File Form 1099 with Your Tax Return

Form 1099

Instructions

Filing Form 1099 with your tax return can seem daunting, but we're here to simplify it. This page is part of our 1099 series:

- 1099 Form Types and Requirements

- How to File a Tax Return with Form 1099 (this page)

- How to Issue a Form 1099.

- How to file a tax return if you are self-employed.

Below, you'll find detailed, step-by-step instructions on adding your 1099 form information to your income tax return(s). Generally, you'll need to gather various forms and schedules like Schedule 1, Schedule 2, Schedule C, and other necessary IRS forms. By following our guide, you can navigate these complex forms with confidence, making your tax filing process smoother and stress-free.

What Is Form 1099?

Form 1099 is a tax form which is used to report non-employment income that you received and needs to be reported on your tax return. Form 1099 is not filed or e-filed on an individual return, but you use the information on your 1099 to fill in various schedules and forms.

The payer sends the proper 1099 to the IRS and a copy of the form to you. There are many different kinds of 1099 forms, each of which is designated by one or more letters (such as 1099-K or 1099-MISC). These forms are all used to report different types of income; see descriptions of each 1099 form.

You may be issued a 1099-K unexpectedly for transactions made on platforms like Venmo, Cash App, or sales on eBay. The IRS planned on lowering the issuing threshold from $20,000 to $600 for transactions, but this was delayed and does not currently apply. They plan on phasing in this rule, but it has not yet been made law. Generally, sales that generate you a profit and cash exchanges for goods and services are subject to this rule. See details on the IRS 1099-K reporting amount adjustment.

When you prepare your tax return, you will need to report all of the taxable income you have received during the tax year. Income information is provided to you on various forms, such as a W-2 or a 1099. A W-2 reports income you earned as an employee, but many other types of income are reported on a 1099 form. If you have income reported on a 1099, you won't have to worry about what forms to fill out and where to enter your 1099 numbers on eFile.com. The app will select the correct tax forms for you and help you complete them. Additionally, it will calculate the various tax figures and enter your income in the right lines of your 1040 Tax Return.

Related Resources:

How to Enter 1099 Information on eFile.com

The simplest way to report this form is by beginning the tax interview when you sign into your eFile account. This will walk you through all the types of income, guide you through specific questions based on your situation, and help you claim tax deductions and tax credits. Following the interview allows the platform to go through each section so you do not miss anything.

Follow these simple steps to e-file your 1099-NEC, 1099-MISC, 1099-R, or other 1099 form in minutes.

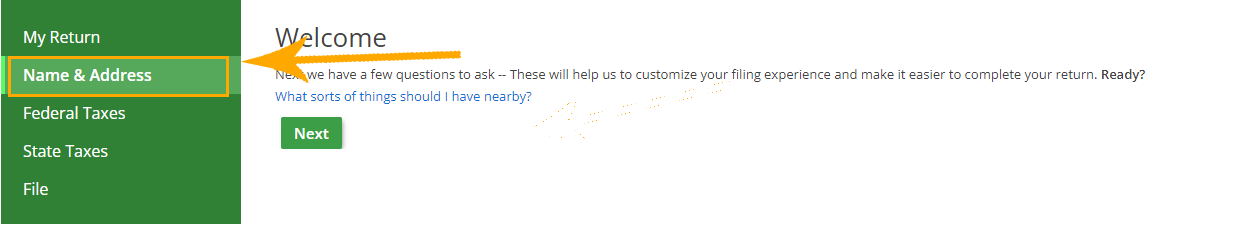

1. Sign up / Sign in to eFile.com

2. Basic Information

Add your basic information, including name and address.

