Health, Medical, and Flexible Spending Accounts

Black Canyon, Colorado

@tevintrinh

There are several programs based on tax breaks that are designed to help you pay for you and your family's medical expenses. The IRS provides special programs for this purpose, including Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and Medical Savings Accounts (MSAs).

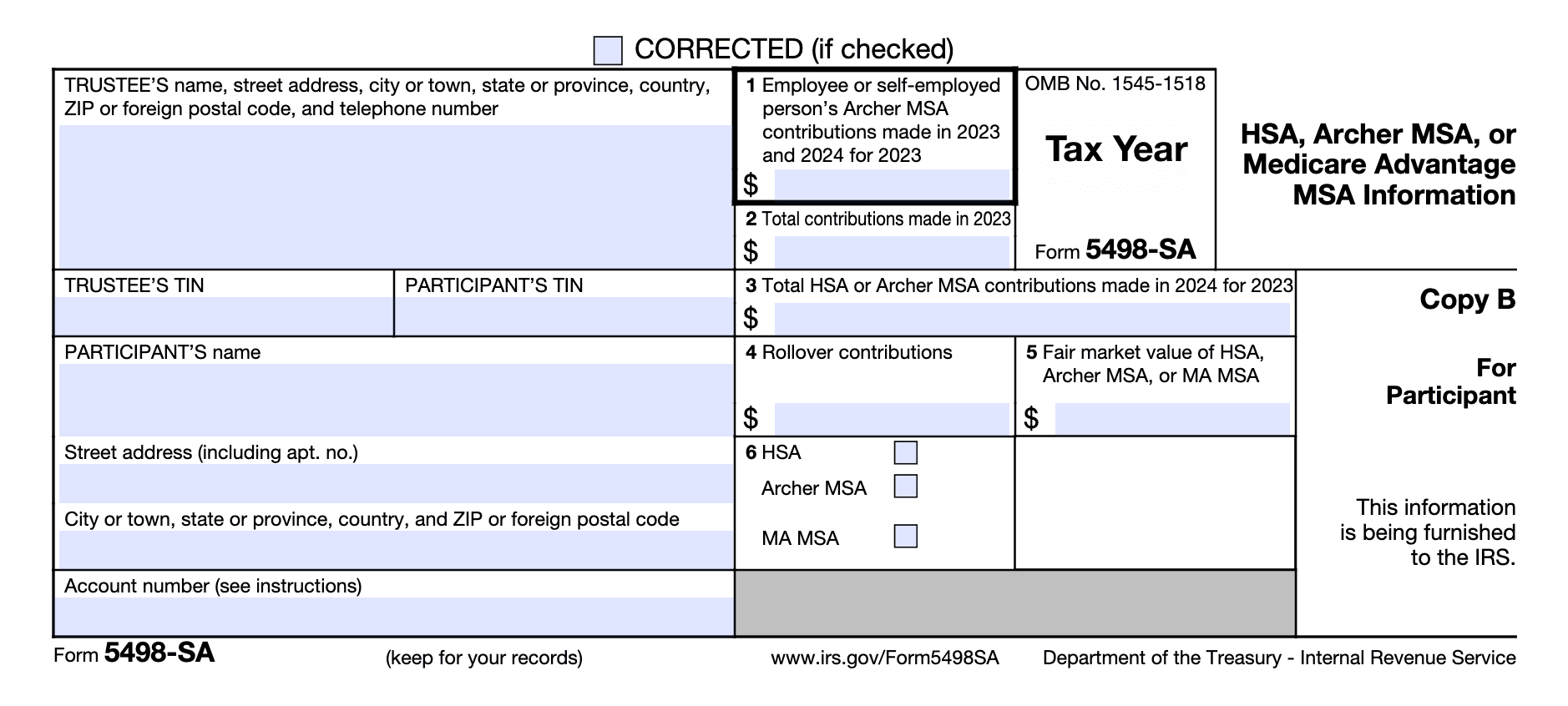

A. Health Savings Account (HSA): Contributions to your HSA are reported using Form 5498-SA. The amount you can contribute tax-free depends on the tax year and your filing status. Details on these limits are provided below.

