Paycheck Calculator and Form W-4

This page covers managing and understanding your federal tax withholding per paycheck via Form W-4. Use this paycheck and W-4 calculator to estimate, calculate, and create your form W-4. Keep these instructions open to assist you in the process or contact us.

Most refunds are the result of too much tax withholding, so you can keep more of your hard-earned money now by understanding this vital information.

- What will my tax withholding per paycheck or pay period be?

- How can you increase or decrease your pay stub pay period tax withholding amount?

- Can I create my W-4 based on my paycheck or pay stub?

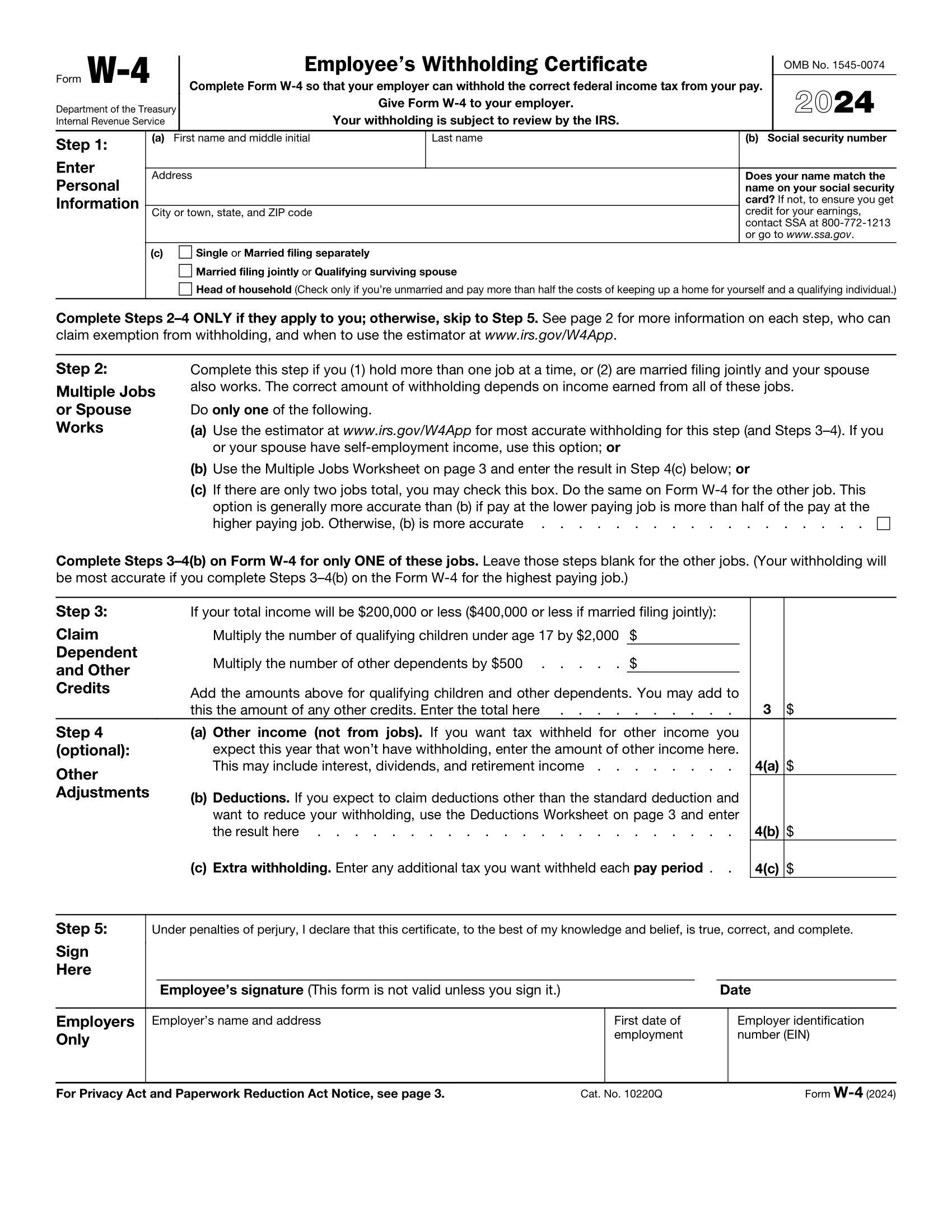

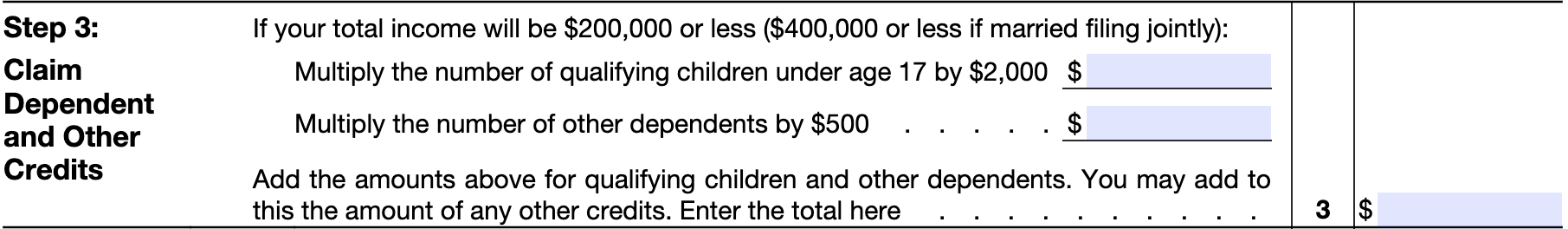

Below are step-by-step instructions on how to use the paycheck calculator and how to create your form W4 based on your pay period's pay stub. The images below show the corresponding fields on the Form W-4. You will know the federal tax withholding amount based on your salary, filing status, etc., before you submit the form to your employer and not the IRS.

Tip: If you want to get your big tax return picture for the tax year, use the free tax calculator and enter all your income, deductions, etc., and estimate your tax results. Use the paycheck calculator again to adjust your W-4 tax withholding based on these results. If this is too complicated, contact a Taxpert® for free assistance.

Step by Step Instructions: Paycheck Calculator and Form W4

Sections A, B, C, D, and E are the entries on the paycheck calculator and how they correspond to Steps 1, 2, 3, 4, and 5 on the Form W4. Once you enter information on the paycheck calculator, the Form W-4 will be created by the app. You can email the form to your employer afterward or download the W-4 at the end of the paycheck calculator.

Start the paycheck calculator. Each question and section of the paycheck calculator links here for detailed instructions and suggestions by the corresponding calculator questions: A1, A2, B1, etc. At the end of the process, your personalized Form W-4 will be created in an easily downloadable or emailable format.

