How to prepare and e-File Form 1040-NR

Form 1040-NR is used by nonresident aliens to e-file a U.S. income tax return. To use Form 1040-NR as your tax form instead of the regular Form 1040, you will indicate this during the Name & Address section. Note that if you are filing with the married filing jointly or head of household filing status, you cannot use Form 1040-NR.

Attention: Contact us if you have non-U.S. methods of payments like a foreign credit card so we can assist you with any payment. Contact eFile now.

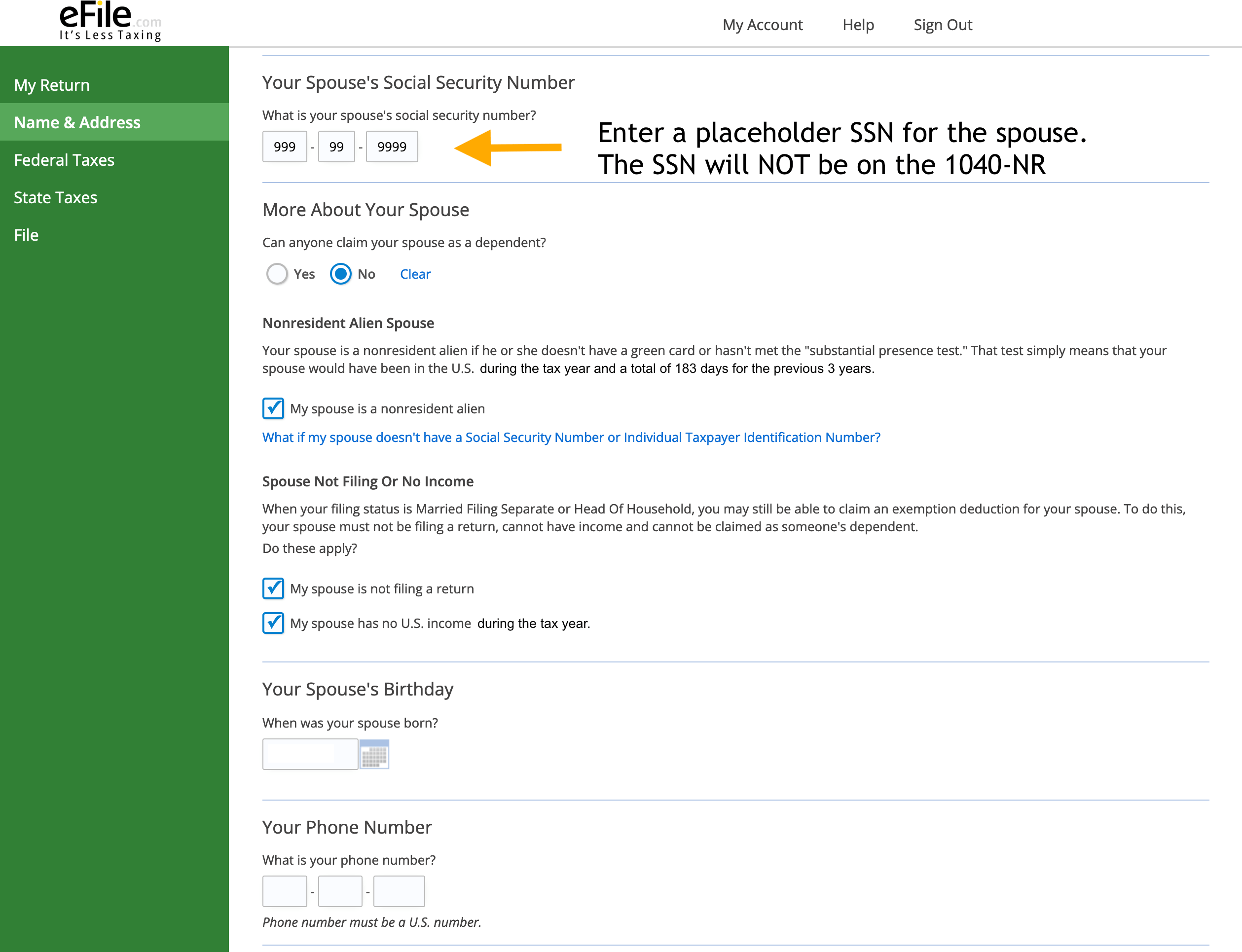

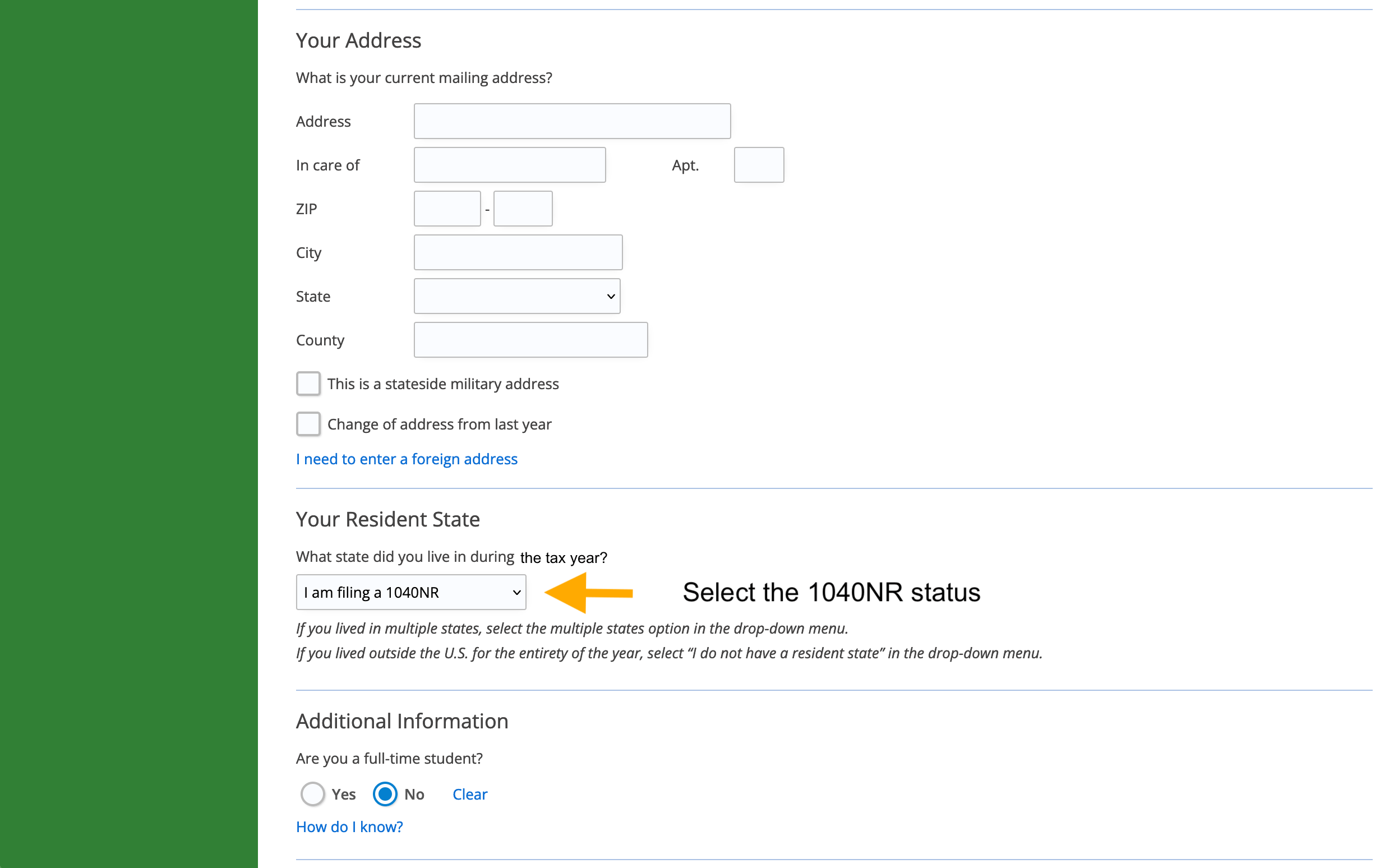

1.2. Select Name & Address

Click on Name & Address on the left green menu and go through the question and answer section. As a married nonresident citizen you can only file with with Married Filing Separate filing status. Thus, enter a placeholder SSN and name for your spouse - they will not be printed on the form 1040-NR.