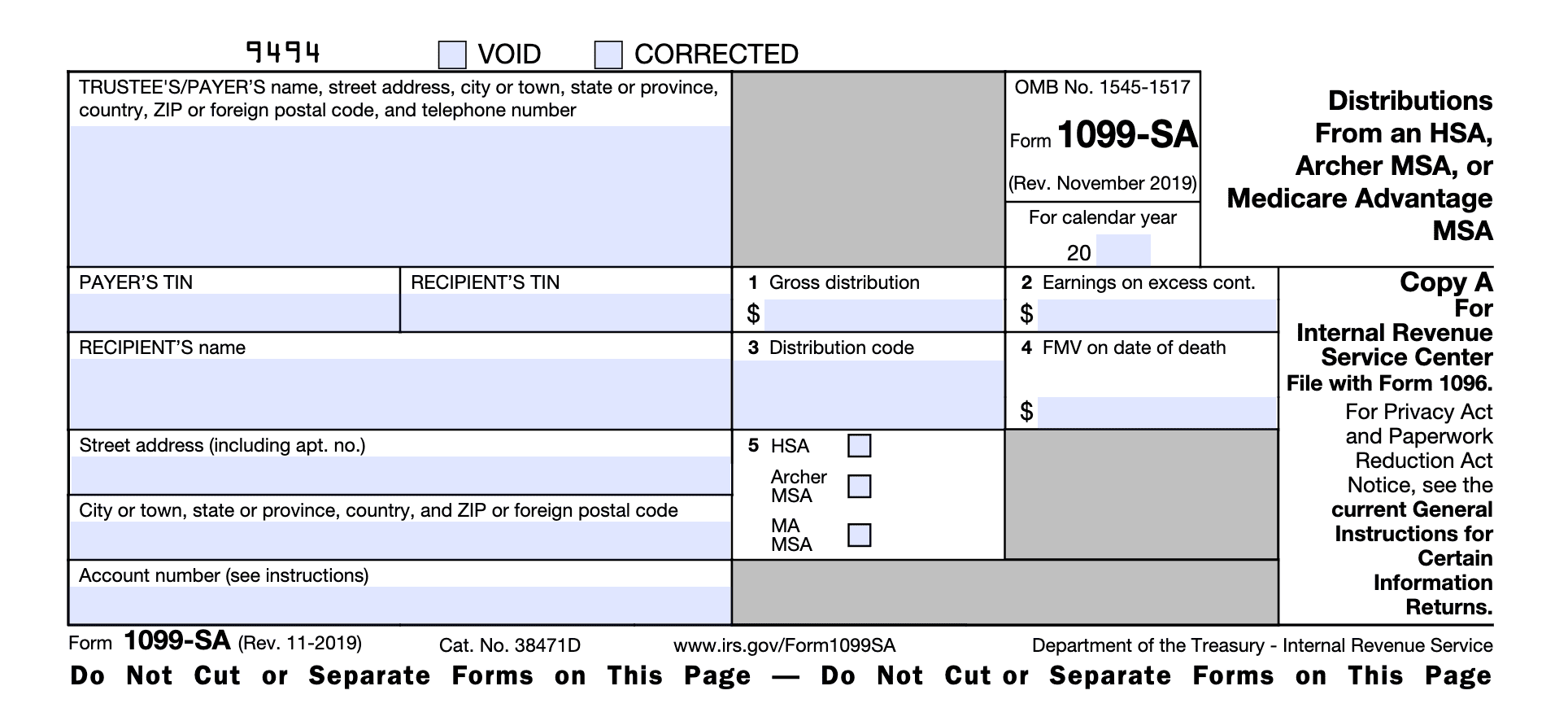

B. Health Savings Account Distributions: If you used HSA funds for qualifying medical expenses, you’ll receive Form 1099-SA. If these distributions were used for eligible expenses, you don’t need to report Form 1099-SA on your tax return but should keep it for your records.

C. Qualifying Expenses: These include expenses for doctor visits, hospital stays, prescribed medications, and other essential healthcare services. However, expenses like gym memberships or healthy foods are not considered qualifying medical expenses.

(Refer to the images of Forms 5498-SA and 1099-SA below for more details.)

Additional Resources:

Based on the answers and data provided in your eFile account, the tax return forms will be created for you. Start free on eFile.com, file by the tax deadline, and you can be assured that we will prepare the tax return forms with 100% accuracy based on your entries. This includes Form 8889 used to report your HSA contributions and/or distributions. See how the eFile Tax App works and start tax planning now.

Common HSA, FSA, MSA, and HRA Expenses

Below are medical expenses which can be paid or reimbursed by one of your medical accounts. You can use money from your health savings account to pay for any of the expenses listed below.

- Dental exams, eye exams, or physical exam since they provide diagnosis on whether an illness or disease is present

- Drug, alcohol, or smoking substance use disorder program fees

- Therapy as long as it is used to treat a disease, such as a professionally diagnosed mental illness

- Nutritional counseling, weight-loss programs, and gym memberships only if the program or membership is used for a specific disease that was diagnosed by a physician or to target a specific structure or function of the body. This includes treating obesity, diabetes, hypertension, heart disease, or by order of a physician following physical therapy. Gym membership fees for the improvement of general health do not qualify.

- Food or drinks purchased for weight loss or another health reason; conditions apply

- Nonprescription or over-the-counter drugs as well as nutritional supplements (recommended by a professional as treatment for a diagnosed condition).

