ITIN Tax Return Preparation Without SSN

Sample Social Security Number (SSN) Card

Sample Individual Taxpayer Identification Number (ITIN) Card

A Social Security Number or SSN is an identifying number assigned to American citizens at birth. This number serves as part of your identity and is needed to e-file your taxes.

If you are not an American-born citizen, then you do not have a SSN and would need an Individual Taxpayer Identification Number or ITIN. This is a 9-digit tax processing number issued by the IRS. ITINs are to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number or SSN from the Social Security Administration or SSA.

- If your ITIN is only used on information tax returns by third parties, you don’t have to renew your ITIN even if the ITIN has expired for purposes of filing a U.S. federal tax return. However, if you file another income tax return in the future, you will need to renew your ITIN at that time for Form W-7.

- See how to file a return and apply for an ITIN.

How to apply, obtain an ITIN? Complete Form W-7 and apply for an ITIN. You can also use Form W-7 to renew an existing ITIN that will expire or has already expired. Don’t complete Form W-7 if you have already an SSN or if you’re eligible to obtain one.

If you have an application for an SSN pending, don’t file Form W-7. Complete Form W-7 only if the Social Security Administration or SSA notified you that you are not eligible for a SSN.

An ITIN will not be issued or renewed for a taxpayer filing as head of household who is not also claimed as a dependent on an attached tax return.

How to Prepare a Tax Return Without an SSN?

B: Obtain a Temporary SSN or

Placeholder SSN

Contact eFile.com support to obtain a temporary or placeholder SSN. This SSN is only to be used during the tax preparation process on eFile.com.

Once you have obtained the temporary SSN, it is imperative that you

DO NOT eFILE a return with this temporary SSN. This temporary SSN will only allow you to prepare the return(s) via eFile.com and it must be removed or covered once you download the return(s). See details under G below.

C: Tax Return Preparation

Follow the tax interview and complete all sections.

D: Tax Return Review

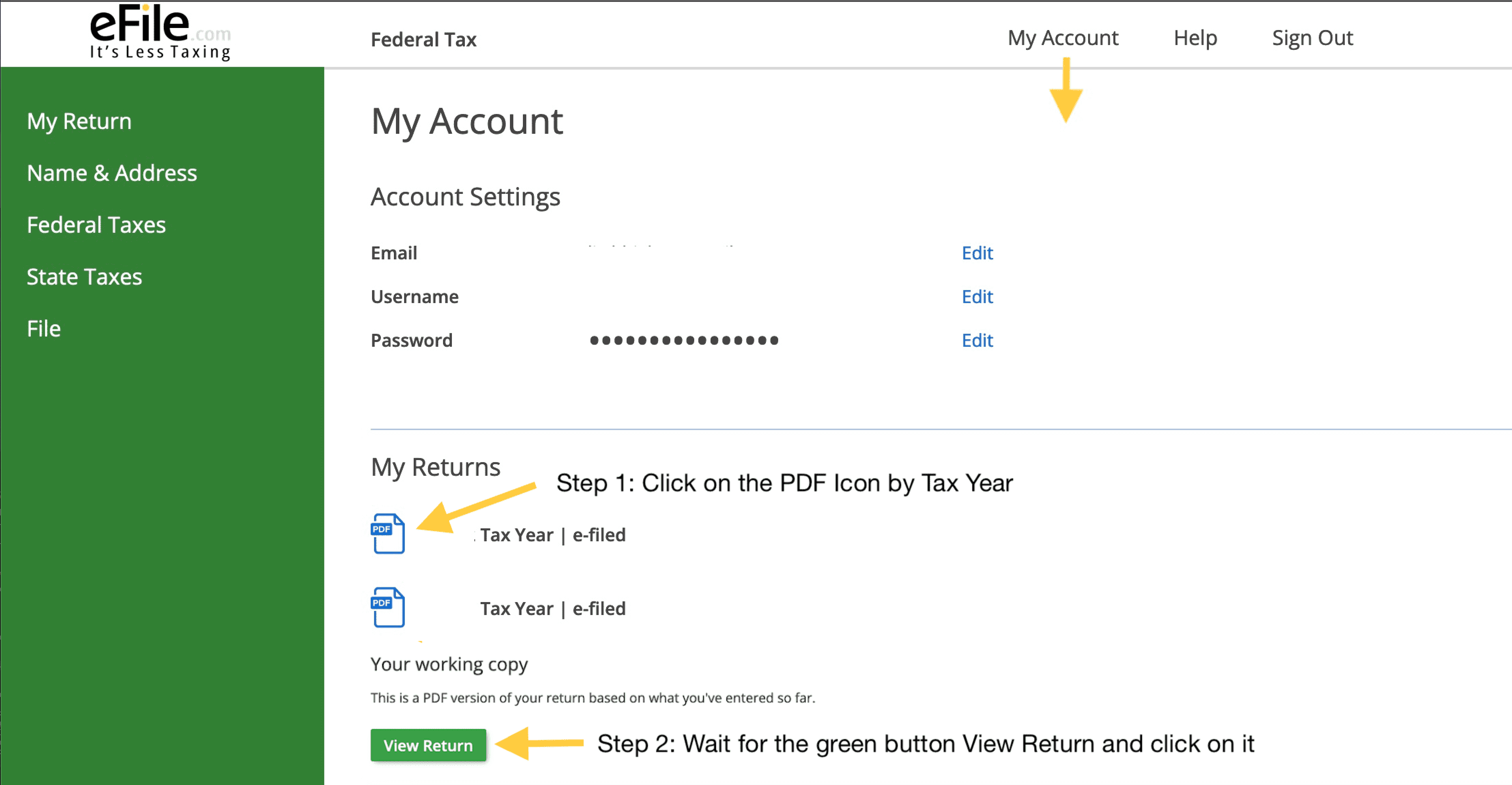

Review your completed return as a PDF file under My Account - see below.

F: Download, Print, Remove SSN, Sign

Follow D above and download your return; print your return and remove the temporary SSN with whiteout or cross-out with a pen. You can then sign your return.

G: Remove SSNs

1. Important: Do NOT attempt to e-file a tax return with a temporary or placeholder SSN.

2. Important: This temporary SSN SHOULD NEVER BE SUBMITTED TO THE IRS. This temporary SSN is ONLY for the purpose of preparing the tax return in your account. It is imperative your REMOVE (white-out) all temporary SSNs from the paper tax return submitted to the IRS in conjunction with the Form W-7 application.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.