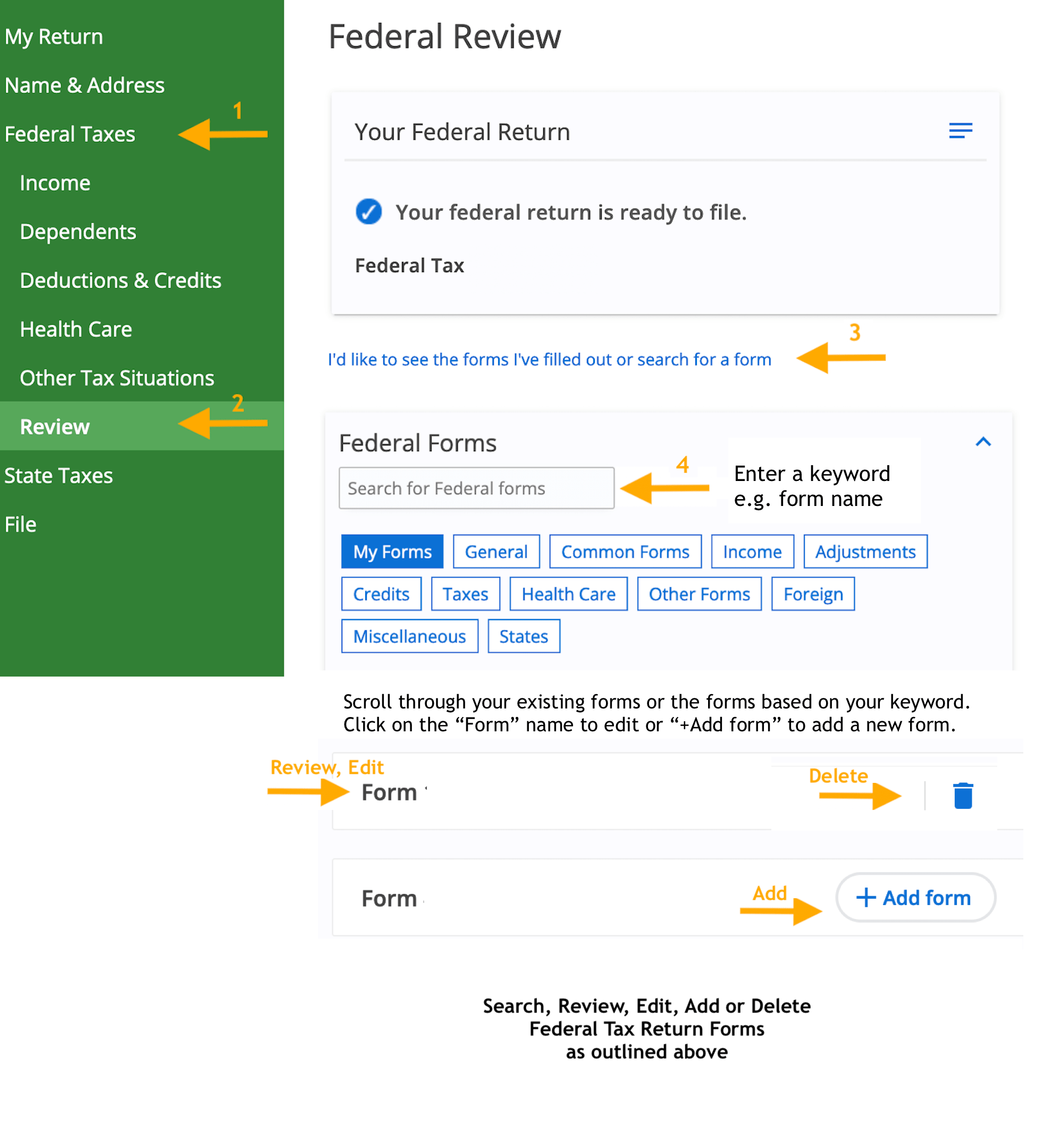

2. Select Federal Taxes -> Review

Navigate to Federal Taxes on the left menu and click Review. Here, click I'd like to see the forms I've filled out or search for a form. Here, you can review or edit forms you have entered, browse various forms by category, and search for a form. You can enter a form number or a key word for the form; for example, enter "dividend" to find where to report your 1099-DIV information. Click the "+ Add form" button to add a specific form manually.

