How to Enter an IP-PIN for a Dependent - IND-996

If you have an IP PIN for your dependent, you will need to enter it in order to file online.

- If you already have an IP-PIN for your dependent(s), follow these instructions on how to enter an IP-PIN for a dependent.

- If you need a new or replacement IP-PIN, then get the IP-PIN and follow these instructions on how to enter the IP-PIN for the dependent.

- If your personal or spouse's IP-PIN gets rejected, you can also get a new IP-PIN. Then enter the IP-PIN during the checkout and e-filing process.

Important: you can get an IP-PIN online for your dependent, spouse etc. by creating an IRS account. You will have to verify their identity during the sign-up process. You may also be able to do it over the phone or through the mail which is less recommended than online.

Where to Enter Your Dependent's IP PIN?

Dependent IP-PIN Solution: Sign in to eFile.com and then select Federal Taxes on the left.

- Select Dependents on the left menu, then open the dependent which you need to enter an IP PIN for.

- Scroll to the bottom of the form and select this link: I'd like to see the advanced options for this dependent.

- Select This dependent has an Identity Protection PIN.

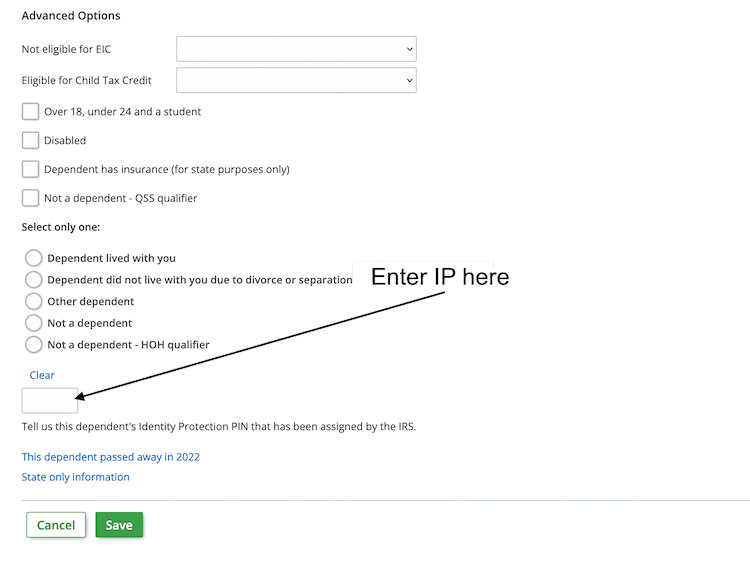

- Enter the IP-PIN in the field; see the screenshot below for further details.

See more resources on the IRS IP-PIN:

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.