Consider saving money in your HSA, MSA, or other account in order to invest and increase your account's value rather than spending it if possible.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-exempt account used to pay or reimburse you and your family's medical expenses if you are covered by a high-deductible health insurance plan (HDHP). A high-deductible insurance plan means that you are responsible for a greater amount of your initial health care costs, saving the insurers money. For you, the benefit generally comes in lower monthly premiums.

You or anyone else can contribute money to your HSA. You can take a tax deduction for money contributed to your HSA by anyone except your employer. The money you take out of the account is tax-free if you use it for qualified medical expenses.

A wide range of IRS-qualified medical expenses are covered with your HSA. These include many expenses that aren't typically covered by health insurance plans, such as deductibles, co-insurance, prescriptions, dental and vision care, and more. See a complete list of IRS qualified medical expenses and details on Health Savings Accounts (HSA) and other tax favored health plans.

You can set up a HSA through your employer, bank, insurance company, or another approved trustee. Health savings accounts are portable, so you can keep the account even if you change employers. The money in an HSA remains in the account until you spend it.

The requirements to qualify for an HSA are:

- You must be covered by a high-deductible health plan (HDHP) on the first day of the month.

- You cannot have any other general health coverage except a high-deductible health plan (there are exceptions for specific coverage, such as for vision, dental, disability, or long-term care insurance).

- You may not be enrolled in Medicare.

- You must not be claimed as a dependent on someone's tax return.

There is a limit on how much you can contribute to your HSA since it yields tax savings. Review the limits in the table below by tax year.

Contribution Limit for a Health Savings Account

Note: If you are 55 years old or older by the end of the tax year, you can add an additional $1,000 to your HSA contribution. You can make tax year contributions until April 15 of the following calendar year.

Health Savings Contributions HSA Form 5498-SA

Contributions that you save or make to your HSA can be carried into the future without a requirement to spend saved amounts. Thus, in retirement, you can use these funds for health-care payments.

You generally cannot make contributions to an HSA if you are covered by a Flexible Spending Account or a Health Reimbursement Account.

Reporting HSA Contributions on Your Tax Return

If your employer made the contributions and they are listed on your Form W-2 or your contributions were made pre-tax, then these contributions will not be on Form 8889 because they are reported on your W-2. However, if you made the HSA contributions post-tax, they will be reported on Form 8889 - eFileIT. The same applies for the HSA employer contribution. The eFile Tax App create the correct forms for you based on your entries during the tax interview.

When you file your tax return, report HSA contributions - see form above 5498-SA - so your deduction can be applied.

Your gross (total) distributions from an HSA are reported to you on 1099-SA - see below.

Health Savings Account Distributions HSA Form 1099-SA

On your eFile.com tax return, contributions and distributions will be reported via Form 8889. Start and prepare your return on eFile.com; we will select the proper form(s) for you and help you fill them out correctly.

Medical Savings Account (Archer MSA)

An Archer Medical Savings Account (MSA) helps those employees of small businesses and self-employed people who are covered by a high-deductible health plan to pay the health care costs of themselves, their spouses, and their dependents. If you are employed, either you or your employer may contribute to your Archer MSA in any given year, but not both. If you are self-employed, only you can make contributions to your MSA.

What does my healthcare plan have to be for me to open a Medical Savings Account?

Your high-deductible plan must meet certain criteria, including an annual deductible threshold and out-of-pocket maximum; the table below summarizes this by year.

2025

Individual: TBD

Family: TBD

Individual: TBD

Family: TBD

2024

Individual: $2,800 - $4,150

Family: $5,600 - $8,300

Individual: $8,050

Family: $16,100

2023

Individual: $2,650 - $3,950

Family: $5,300 - $7,900

Individual: $5,300

Family: $9,650

2022

Individual: $2,450 - $3,600

Family: $4,950 - $7,400

Individual: $4,950

Family: $9,050

2021

Individual: $2,400 - $3,600

Family: $5,300 - $7,900

Individual: $4,800

Family: $8,850

What qualifies as a high deductible plan?

For 2024, a qualifying high deductible plan has an annual deductible of $1,600 or more for individuals and $3,200 or more for family plans. The plan must also have an out-of-pocket maximum that does not exceed $8,050 for individuals or $16,100 for family coverage. This is up from a deductible of $1,500 or more for individuals and $3,000 or more for family plans in 2023. The out-of-pocket maximum for 2023 does not exceed $7,500 for individuals or $15,000 for family coverage.

You can set up an Archer MSA through your employer, a bank, an insurance company, or another financial institution. Medical Savings Accounts are portable, so you can keep the account even if you change employers and the funds in an MSA remain in the account until you spend them.