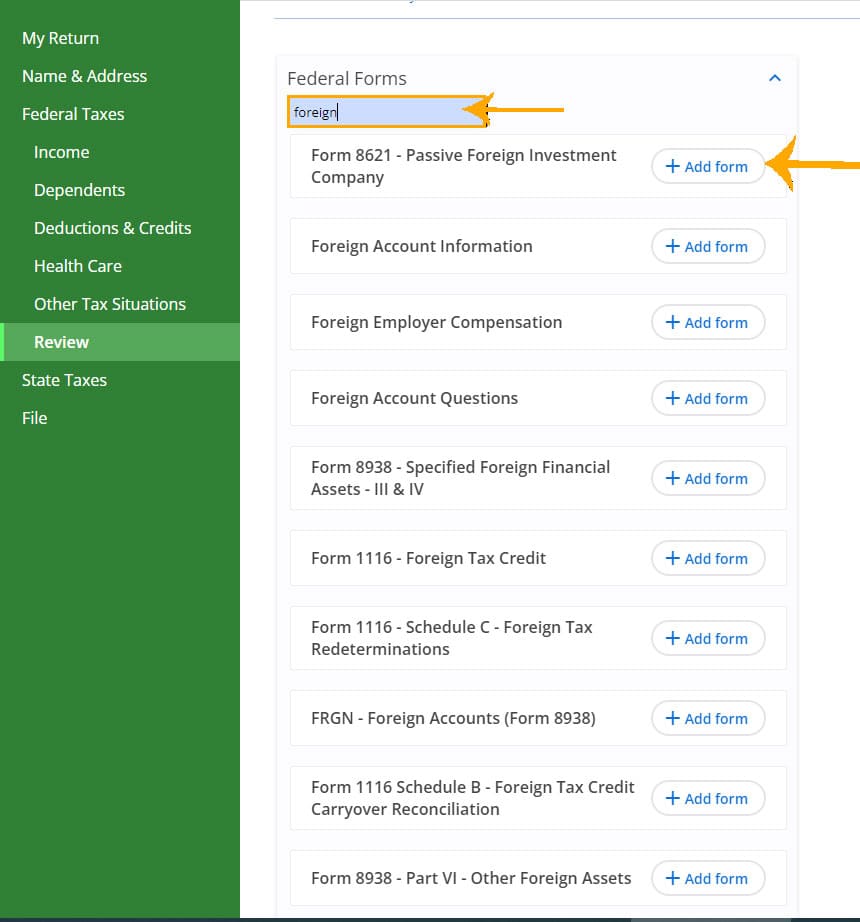

3. Search Foreign Forms

Follow these screen instructions and enter "Foreign" if you need to add any forms related to foreign earned income.

4. List of Foreign Forms

After you entered "Foreign," you will see these options. Click on "Add Form" for more details.

- Foreign Return Options

- Form 1116 - Foreign Tax Credit

- Form 8938 - Part VI - Other Foreign Assets

- FRGN - Foreign Accounts (Form 8938)

- Foreign Account Questions

- Form 8621 - Passive Foreign Investment Company

- Form 2555 - Foreign Earned Income Exclusion

- Foreign Employer Compensation

- Form 8938 - Specified Foreign Financial Assets - III & IV

- Form 8805 - Foreign Partner's Information Statement of Section 1446

See additional information about foreign income.

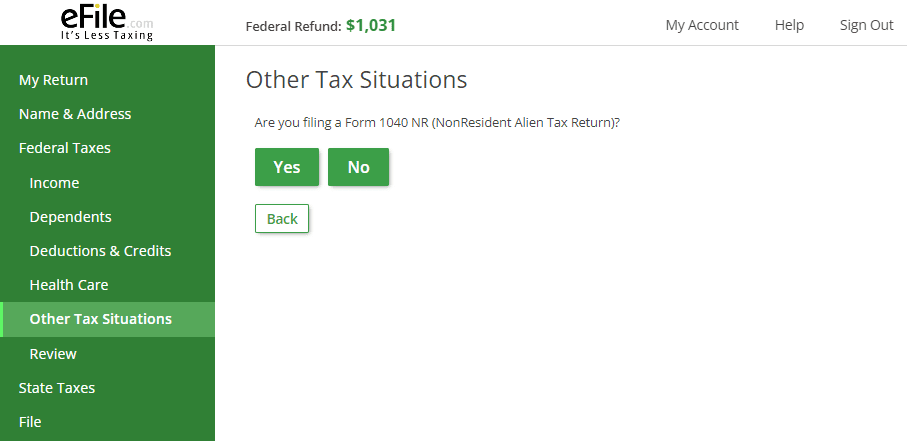

5. Other Tax Situations

Follow these screen instructions and enter "Other Tax Situations" if you need to add any forms related to foreign earned income.

