Prepare, File One or Multiple State Tax Return(s) Only

All, not each,

41 States + DC

only $29.95!

Per IRS and states regulations - not eFile.com - taxpayers can NOT e-file one or more state returns alone (the exception is California) without e-filing the federal return. This is because the tax data on a federal return is, to a great degree, identical to that of a state tax return. Thus, state tax agencies depend on IRS data verification during e-filing to reduce tax fraud and identity theft. A state tax return can only be e-filed with an IRS or federal income tax return, not just on eFile.com, but anywhere.

However, you can PREPARE one or all 41 state income tax returns plus the District of Columbia without also e-filing an IRS return via the eFile.com Tax App for only $29.95. Consider e-filing your federal and state tax returns all at once on eFile.com- it will save you time, money, and effort.

Tax Prep Savings Tip: Next year, spare yourself the hassle of using multiple sites to prepare returns, e.g., federal on one site and state on another. Instead, contact us for the special FREE FEDERAL and PAID STATE ONLY promotion code so your federal tax return is free and you only pay one low price for many states. On eFile.com, IT's either free or the lowest price guarantee, IT = Income Taxes!

Low-Cost and Simple Way to File Multiple State Tax Returns

When to file multiple state returns: There are certain times when you may need to file two or more state returns; on eFile.com, the price is still just $29.95 compared to $100 or more on other platforms. Common scenarios include:

- You lived in one state but worked in another with state income taxes.

- You moved during the year and must file two part-year resident state tax returns.

- You earned income in a state you did not live in (interest income, other investment income, etc.)

The eFile.com tax preparation app lets you prepare and download your state tax return(s). When done, print all state income tax returns for one low price, not one per state. Compare that to TurboTax® and H&R Block® who charge over $50 per state*)! eFile.com charges only $29.95 for ALL your state income tax returns: start now.

Contact us here to receive a state-only code during checkout so you do not have to pay for federal preparation. You will only pay the state preparation fee.

KEY TAKEAWAYS

- Taxpayers cannot e-file one or more state tax returns without also e-filing a federal return, as state tax agencies rely on IRS data to verify tax information and reduce fraud.

- California is the exception to the rule, allowing taxpayers to e-file state returns without requiring the federal return to be e-filed simultaneously.

- Taxpayers can prepare state tax returns without e-filing a federal return. They can prepare multiple state returns, including the District of Columbia, without e-filing the federal return.

- Common scenarios requiring multiple state returns include living in one state and working in another, moving during the year, or earning income in a state where you do not reside.

- If a federal return has already been e-filed on another platform, taxpayers can still prepare, print, and mail their state returns separately by following specific steps to ensure the federal information is included for state return preparation.

If you e-filed your federal tax return on TurboTax®, H&R Block®, or any other tax preparation platform, you can still prepare, print, and mail all your state income tax return(s) on eFile.com for one low price. However, to save you time and money, we invite all TurboTax® and H&R Block® users to use eFile.com for BOTH their federal return and state return. Not only will you save time and money, but you can also e-file BOTH your federal and state returns and benefit from superior free Taxpert® support. There are no digital assistants on eFile.com; you will only talk to real people.

Since much of the tax information (income, personal information, deductions, etc.) on a state income tax return is similar to a federal income tax return, eFile.com will guide you through the same screens for federal and state. Thus, you will complete what looks like a federal tax return. However, you will not e-file the federal return at checkout but print to mail and file your state return.

State Only Return, No Federal Return

Due to policy by tax authorities (not eFile.com nor any other online tax preparation platform), you can only e-file a state tax return with your federal tax return. If you have already e-filed or filed your federal return, you can still prepare your state return on eFile.com. Enter all your tax data, but on checkout, simply follow the steps and screen instructions below:

- If you do not have an eFile.com account, create a free account.

- If you have an eFile.com account, sign in and prepare your state return; you will start by entering general information.

- You will need to prepare a federal return, but you will NOT have to e-file it during checkout and you will NOT have to pay for it. This seems confusing, but you must prepare a federal return on eFile.com even if you have already filed or e-filed a federal return elsewhere because the state return is largely based on the federal return. Follow the steps to generate your state return(s).

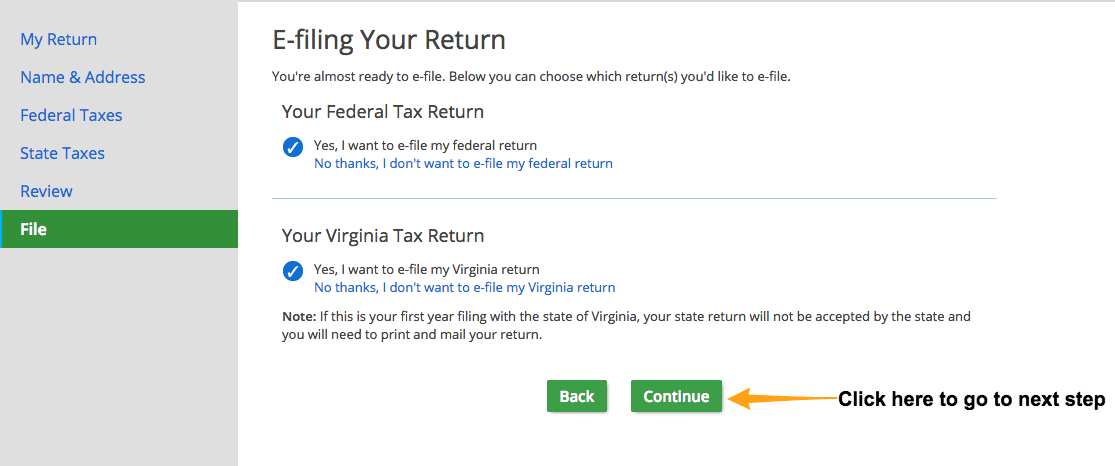

- Do not select the No thanks, I don't want to e-file my federal return link. This seems contradictory because you are not filing the federal return, but you will need to keep the Yes, I want to e-file my federal return selection and select the green Continue button to move on to the next step, as shown below.

