Tax Return and Tax Refund Status

The IRS Where's My Refund tool provides the tax refund status for the last 3 tax years.

Once you have e-filed your taxes, your tax return status will change to Accepted by the IRS. If your return was Rejected by the IRS for any reason, it can generally easily be corrected and then re-efiled for acceptance. Rejections are typically not the result of un-reported taxable income, incorrectly claimed dependents, etc., they are most often cause by a data mismatch, such as the wrong AGI being entered.

If the IRS is delaying your tax return as shown on the tool, view this tax return road map for a better understanding which steps a tax return might go through.

Tax Return, Refund Steps

If your return is not immediately accepted, do not panic - filing your taxes involves multiple steps. That being said, your return may be stuck in pending; this is a normal, routine state that every tax return or extension goes through and it may last longer than other years. Follow the steps below to get your taxes done and learn about the different stages of filing your taxes online.

2. Your Tax Return Status

A: Check your tax return status online via the platform you filed on. If you e-filed your tax return at a different site, sign in to your account on that site; eFile.com cannot provide tax return status information for other websites or tax offices.

B: Sign in to your existing eFile.com account and you will see the status of your prepared and e-filed tax return:

- Not e-filed | In Progress

- Pending

- Accepted

- Rejected.

C: If your return was

rejected, most likely for a minor technical data mismatch, you can correct any errors and e-file again until your return is accepted at no additional charge. In case of an IRS rejection - not by eFile.com -

the rejection reason is shown in your account and you will be given details as well as a link to fix the issue. For specific assistance, contact eFile.com support so we can guide you through the required corrections. We will provide you detailed instructions on how to correct your return.

In summary: Once you e-filed your return(s) you will receive an email on the IRS acceptance status; otherwise, sign in to your eFile.com account and check if you e-filed your IRS and applicable state return(s). After sign in, select My Return see the status on the right-side page. Generally, you can get tax refund information 72 hours after the IRS has acknowledged the receipt of your e-filed tax return or three-to-four weeks after mailing a paper tax return.