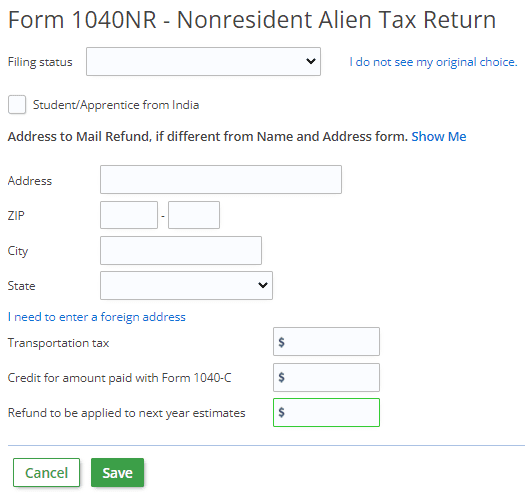

6. Add 1040-NR Forms

Follow these instruction to add 1040NR forms - In the search box enter 1040-NR or 1040NR.

Interest/Dividends: US citizen and resident alien report Interest and Ordinary Dividends on Schedule B (Form 1040). It is not used with Form 1040-NR. Interest and dividends are reported on Form 1040-NR the following ways:

- Interest and dividends that are effectively connected with U.S. trade or business are reported on the face of the 1040-NR on lines 2 and 3 - check your PDF in your My Account and you will see the interest listed there.

- Interest and dividends that are not effectively connected with U.S. trade or business are reported on Schedule NEC (Form 1040-NR).

- If a 1040-NR filer also received interest and dividends related to foreign financial assets, you might also need to file Form 8938, Statement of Specified Foreign Financial Assets.

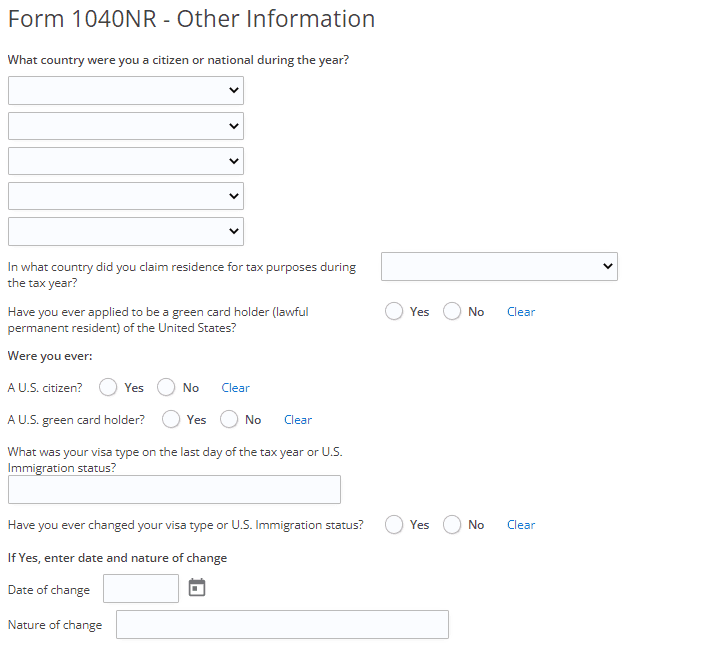

- Next, select Review and you will be prompted to finish your 1040-NR by clicking the green button. This will bring you to a lengthy section, but only certain entries are needed. Enter all applicable information as applicable; the following questions are required:

- What country were you a citizen or national during the year?

- In what country did you claim residence for tax purposes during the tax year?

- What was your visa type on the last day of the tax year or U.S. Immigration status?

- Give number of days you were present in the United Status during: 2021, 2022, 2023.

