How to Enter, Report Schedule K-1 for Form 1120S

Report and enter Schedule-K for either Form 1120, 1041, or Schedule K-1, K-3 for form 1065 on eFile.com.

You may receive one of the following K-1 forms for your specific type of income:

- Schedule K-1 1041 Form: Beneficiary’s Share of Income, Deductions, Credits, etc. - Schedule K-1 for Form 1120

- Schedule K-1 1041 Form: Beneficiary’s Share of Income, Deductions, Credits, etc. - Schedule K-1, 1065

- Schedule K-1 1041 Form: Beneficiary’s Share of Income, Deductions, Credits, etc. - Schedule K-1,1041

See simple instructions on how to enter any specific form on eFile.com.

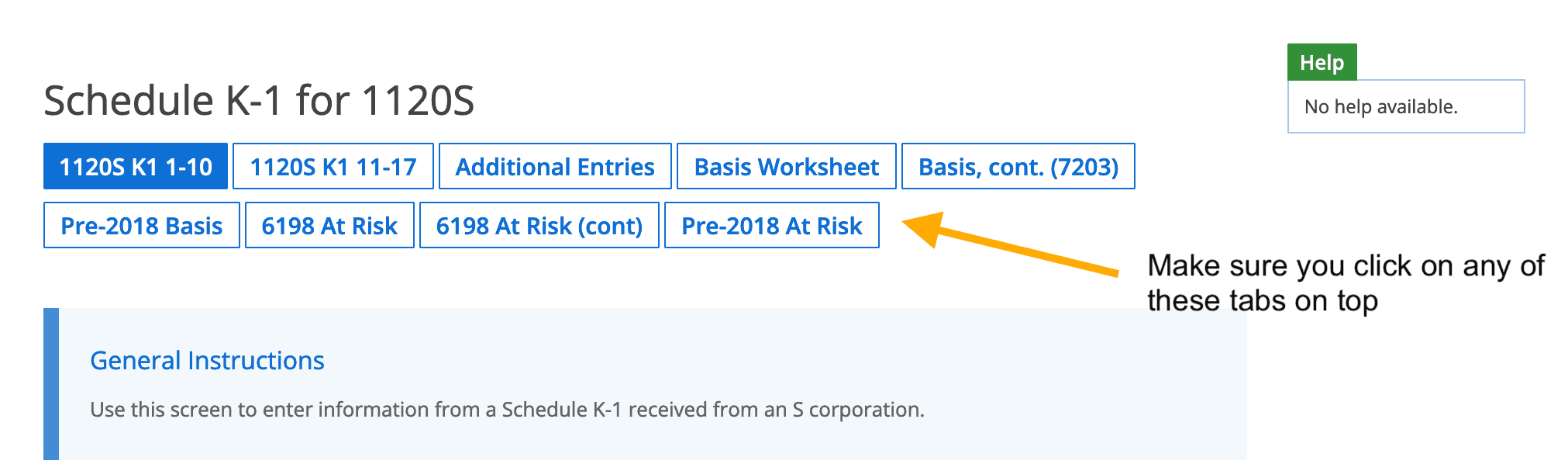

To add Schedule K-1 and its related forms, click on Federal Taxes > Review > I'd like to see the forms I've filled out, or search for one and enter the one you are looking for. For example, Schedule K-1 1065, 1041, or 1120; enter the form numbers into the search box and fill in the information from your tax forms.

You can simply search for "K-1," and all applicable forms will be shown for you to add. Click the plus sign (+) or "Add form" button to begin entering the information from your K-1 or other forms.

If you work in addition to receiving income as a beneficiary, you can file your Form 1040 return, including your other income.

How to add a W-2 on eFile.com: Sign in -> Federal Taxes (left green menu) -> Income, and on the right side, you will see the W-2 section and click on Add Form.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.