Paycheck Calculator Question A1:

Select your Filing Status on the Paycheck Calculator as of December 31 of this year.

For question A1, the paycheck calculator asks you to select a tax return filing status: single, married, surviving spouse, or head of household. On your federal tax return, you are required to enter your filing status. It is mainly based on your marital status as of December 31 of the given tax year, and the tax withholding changes by filing status.

Tip: Since the W-4 is a planning tool, unlike a tax return, you may change your filing status to optimize your tax withholding. For example, you might be single in March of a given tax year but be married by December 31 of the tax year. Thus, you could select married as your status on your W4. Or, you might be married as you complete the W-4 form but are divorced by December 31. Thus, you might want to enter single or head of household. Below is Step 1-c, the section on the W-4 where the calculator will place your filing status.

Form W-4, Step 1-c Image. The paycheck calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question A2:

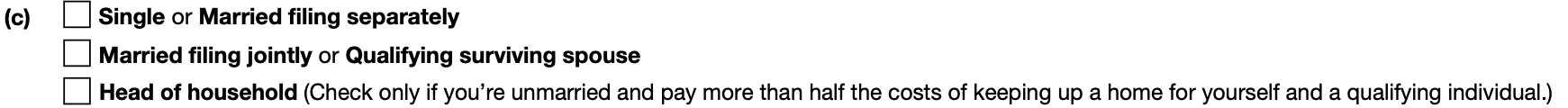

Do you (or you and your spouse if married) have more than one job?

If you have one W-2 job, select No. This includes your spouse if married, so the No would apply to households where only one member of a couple has a W-2 position.

If you (or you and your spouse together if married) have two jobs, and if the lower-paying job's earnings are more than half of the pay at the higher-paying job, select Yes here. (Note: Do the same when you use the paycheck calculator to complete the W-4 for the second job.)

If the pay difference is less than half at the lower paying job than the pay at the higher paying job, then answer Yes and complete this worksheet and follow the instructions on the worksheet.