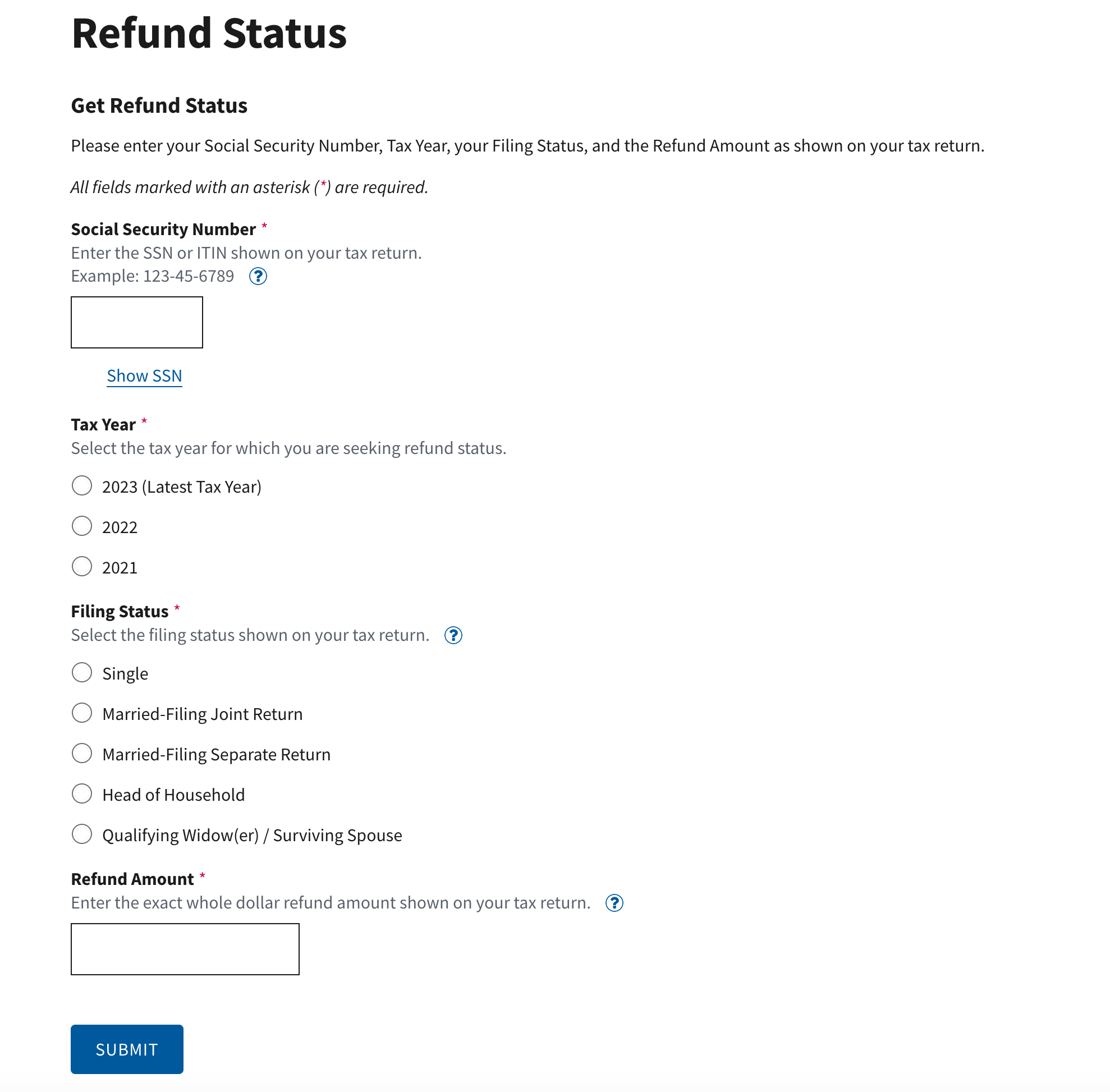

Make sure you have a copy of your tax return handy when looking up your refund status. You can find this under

My Account on eFile.com, as you will need to provide the following information from your tax return:

- Your Social Security Number (or Individual Taxpayer Identification Number)

- Your filing status (single, married filing joint, married filing separate, head of household, or qualifying widower)

- The exact whole dollar amount of your refund.

Then, visit the

Where's My Refund lookup tool.

The page should look like this:

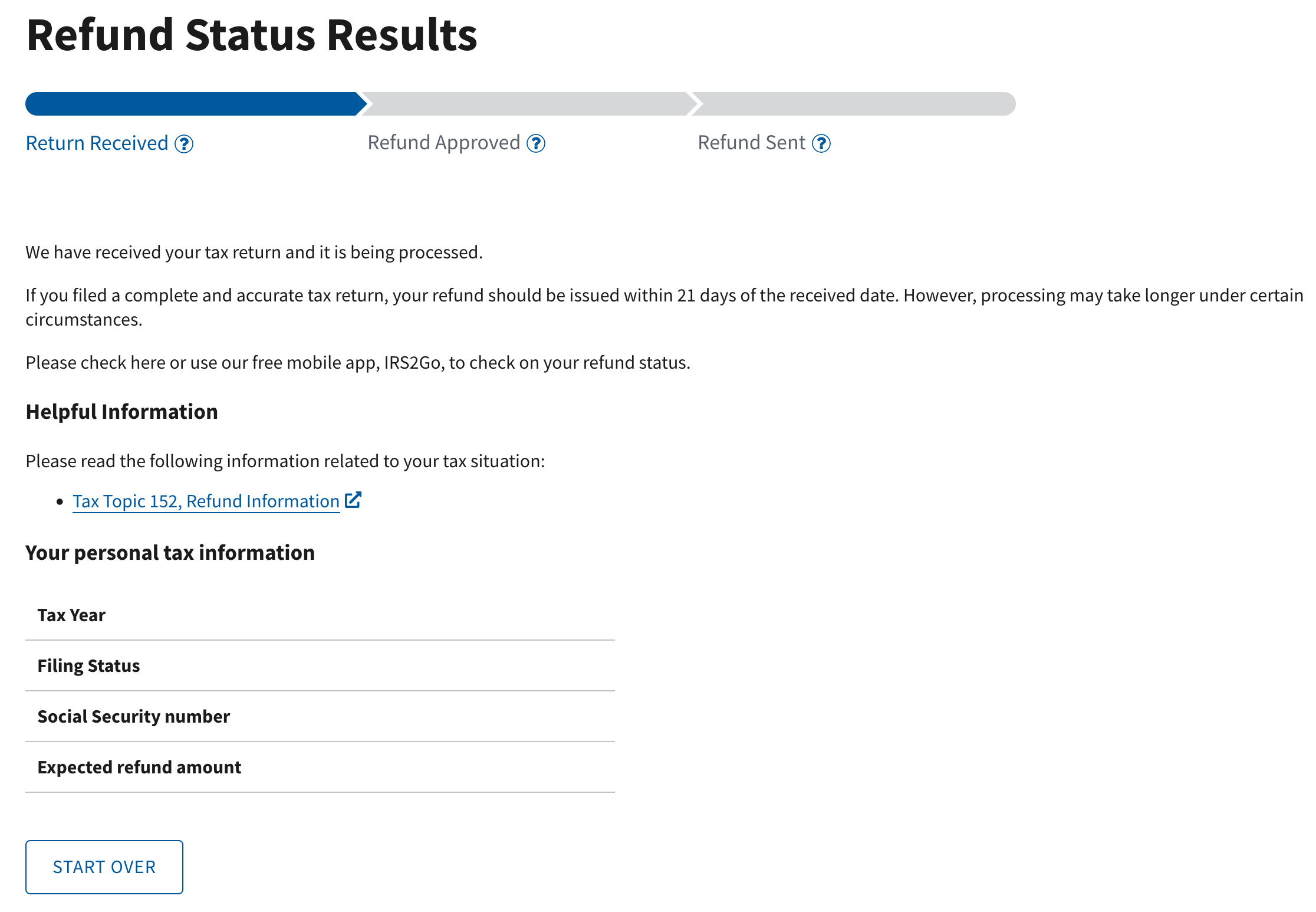

Once your data is entered, you should see this result page:

If you have further IRS questions about the status of your return, you can also call the IRS Tax Assistance Hotline: 1-800-829-1040 (Monday through Friday from 7:00 a.m. to 10:00 p.m. local time).

State Refund Status

Where's my state refund? Each state has their own resources to check your state tax refund status. Use the link to select your specific state so you can get an update on your state refund after it has been accepted.

Checking your Tax Refund Status

In the past few years, the IRS has seen extensive delays processing refunds due to several circumstances, including massively increased traffic through their webpages and IRS phone numbers.

Only after your tax return is accepted by the IRS can you expect your tax refund. How your refund is released by the IRS depends on which refund method you selected when you e-filed or filed your return.

1. Direct Bank Deposit: Your tax refund will be electronically transferred directly from the IRS (U.S. Treasury) to the bank account you entered during your tax preparation on eFile.com.

Go to this page to find your refund status and check in this order:

- Tax refund dates in the table for different deposit methods

- Your tax refund status via the lookup tool

- Contact your bank or call the IRS Refund Hotline: 1-800-829-1954.

Tip: e-filing and selecting direct deposit is the fastest way to receive your refund.

2. Direct Deposit with e-Collect - Deduct Fee from Refund (DFFR): If you paid your tax preparation fee via e-Collect, your tax refund will be transferred from the IRS to our e-Collect partner, EPS Financial and Pathward Bank, and then to your bank account, minus the tax preparation fee (for Deluxe or Premium service plus state preparation, if applicable). A service processing fee (e-Collect fee) of $24.95 will be charged for this service. This fee is charged by EPS Financial, not eFile.com, and will be automatically deducted from your tax refund.

If you choose this option, you can visit the EPS website and create an account in order to check the status of your refund. Once you have an account, you will be able to track the status of your refund and the expected date of your deposit.

Get your tax refund status, amount, and estimated dates online.

Note: If you contacted the IRS and they informed you that your refund was transferred to a bank or a bank routing number different than the routing number of your bank, don't worry. The IRS and eFile are not banks, thus the e-Collect partner, EPS Financial and Pathward Bank, us a unique routing number to transfer your tax refund to your bank.

3. E1 Visa® Prepaid Card by Mail (Issued by EPS Financial): If you selected to have your tax preparation fee deducted from your expected tax refund, but you do not have a bank direct deposit account, you can select to have your refund put on an E1 Visa® Prepaid Card. You should expect to receive the card in the mail 7-10 business days after the IRS accepts your tax return. Once EPS processes your fees, the remainder of your refund will be deposited onto the card.

You can view this page to find your refund status before checking in this order:

Note: If the IRS distributed your refund to a bank you do not recognize, this is the temporary bank account set up by EPS financial to process your refund and issue your refund.

4. IRS Check by Mail: Once your tax return has been received and processed, the IRS will issue you a paper check and send it through the post office. It generally takes about twice as long as direct deposit to receive your refund in the mail. You can still check the IRS tool to get a status and it will show when they mailed your refund check once it has been processed.

If you have questions or concerns about obtaining your tax refund status, contact eFile.com support.

Learn more about unclaimed tax refunds or tax refunds that did not reach the recipient. See different levels of tax preparation and e-filing services on eFile.com, then review how the eFile app works before you sign up for a free account to e-file your tax return.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.