are out of the country, this gives you two months from the original filing date.

Step 1: Prepare and File Your Tax Return or Extension

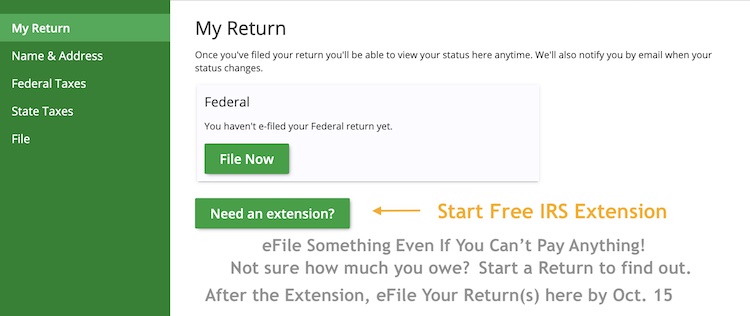

If you do not have an eFile.com account, click the button below to start and e-file your tax return. If you are already an eFile.com user, click the "Sign In" link to start/continue and e-File your return.

Start Your Tax Return Now!

Already have an eFile.com account? Sign In

If you still do not have all the documents you need to prepare a return, you should contact any employers and other organizations that owe you information.

Prepare and e-file your tax return as you collect different tax forms. Employment or wage forms, such as Form W-2, are required to be sent to employees by January 31 following a given tax year. Give your employers time around this date before you contact them or the IRS regarding absent forms. Missing forms are one reason you may want to file a tax extension. Once you have all your forms, start the tax interview to report all your information, or see this page for a guide on where to enter information on the eFile Tax App. Follow this information once you are able to complete your tax return.

Contact eFile.com tax support if you need help with your return.

Step 2: Pay Your Taxes or Set Up Tax Payments

Now that you have entered all your information, it's time to checkout on the eFile app. Use one of the following options below to pay your taxes owed:

If You Have the Funds to Pay Your Taxes

- Electronic Fund Withdrawal from Bank Account (Direct Debit): You can pay your taxes via direct debit from your bank account when you prepare and e-file your tax return online.

- Mail a Check or Money Order: After you e-file your return, a payment voucher is generated with your return. You can use this voucher to pay with a check or money order.

- Credit or Debit Card: Be aware that if you pay your taxes with a credit card or debit card via the IRS or another site, there is a "convenience" fee based on the amount you pay.

- Pay After Filing Directly to the IRS: make a direct payment to the IRS - you can elect not to pay anything on the eFile app and instead pay later on the IRS payment portal.

For an in-depth overview of the ways to pay your taxes due, read more about the direct tax payment options.

If You do NOT Have the Funds to Pay Your Taxes

- Short-Term Extension of Time to Pay: If you can pay your balance within 120 days, you can apply for an extension of time to pay with the IRS. There is no fee to apply for a payment extension.

- Installment Payment Plan Agreement: If you owe no more than $50,000, you may qualify for an installment payment plan agreement with the IRS. There is a non-refundable $105 fee to apply, and you might still owe interest and/or penalties to the IRS for late payment.

- Offer-in-Compromise: An offer-in-compromise is your last resort and is not an option for most taxpayers. It allows you to pay off your tax debt for an amount lower than what you owe. The IRS will only ever approve this if they believe that they will never be able to obtain the full amount from you because of your financial circumstances.

Learn more about the above tax payment plan options.

If you have debt with the IRS, see how to pay taxes when you don't have the money. Learn how to make estimated payments during a tax year if you expect to owe tax at the end of the year. You may have to pay an estimated tax quarterly if you are an independent contractor who receives a 1099 form. Additionally, see how to optimize your tax withholding if you owe tax at the end of the year or receive a large tax refund. A big check on Tax Day means you allowed the IRS to borrow too much of your income as an interest-free loan.

Find

ways to save on tax and

money-saving tips during the year; find

tax help during tough times plus

unemployment and taxes.

Tax planning: Use this free tax refund calculator to estimate your current year taxes and get ready for next year.

Since the IRS no longer accepts extensions after Tax Day - even if they were e-filed and rejected on or by each year's specific day - you should e-file or file your tax return as soon as possible (and pay as much as you can) to avoid additional filing penalties.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.