Married or not, if your household has more than two jobs, answer Yes, complete this worksheet, and follow the instructions on the worksheet.

Form W-4, Step 2 Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question B1:

Select your Pay Period for this Job

If you do not know already, ask your employer how often you will get paid. Here is a list of the most common pay periods and number of paychecks:

Semi-monthly: 24

Weekly: 52

Bi-weekly: 26 or 27 (based on calendar year)

Monthly: 12

Annual: (based on pay period). If you have your annual gross pay amount, divide that amount by the number of the expected pay periods. Select that pay period with the Paycheck Calculator here, and after the next question below, enter that amount under B3. Enter Gross $ Amount per pay period.

Form W-4 does not capture the pay period; thus, there is no image. The pay period is used to calculate your tax withholding amount

Paycheck Calculator Question B2:

Select your Payment Type

If you get paid a salary, enter that type here. If you receive multiple salaries for the same job, click the Add link. (Do not add salary income from another job here; create a separate paycheck with the PAYucator). If you also receive hourly-based pay for this job, multiply the hourly rate by the number of hours and add it as salary.

If you log your hours and get paid hourly, enter the hourly rate and number of hours per pay period. If you receive multiple hourly-based payments for the same job, click the Add link. Do not add hourly income from another job. If you also receive a salary for this job, divide the salary amount by the number of hours you work for this salary. For the Hourly Rate, enter the number of hours and the result of Salary/Hours = Hourly Rate here.

Form W-4 does not capture the payment type; thus, there is no image. The payment calculates your tax withholding per pay period and annual gross payment or income.

Paycheck Calculator Question B3:

Enter your gross $ Paycheck Amount per Month

This is the gross salary or hourly payment amount you get paid per selected pay period before taxes and other deductions are deducted.

You can determine your gross annual pay or income by multiplying this amount by the number of pay periods.

If you only have your annual pay or income, divide that amount or income by the number of pay periods you have selected with the PAYucator or Paycheck Calculator. You will then know your gross paycheck amount per pay period. Enter that amount here.

If you need to add additional income from this job, click the Add link and enter it here. (Note: Do not enter income from other jobs here). Form W-4 does not capture the gross paycheck or payment amount; thus, there is no image. The per pay period gross paycheck amount is used to calculate your federal tax withholding.

Paycheck Calculator Question C1:

Select a Pre-Tax Health Insurance Type and enter the amount

If you make contributions to one or more employer-offered pre-tax health insurance plans, select from one of the following medical plans: Medical, Dental, Vision, HSA 1 or Health Savings Account, FSA or Flexible Savings Account or Other, and enter your per-pay period medical plan contribution amount.

This amount will reduce your take-home pay, and you will not pay federal income taxes or make Social Security and Medicare contributions from your pre-tax health insurance plan payments.

If you need to add pre-tax medical health plan contributions for this job, click the Add link and enter them here. (Note: Do not enter contributions from other jobs here).

Form W-4 does not capture medical insurance contributions; thus, no image exists. The pre-tax medical health plan deductions are used to calculate your per-pay period federal tax withholding.

Paycheck Calculator Question C2:

Select a Pre-Tax or After-Tax Retirement Plan and enter the amount

If you make contributions to one or more employer-offered pre-tax or after-tax retirement plans, select from one of the following retirement plans: 401(k), 401(k) catch-up, Roth 401(k), Roth 401(k), 403(b), 403(b) catch-up, Roth 403(b), Roth 403(b) catch-up; generally, only the Roth plans are after-tax plans.

This retirement contribution amount will reduce your take-home pay amount. You will not pay federal income taxes (for pre-tax plans), and Social Security and Medicare contributions will be deducted. For after-tax plans, federal taxes will also be removed. Thus, the retirement plan contribution and associated taxes will reduce the take-home pay.

If you need to add additional retirement plan contributions for this job, click the Add link and enter them here. (Note: Do not enter contributions from other jobs here).

Form W-4 does not capture retirement plan contributions; thus, no image exists. Retirement contributions are used to calculate your per-pay period federal tax withholding.

