Report IRA Contributions on Your Tax Return - Form 5498

Did you receive an IRA contribution summary via Form 5498 or 5498-SA by January 31? Are you unsure of how to enter this form on your tax return?

- If you have IRA contributions to add to your return in order to reduce your taxes, you can do this manually by adding your contribution to your eFile account. This should only be done for contributions that were not already reported on your W-2.

- Important: in many cases, Form 5498 and 5498-SA are informational and you do not need to do anything with them.

- After you have entered "IRA" in the search box (see steps below), select one of the forms that reflects what is reported on the form 5498 you received.

Follow the steps on how to enter and report Form 5498 and or Form 1099-R information on your eFile.com tax return.

2. Enter IRA Contributions

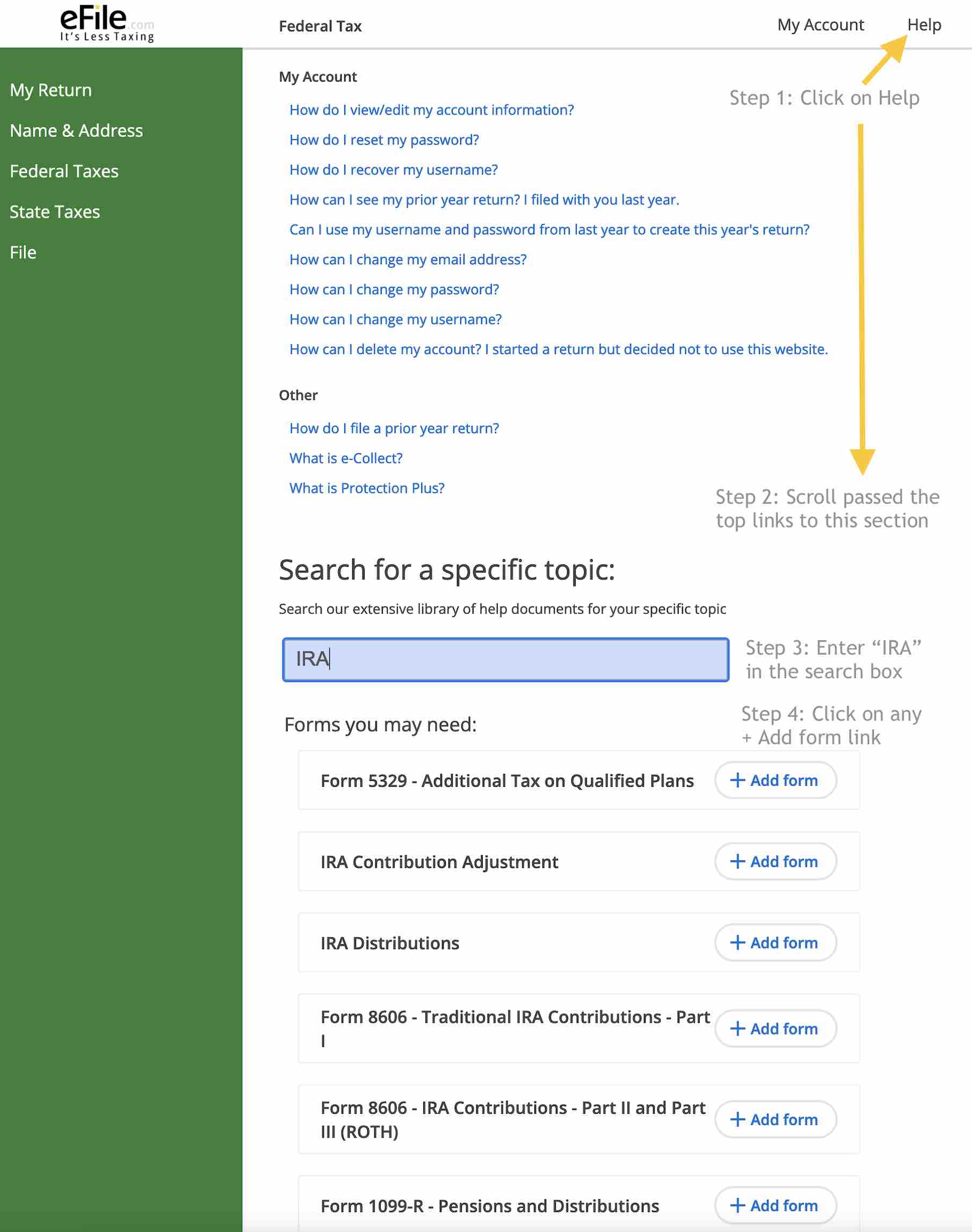

As you work through all sections, eFile will ask you if you contributed to an IRA during the Retirement section under Deductions & Credits. However, you can also add it manually. Select Help in the top section and enter

IRA in the search box. Then scroll through the list of forms and select the IRA contribution option you need by selecting

Add form. If you made IRA contributions that you paid with after-tax dollars and thus want to deduct your contributions, you can add the Traditional IRA contributions worksheet or the IRA Contribution Adjustment.

See the details below.

3. How to Review, Add, Delete a Form or Page

5. Contact eFile.com Support

Let us know and

contact us if you have questions about this or any other form.

See details on the Forms 5498 and 1099-R and detailed IRS information on related forms: 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.