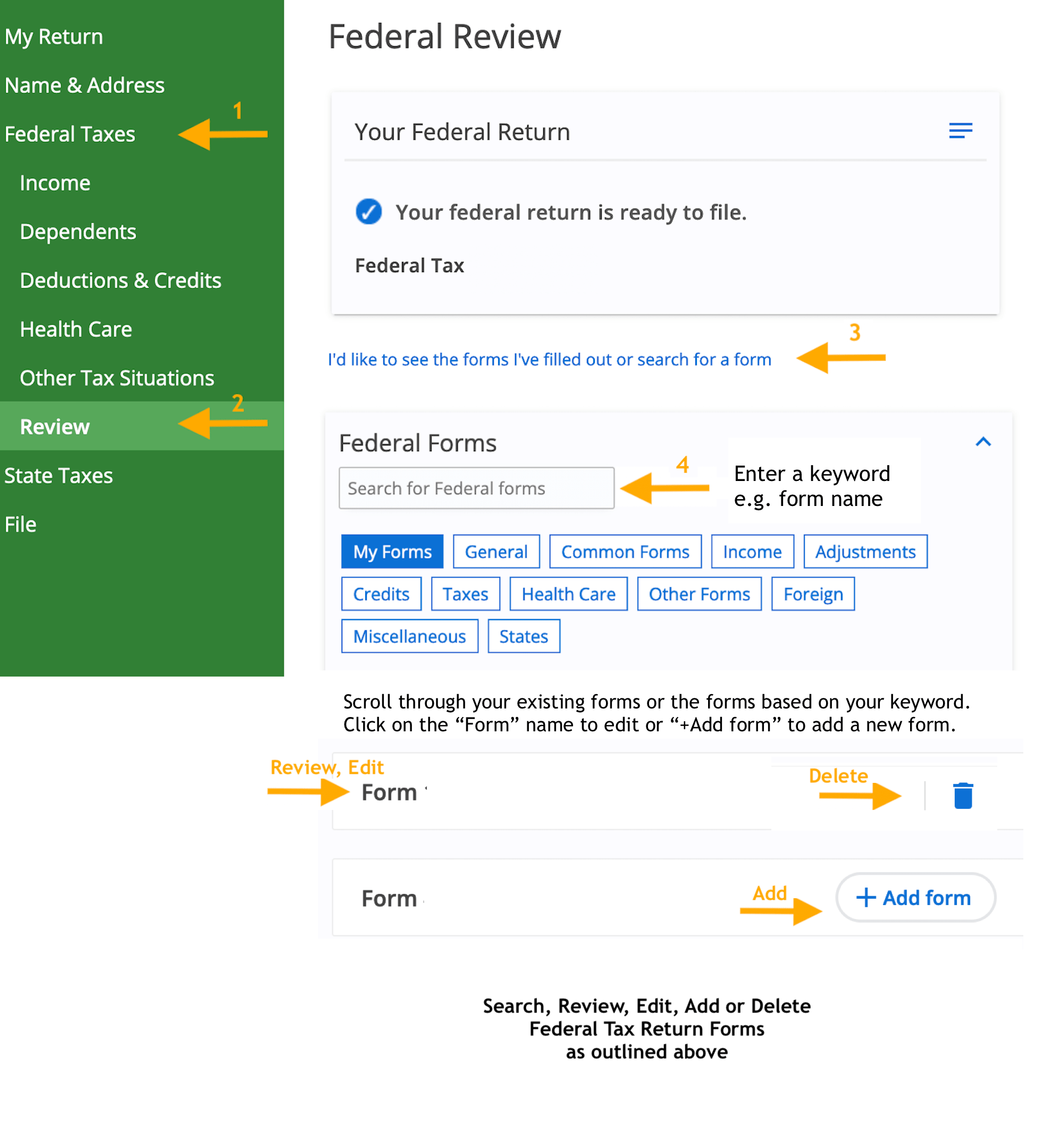

3. Federal Taxes -> Review

Simply follow the tax interview and you will be walked through adding all your income and forms. To find a specific form, select Federal Taxes -> Review > "I'd like to see the forms I've filled out or search for a form."