Paycheck Calculator Question D1:

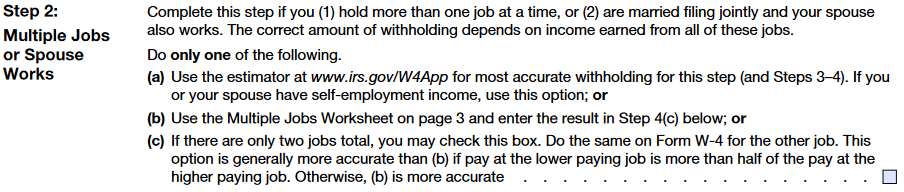

Enter the number of your Dependents or est. Child Tax Credit

Increase Dependents => Decrease Tax Withholding

Decrease Dependents => Increase Tax Withholding

If unsure who qualifies as your Dependent(s), use the DEPENDucator tool and enter the number here.

The PAYucator applies the maximum Child Tax Credit per pay period. However, you might not qualify for the total child tax credit amount if you have other income. Therefore, you can adjust the Dependent-based Child Tax Credit amount here. If you increase your child tax credit amount, your tax withholding per pay period would decrease. Decreasing the child tax credit amount would increase the per pay period tax withholding amount.

For accuracy purposes and to be comprehensive, we need to point out that if you use the paycheck calculator during the year, you can increase the child tax credit amount here to compensate for the past pay periods for the current year. For example, to claim a $2000 child tax credit for the entire year on your tax return, you would enter $333.33 as your child tax credit here for the monthly pay period if you completed the W-4 for July 1- December 31. If you completed the W-4 in any other month, divide $2000 by the remaining pay periods for the current year and enter that amount. If you do this, you must submit a new W-4 by January 1 next year to adjust this for the new tax year, and you would enter $166.66 in January next year. Contact a Taxpert if you have questions about this.

