How to Report Unemployment Income

Unemployment compensation, benefits, or income is considered taxable income and thus needs to be reported on your tax return.

How to File Taxes on Unemployment?

As an unemployment benefit recipient, you will receive Form 1099-G, Certain Government Payments, from you state tax agency by January 31, either by mail or electronically. If you did not receive the 1099-G from your state, contact them or the state unemployment compensation website for this form.

Instructions: What do I do with Form 1099-G?

Form 1099-G reports the amount of unemployment compensation received in Box 1 and any federal income tax withheld in Box 4. Be sure to include these amounts on your tax return on eFile.com - see instructions below. State details are added lastly on the page if your state taxes unemployment income.

In your eFile account, you will be walked on all your various types of income. Under Federal Taxes > Income, you will be able to report your 1099-G under the Other section towards the bottom of the page. The easiest way to add your unemployment income is by following the tax interview. This will assure you add all types of income you may have received during the year.

Alternatively, you can add is manually by searching for the form.

Step 1: Sign in your eFile.com account

Step 2: After signing in to your eFile account, select Help in the upper right and search for 1099-G and add the form.

On the form page, enter and search for 1099-G and select +Add Form. Finish the unemployment section by adding the information from your 1099-G and the eFile App will generate the required forms and include them with your return.

Was Unemployment Tax-Free in 2020?

For 2020 Returns only, the IRS excluded up to $10,200 from your taxable income. This does not apply to any other year. The details below are archived for informational purposes only.

You may have received unemployment income as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES). There were some income tax adjustments due to the American Rescue Plan or stimulus three legislation as of March 12, 2021 outlined below. This was done through the $10,200 Unemployment Compensation Exclusion or UCE. The unemployment changes apply to 2020 Taxes only.

- If you eFiled your 2020 Return on or before March 15, 2021 and reported unemployment income and you want to adjust your income tax return based on the American Rescue plan as of March 12, 2021, you do not have to do anything. The IRS confirmed that they would issue refunds for taxpayers who reported all of their unemployment income as taxable income. On March 31, 2021 the IRS announced the money would be automatically refunded during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021. If you did not receive this refund and have determined you were owed one, contact the IRS.

- If you eFiled on or after March 16, 2021 and reported unemployment income, the eFile Tax App will have calculated all necessary adjustments; you do not have to do anything else.

- See details on when can you expect payment of the plus-up or unemployment refund increase if you filed before March 16, 2021.

If you reported unemployment income, e-filed before March 16, 2021, and your return got accepted by the IRS and you want to adjust the income tax for unemployment benefits due to the Stimulus 3 legislation, do NOT file a tax amendment. The IRS should have issued you an additional refund. Only file an amendment if you were newly eligible for tax credits as part of the change. See more details on when an amendment is required for the UCE.

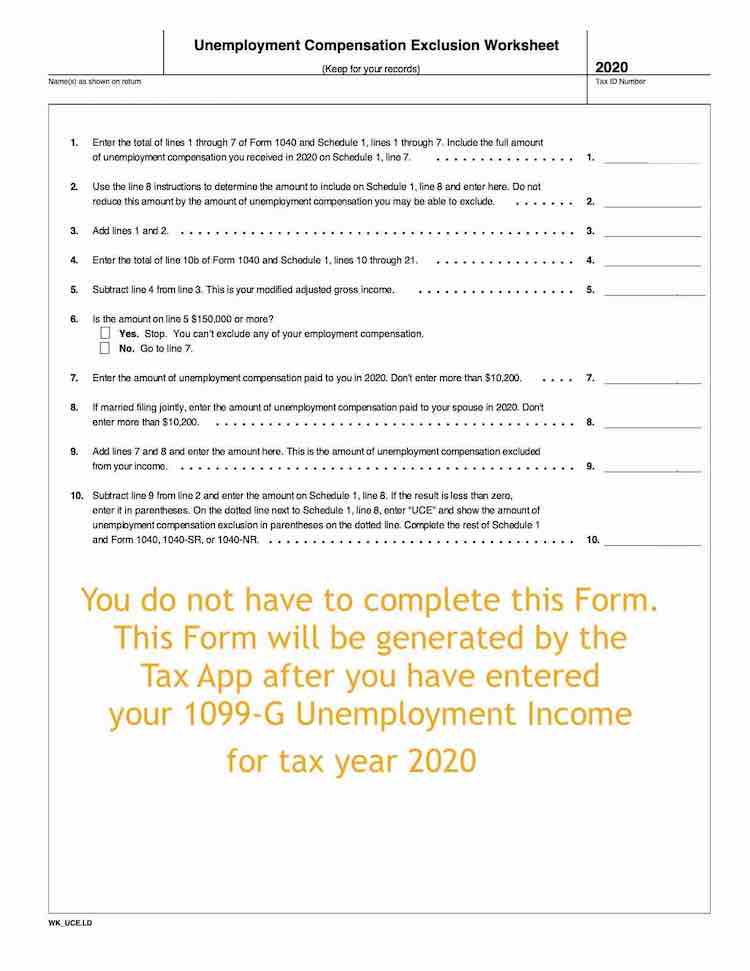

If you reported unemployment income and you e-filed on or after March 16, 2021, the eFile.com Tax App would have made this adjustment and added the Unemployment Compensation Exclusion Worksheet - see below - as part of your tax return:

Find more information on unemployment benefits.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.