4. Search 1099 Form

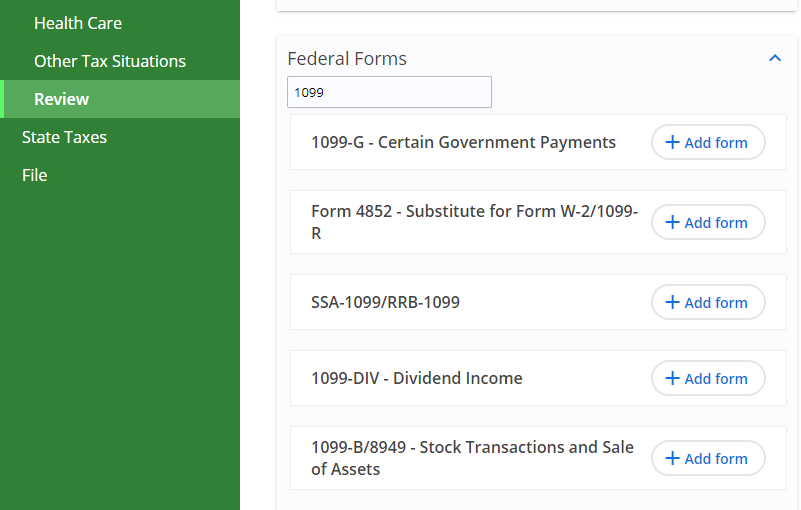

Scroll down to the "Federal Forms" search box and enter 1099 in the box. Add the number if you know it and select your form from this list.

5. Fill in Form Information

Enter the details from your form in the corresponding spaces on the 1099 form screen. See the "Help" box on the upper-right of the screen for more information about each entry.

Select the green "Save" button at the bottom of the 1099 screen when it's completed.

6. Review Forms

Review your forms and other entries carefully; the eFile Tax App will prompt you to open a completed copy of your entire tax return before you sign anything.

7. Check Applicable Services Fees

Pay any applicable service fee(s) and send your return, including information from your 1099, to the IRS and state as applicable.

8. eFileIT and Be Done with IT

You're done! Tell others how simple it was to e-file your taxes by yourself.

Note

A few of the less common 1099 forms do not have separate entry screens and the information must be entered directly on another form. eFile.com will present you with the correct forms based on your answers to a series of "yes" or "no" questions. If you do not know where to enter something, or if you have any trouble at all, contact us for free help.

Listed below are the 1099 forms you can add to your return on eFile.com - select the form number for step-by-step instructions on adding the form to your account.

- 1099-A: Acquisition or Abandonment of Secured Property

- 1099-B: Proceeds from Broker and Barter Exchange Transactions (stock transactions and sale of assets)

- 1099-C: Cancellation of Debt

- 1099-CAP: Changes in Corporate Control and Capital Structure

- 1099-DIV: Dividends and Distributions - details on dividend income

- 1099-G: Certain Government Payments (unemployment, state tax refunds, and other government payments)

- 1099-INT: Interest Earned

- 1099-K: Payment Card and Third party Network Transactions (sales paid online via money transferring apps or websites)

- 1099-LTC: Long-Term Care and Accelerated Death Benefits (long-term care insurance)

- 1099-MISC: Miscellaneous Income

- 1099-NEC: Nonemployee Compensation (self-employment details)

- 1099-OID: Original Issue Discount (certain interest income)

- 1099-PATR: Taxable Distributions Received from Cooperatives

- 1099-Q: Payments from Qualified Education Programs (only reported if distributions were spent on nonqualified expenses)

- 1099-R: Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. (retirement plan withdrawals)

- 1099-S: Proceeds from Real Estate Transactions (if your sold a home, you will likely have a capital gain)

- 1099-SA: Distributions from an HSA, Archers MSA, or Medicare Advantage MSA (see details on HSA, MSA distributions)

- RRB-1099 or RRB-1099-R: Railroad Retirement Board Statement

- SSA-1099: Social Security Benefit Statement (details on Social Security income).

If you never received or are unable to get a your 1099-R or W-2, you can use eFile to generate Form 4852, Substitute for Form W-2/1099-R.

What to Do If There is No 1099

What if you did not receive a 1099 form? It is possible that you were paid such a small amount that the payer is not required to issue you a 1099. Regardless, you are still required to report any taxable income you received. You can enter the information on the appropriate 1099 screen even if you do not have an actual paper form.

This could include a small amount of money—less than $600—earned from partaking in contract work like DoorDash or Uber. If you earned insignificant income from side work like this, simply add this income to your eFile account on the business screen. There is an entry field which prompts you to enter income earned that is not reported on a 1099 form.

If you should have been sent a 1099 but were not, you may be able to use Form 4852 as a substitute which can be prepared on eFile.com. We do recommend reaching out to the payer to receive this form as it provides important tax information. If you are unable to get it, you should report the missing form to the IRS and ask for their guidance on how to proceed. You can call IRS taxpayer assistance at 1-800-829-1040. If you need any further assistance with preparing and e-filing your tax return with 1099 information, contact eFile.com support.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.