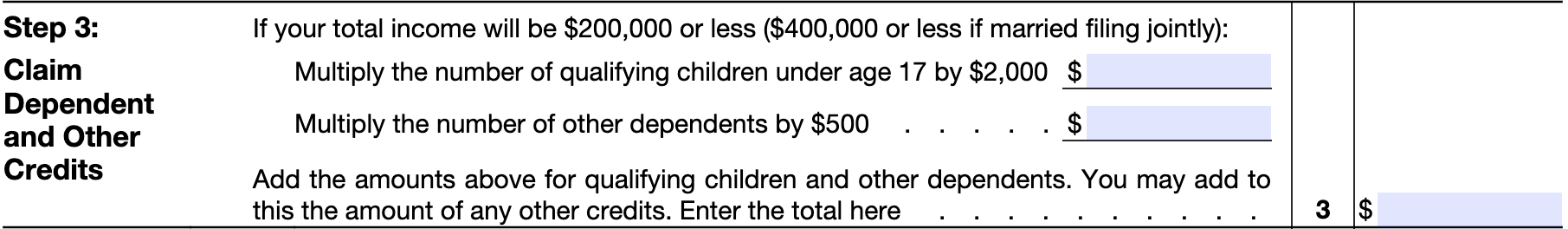

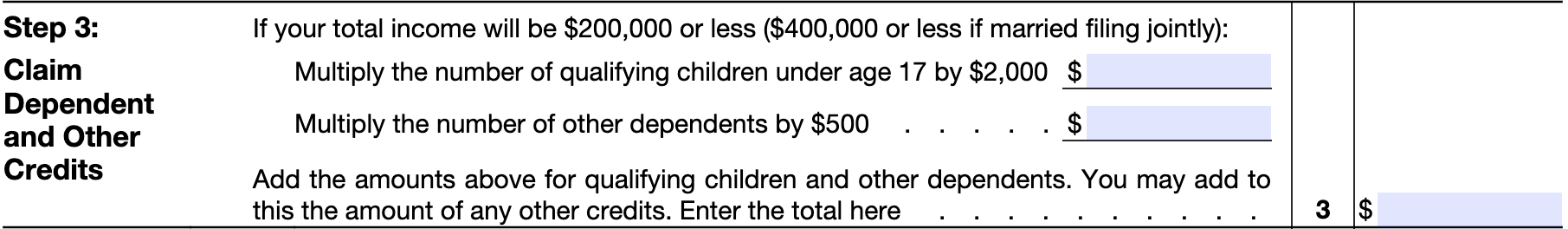

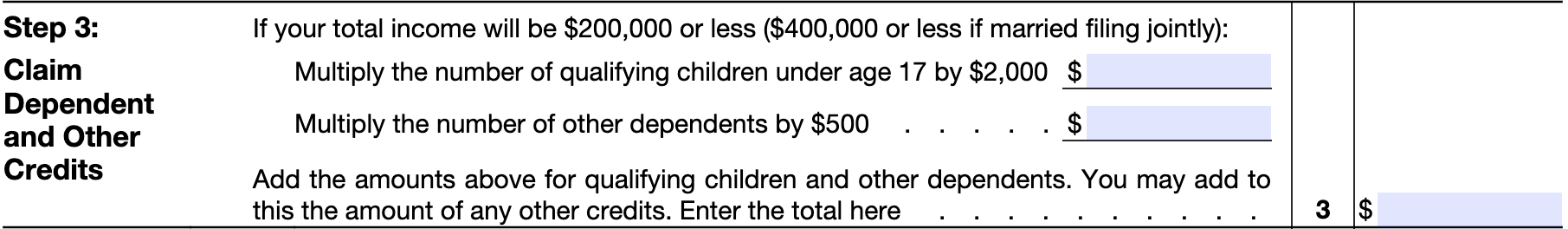

Form W-4, Step 3 Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question D2:

Enter the number of Other Dependents or est. Other Child Tax Credit Amount

Increase Dependents => Decrease Tax Withholding

Decrease Dependents => Increase Tax Withholding

If you are not sure who qualifies as your Other Dependent(s), use the RELUcator tool as you can find out if one of your relatives might be eligible as your Other Dependent.

The PAYucator applies the maximum Other Dependent Credit by default for the given pay period.

You can adjust the Other Dependent Credit amount to increase your tax withholding by reducing or decreasing your tax withholding by increasing the credit amount.

Form W-4, Step 3 Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question D3:

Enter an Amount for other Tax Credits

Increase Tax Credits => Decrease Tax Withholding

Decrease Tax Credits => Increase Tax Withholding

If you qualify for any other federal tax credits, enter them here.

Increasing your federal tax credit amount will decrease your federal tax withholding on the form W4. Reducing your federal tax credits will increase your federal tax withholding amount on Form W4.

Form W-4, Step 3 Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question D4:

Total Tax Credits

The PAYucator or paycheck calculator will add all the tax credits here and report them on the W-4 form. Increased Tax Credits would decrease the federal tax withholding amount, while decreased Tax Credits would increase the federal tax withholding amount. List of federal tax credits

Form W-4, Step 3 Image. The Paycheck Calculator will place the information there, so you have nothing to do.

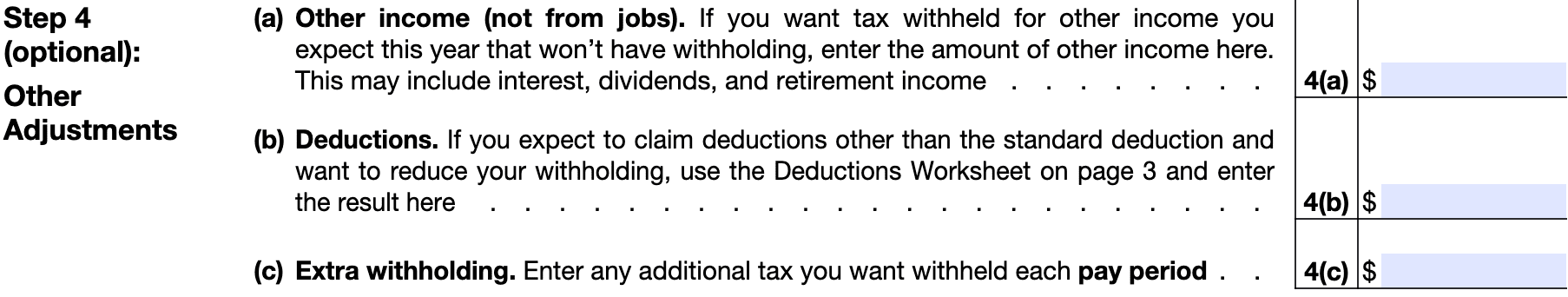

Paycheck Calculator Question D5:

