Prior Year Adjusted Gross Income or AGI

How can you find your AGI or Adjusted Gross Income from the previous year?

- The AGI is a dollar amount needed to verify your identity when e-Filing your 2024 tax year IRS tax return via eFile.com or any other platform; it's part of the e-filing verification process. Your AGI from your previous year's tax return is needed.

- If your return was rejected even though you had entered the correct AGI, please follow these AGI correction instructions.

The AGI is a dollar amount needed to verify your identity when e-Filing your 2024 tax year IRS tax return via eFile.com or any other platform; it's part of the e-filing verification process. Your AGI from your previous year's tax return is needed.

NOTE: During this process, you'll be asked if you filed a previous year's return. If you did not file an IRS tax return last year, answer No when prompted.

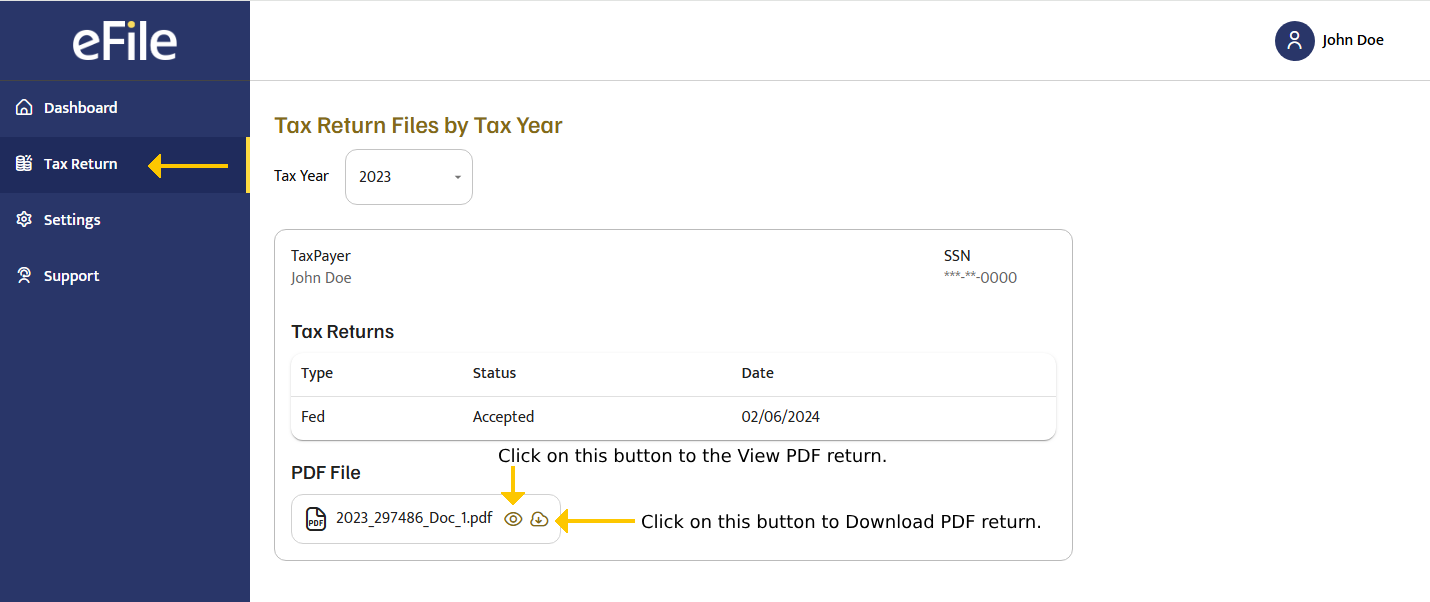

1. Sign in to eFile.com

Click on My Account

Step 1: Sign in to eFile.com

Step 2: Click on My Account in the upper right menu.

Step 3: Click on the PDF Icon for the tax year you're looking for.

2. View your My Account

Click on the PDF Icon for your desired tax year

Based on your browser settings, the PDF will either open in a tab or prompt you to download the PDF.