- Before you reach the next step, you will go to a screen describing the additional audit protection service. Since we already offer free audit protection, select the "No thanks" button so you will not be charged for the service.

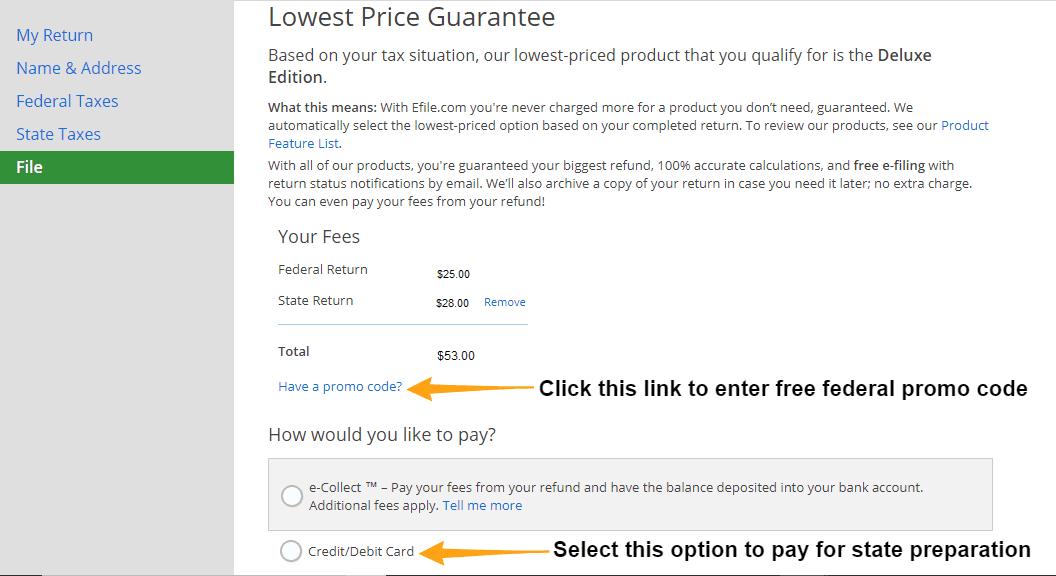

- On the Lowest Price Guarantee screen, you will still see a fee for preparing the federal return. Contact eFile.com support, and one of our Taxperts® will give you a special discount code so you are not charged for the federal return. Important: You are not paying for e-filing as this is included for free when you e-file your federal and state taxes together. You are paying for the full preparation of your state return for you to print and mail.

- To enter the code, select the blue Have a promo code? link, enter it in the box that appears, and select "Apply Code." You can only enter one promo code, so do not enter any other discount codes. Once you enter the promo code, select the Credit/Debit Card option to pay with your credit or debit card and select the green "Continue Payment" button to submit your payment information. With this code, you will only pay for the state preparation. Important: You cannot use the e-collect feature to pay for your return. The banks require an e-filed federal return for this; since you are not e-filing federal, you will need to pay the state fee via debit/credit card.

- Select "My Account" on the top of your eFile.com account screen, and you will see a link to a PDF copy of the tax return you prepared on our site (on a mobile device, select the three dots). Select that link to download and print your state return and make sure you sign the return before you mail it - see mailing instructions and addresses. If there is no link to your PDF return (or if the PDF has a "Not Valid for Filing" watermark), you will need to pay for the preparation of your state return to generate the PDF and remove the watermark. However, if you still do not see the PDF link and/or see the watermark after paying for the preparation of your return, select "File" on the left menu and select the green "Continue" button until you get to the screen that has the “Yes, I'd like to create a preview of my return” link. Once you select that link, the PDF will be generated and updated without the "Not Valid for Filing" watermark. You'll see a link to the return on the “My Account” screen.

- If you need more help preparing, printing, and mailing only your state return, contact eFile.com support.

When to File Other State Returns

You generally have to file a tax return for your resident state. However, you may need to file more than one state return if any of the following are true:

- You resided in more than one state, moved from one state to another state, and/or worked and earned income in another state.

- You had gambling winnings, rental income, partnership, or S-Corp income from a business based in another state.

- You received retirement income or pension income from another state in the year you moved.

- You had income from an estate or trust with interest in another state.

- Your employer improperly withheld taxes for the wrong state.

You might need to file returns for multiple states if you lived or earned income in more than one state. Depending on your situation, you may need to file part-year resident returns or nonresident returns. eFile.com will determine the correct type of state tax return(s) to prepare. Find out more about resident, part-year resident, and nonresident state tax returns.

Only on eFile.com can you file multiple state returns for one low price!

If you have questions about preparing and filing your state and/or federal returns, do not hesitate to contact eFile.com support.

Already filed? Check the status of your state income tax return refund.

*) Subject to change.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.