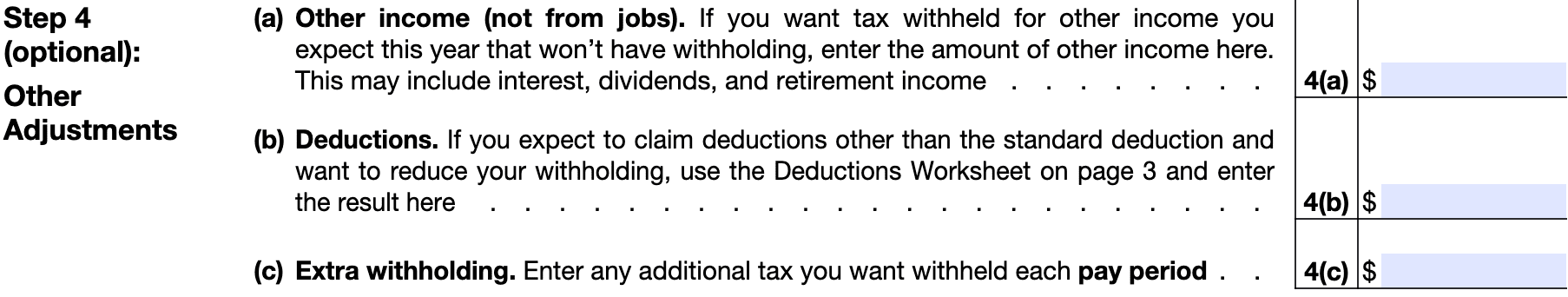

Enter an Amount for additional Deductions

Increase Deductions => Decrease Tax Withholding

Decrease Deductions => Increase Tax Withholding

Do not enter Standard Deductions here as they are applied by the PAYucator or paycheck calculator. Enter any estimated tax return deductions here.

If you increase the tax deduction amount here, it will decrease your paycheck federal tax withholdings. If you decrease tax deduction, it will increase your W4-based federal tax withholding amount.

Tax deductions here and thus on the W-4 Form are a tool to increase or decrease per pay period federal tax withholding. Remember, as long as you keep your tax return results at a low refund, you can use tax deductions to manage your tax withholding amount.

Form W-4, Step 4(b) Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question D6:

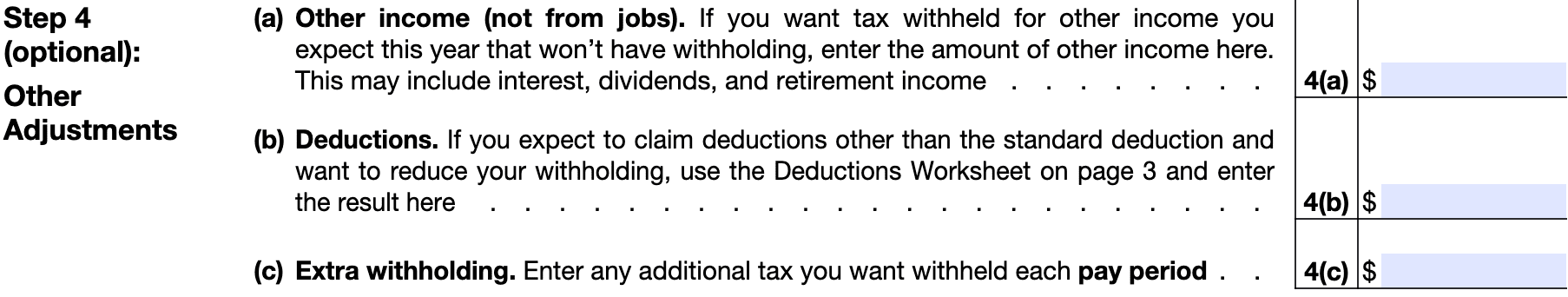

Enter an Amount for other Income

Increase income => Increase Tax Withholding

Decrease income => Decrease Tax Withholding

If you have other income in addition to the W-2 income from this job and you are not withholding federal taxes anywhere else, e.g., via Form 1040-ES, etc., for this income, and you wish to withhold federal income taxes via this job, enter this income amount here by the pay period selected.

If you only have the other income amount for the tax year, divide the other income amount by the remaining pay periods for the year. For example, if the other income was $2000 and it's August, and there are four remaining monthly periods left for the year, divide $2000 by four and enter $500. Contact a Taxpert if you have questions about this.

Form W-4, Step 4(a) Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question D7:

Enter an Amount for extra Federal Tax Withholding

Add an additional Amount

If you want to enter a fixed dollar amount in addition to your current federal tax withholding per pay period, enter that amount here. Your federal tax withholding amount will increase, and your take-home pay will decrease by that amount. Social Security and Medicare contributions will not be deducted.