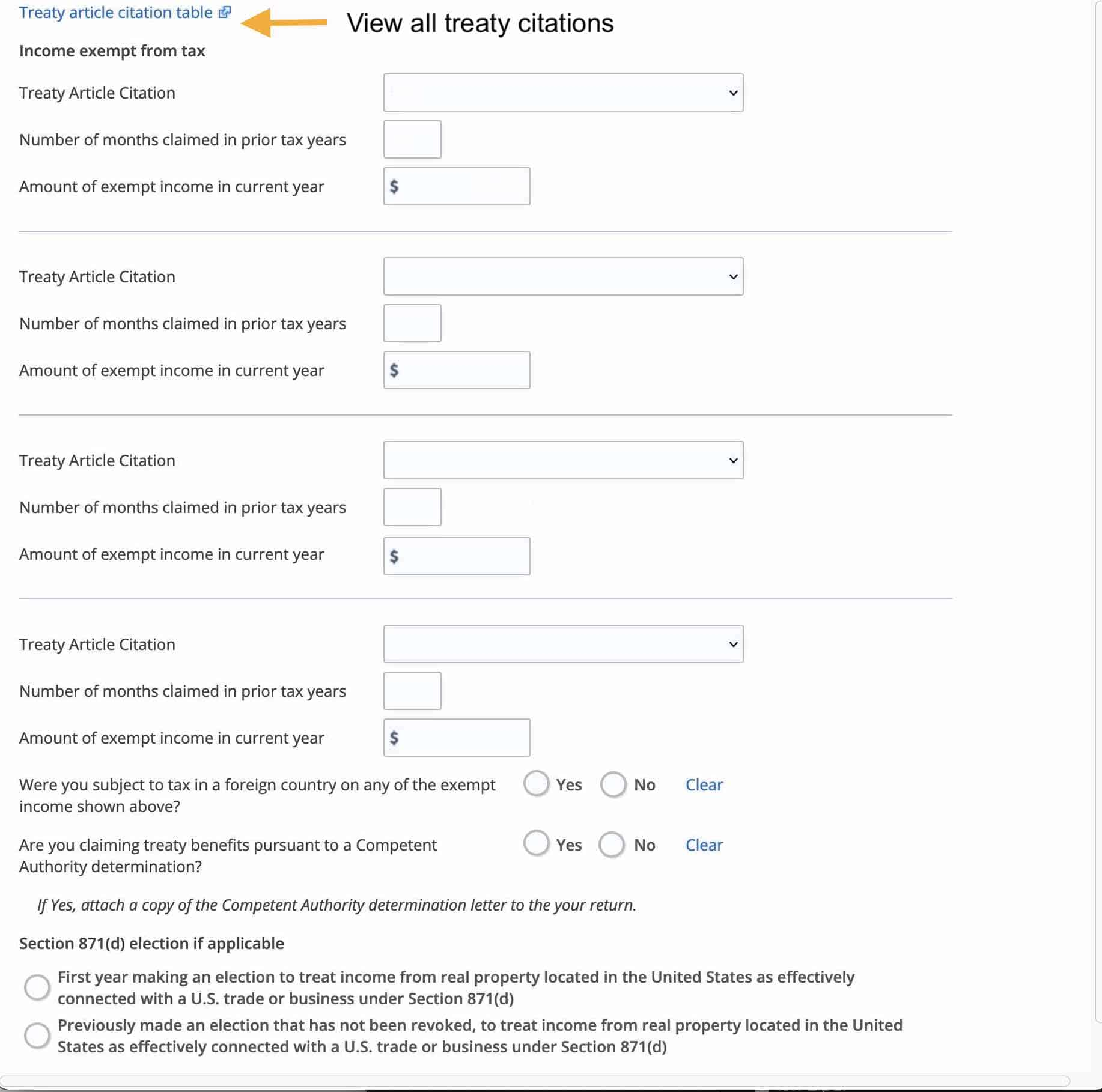

1040-NR Treaty Section: Based on the treaty citation table select the treaty article citation in the drop box.

6. Exempt Interest Income

If the taxpayer is claiming that their interest income is exempt by treaty, they would not report it on the 1099-INT screen, but only on Schedule OI where they selected the treaty article.

Once you are done with the form 1040-NR as a nonresident, proceed with adding all your income, deduction, and other tax information you may still need to input. You can also manually add other foreign-related tax forms from the green menu on the left click on:

- Federal Taxes -> Review -> (on the right side page)I'd like to see the forms I've filled out or search for a form -> select the Foreign tab.

Foreign Credit Card: If you do not have a U.S. credit card contact us here if you have a foreign based credit card and we will guide you through the check-out process as a U.S. credit card is required from inside the app to pay for the tax preparation fees.

For direct refund deposits you will need a U.S. bank account for the IRS to deposit a refund into or to take a payment from. Otherwise, a check can be mailed to you.

If you use 1040-NR, the following states will not allow you to e-file a state return. You can however prepare them and download, print, sign and mail them in from your My Account:

- Alabama

- District of Columbia

- Hawaii,

- Illinois (only if Social Security income is present on your return)

- Nebraska,

- Oklahoma.

Related:

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.