You qualify for an Archer Medical Savings Account if all of the following are true:

- You are employed by a small employer (with an average of 50 or fewer employees over the last 2 years) at the time you start the MSA or you are self-employed.

- You are covered by a high-deductible health plan (HDHP).

- You do not have any other general health care coverage except a high-deductible health plan (there are exceptions for specific coverage, such as for vision, dental, disability, etc.).

If you are eligible to be covered by Medicare, then you cannot enroll in an Archer MSA, but you can enroll in a Medicare Advantage MSA. This is like an Archer MSA, but you can only use the funds from a Medicare Advantage MSA to pay your own qualified medical expenses.

If you make contributions to your MSA, you can deduct the contributions on your tax return even if you don't itemize deductions, unless you are eligible to be claimed as someone else's dependent for the year. Distributions from an MSA are tax-free if the money is spent on qualified medical expenses, such as expenses not covered by your health plan because you have not yet met the high deductible (see a list of qualified medical expenses).

The maximum annual contribution to an MSA is 75% of your family health plan's annual deductible amount, or 65% of the deductible if you have a self-only plan. If you were not covered for the whole year by a high-deductible health plan, the maximum allowable contribution to your MSA is reduced by 1/12 per month in which you were not covered.

You may be able to carry forward excess contributions to an MSA and deduct them in a future year. Generally, you can also roll over funds from an MSA to a Health Savings Account tax-free. There are no HSA contribution limits for rollovers, but you can only make one rollover contribution per 1-year period.

Your total (gross) Archer or Medicare Advantage MSA distributions for the year will be reported to you on Form 1099-SA. When you file your tax return, you must report all distributions from your HSA - and contributions to your HSA - on Form 8853 - eFileIT, which can be e-filed with your return on eFile.com. We will automatically select this form for you on eFile.com if you qualify for it based on your answers during our tax interview.

Flexible Spending Account or Arrangement (FSA)

A Flexible Spending Arrangement or Account (FSA) is an employer-sponsored account that helps you pay for you and your family's medical expenses. This may sometimes be referred to as a cafeteria plan. You may also set up a Dependent Care FSA or DCFSA which has the same tax implications as one used for medical expenses. An FSA is funded by voluntary paycheck withholding and by employer contributions. All money contributed to an FSA is completely tax-free for you. No payroll or income taxes are withheld from your contributions to an FSA and contributions by your employer are excluded from your taxable income. Withdrawals from a Flexible Spending Account are tax-free if the money is spent on qualified medical expenses.

You can only establish an FSA through your employer, meaning self-employed people are not eligible. You do not have to be covered by a high-deductible plan or by any other health plan to qualify for an FSA.

With an FSA, there are limits for how much you can contribute per year and how much carries over into the next year. Review the table below for these figures.

The maximum amount you can contribute to an FSA through paycheck withholding is $3.200 in 2024, up from $3,050 for 2023. There is no IRS-imposed limit on the amount your employer can contribute, but there may be other limits if you are considered a highly compensated employee.

At the beginning of each year in which you have a Flexible Spending Account, you must decide the amount that you will contribute to it over the course of the year. It is important not to contribute too much to an FSA, because FSAs are "use-it-or-lose-it" for any amount above the carryover limit. This means that you must spend the money in the account by the end of the tax year or else any remaining amount is forfeited, excluding the amounts in the table above. For example, any amount up to $610 kept in your FSA in 2023 can be carried into 2024.

Your employer can provide up to a 2 and 1/2 month grace period for you to spend the money in the following year. It is also possible to roll over funds from an FSA to a Health Savings Account, tax-free. Rollover contributions to HSAs have no dollar amount limit, but you may only make one rollover contribution per 1-year period.

You do not report Flexible Spending Account contributions nor distributions on your tax return.

See also: Child and Dependent Care Credit.

Health Reimbursement Arrangement (HRA)

A Health Reimbursement Arrangement (HRA) is an employer-sponsored plan that reimburses you for the health care costs of you and your family. Your employer is the only one who can contribute to your HRA.

An HRA is established by your employer, so self-employed individuals are not eligible. There is no requirement to be covered (or not covered) by any other type of health plan, so you can enroll in an HRA if it is offered by your employer, no matter what other health coverage you have (or do not have).

Your employer can set the maximum coverage amount, but the IRS limits this to $1,950 for 2023, up to $2,100 in 2024. Employer contributions are tax-free income to you. Reimbursements are excluded from your taxable income if the money was spent on qualified health costs and medical expenses. There may be some exceptions if you are considered a highly compensated employee. Unlike FSA funds, unused funds in an HRA at the end of the year are not forfeited and can be carried forward to later years.

Information about a Health Reimbursement Arrangement is not reported on your tax return.

Tax Tip: You can itemize and deduct medical expenses that are not covered by one of these health plans.

More Information

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.