Form W-4, Step 4(c) Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question D8:

W-4 Form Tool Exempt Option 4(c) Exemption from Tax Withholding

Enter Exempt below Extra Withholding

You have the option to exempt Tax Withholding from your paycheck. Social Security and Medicare contributions will not be exempt. You can claim exemption from paycheck tax withholding for the calendar or tax year if the following 2 conditions apply:

1. During the previous tax year tax return you had no federal income tax liability (e.g. your 2022 tax return on form 1040 line 24 was zero or showed a tax refund) and

2. you do not expect any income tax liability during the current tax year, or you were not required to file a 2022 return because your income was below the filing threshold for your correct filing status. If you claim the tax withholding exemption for the current tax year, you will have no income taxes withheld from your paycheck. As a result you may owe taxes and penalties when you file your next tax return. If you certify that you meet both of the conditions listed above, then 'Exempt' will be listed on Form W-4 in the space below Step 4(c). Steps 1(a), 1(b), and 5 are required on Form W-4 and will be listed on the Form W-4. In order for the Exempt status to continue into the next tax year, you will need to submit a new Form W-4 by February 15 each year.

For example, in order to claim for 2025 tax year the tax withholding exemptions, complete and submit a new W-4 form by February 15 2025 to your employer.

Form W-4, Step 4(c) Image. The W-4 tool will "Exempt" there for you. .png)

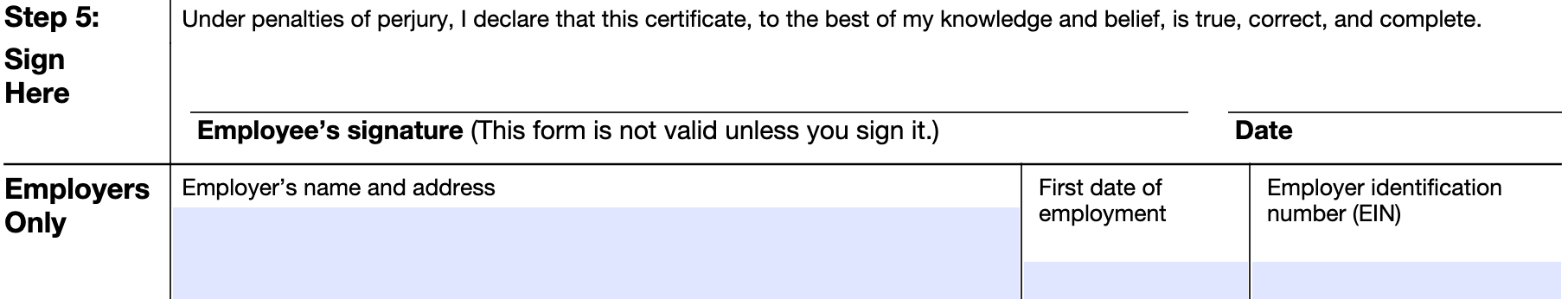

Paycheck Calculator Question E1:

Enter the date on which you will submit this W-4 Form to your employer

The date you enter here will depend on the date you submit the Form W-4 to your employer and the time between the W-4 submission and the next pay period date. The date you enter might or might not be the effective date for the W-4 and might vary by one pay period.

Contact a Taxpert if you have questions about this.

Form W-4, Step 5 Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question E2:

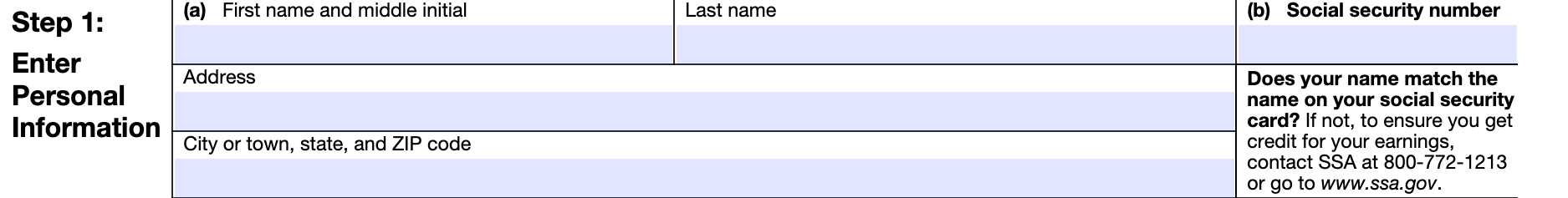

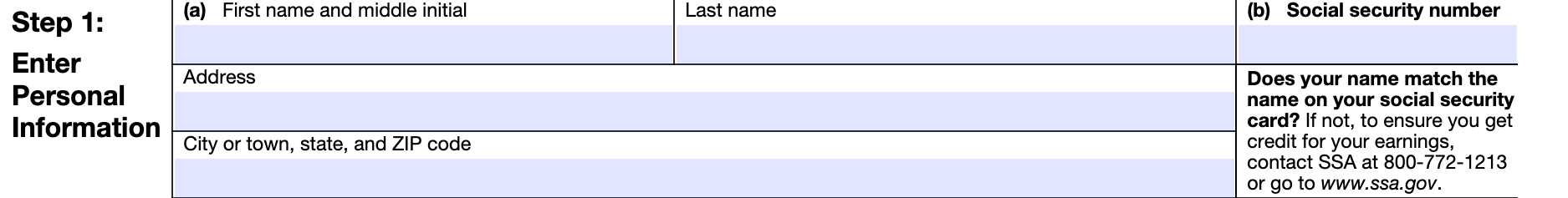

Enter your Name and Address

Your Name and Address are required on Form W-4 in Step 1(a), and the information will not be stored by eFile.com nor shared with third parties. The data will only be placed on the W4 Form by the app for the employer.

Form W-4, Step 1(a) Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question E3:

Enter your Social Security Number or SSN

Your Social Security Number or SSN is required on Form W-4 in Step 1(b). As you can see, the numbers are disguised as you enter them, and the information will not be stored by eFile.com nor shared with third parties. The data will only be placed on the W4 Form by the app for the employer.

Form W-4, Step 1(b) Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question E4:

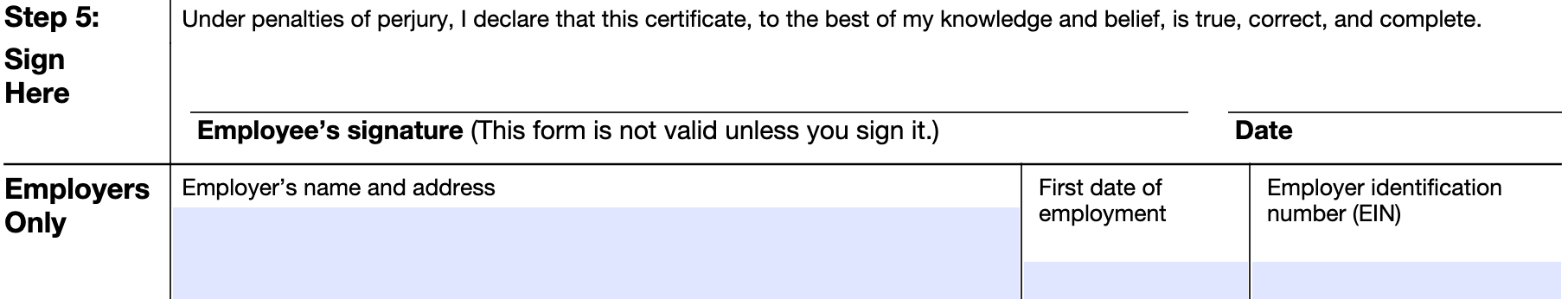

Place your signature on Form W-4

Your signature is required on Form W-4 in Step 1(c). You can either draw your signature or type it, which will be placed on Form W-4 by the app for your employer. Your signature will not be stored by eFile.com nor shared with third parties.

The employer's name and address, as well as your date of employment and EIN, are not required. The employer will enter this.

Form W-4, Step 5 Image. The Paycheck Calculator will place the information there, so you have nothing to do.

Paycheck Calculator Question E5:

Enter your and/or your employer's email address

Your and/or your employer's email address allows you to send the completed W-4 Form to you and/or your employer. eFile.com will store the email address; you can unsubscribe from any other future emails. No further information you entered here will be stored or shared with third parties. Your email address will not be sold or shared with other third parties.

Click on Create W-4 Form, and a copy of your W-4 Form will be generated as a PDF.

Form W-4 does not require an email address; thus, no image exists.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.