3. View PDF

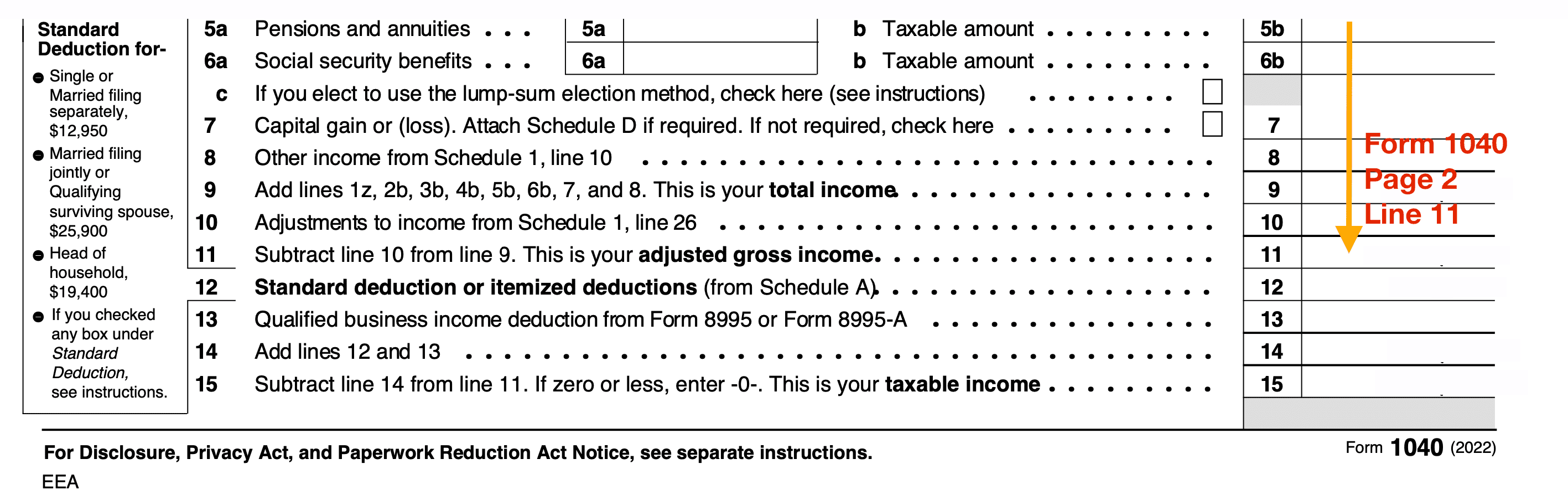

Form 1040, 1040-SR, 1040-NR Line 11

Based on your browser settings, the PDF will either open in a tab or prompt you to download the PDF.

4. Didn't Use eFile.com

for your Past Tax Returns?

If you did not eFile your return with eFile.com, open your Tax Return - PDF or paper form - Form 1040, 1040-SR, 1040-NR on page 2, and Line 11 is your AGI.

Note: eFile.com stores your previous tax return for free. You will always have access to it next year.

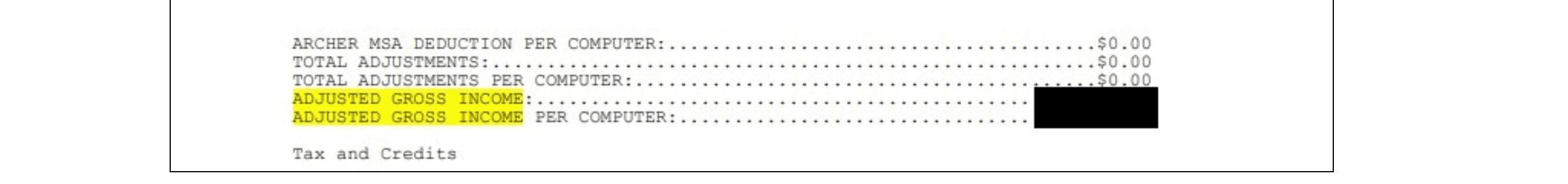

5. Can't Find Your

Old Tax Return?

Get a free Tax Transcript. Your AGI for the year you select will be on your Transcript on page 3. Look for ADJUSTED GROSS INCOME, and you'll find it.

Option: Request a tax return paper copy from the IRS by mailing in Form 4506, Request for Copy of Tax Return the IRS - not eFile.com - will charge $43, however, we do not recommend this. Instead, we encourage you to get a free tax transcript.

Tip: eFile.com stores completed returns for existing customers for free so that you will have access to it next year.

6. Did you NOT file a Tax Return?

During checkout on eFile.com, answer this question: Did you file a return last year? No? Then your AGI should be entered as $0.

If you are age 16 or younger and file for the first time, you can prepare your return on eFile.com, but you can not e-File. Download your return from My Account - see above Step B - and mail them in.

7. Enter AGI During checkout

8. Return Rejection

Due to Incorrect AGI?

During the last three years, IRS - not eFile.com - AGI rejections have occurred for many different reasons. Do not give up e-filing your return before you go through these steps: How to correct an AGI rejection at no charge.

8. Need AGI Help?

Let us know, and we will assist with AGI-related questions:

Contact Us!

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.