Report, Add First-Time Homebuyer Credit to Return

How do I report repayment information for the First-Time Homebuyer Credit I claimed?

The IRS has record of taxpayers who owe repayments of the First-Time Homebuyer Credit. If you file your return without this information, this will result in a rejection from the IRS - not eFile.com. If you receive this rejection, see how to correct and re-eFile at no additional charge.

First-Time Homebuyer Credit

Before filing your return, you should be asked about any repayments of this tax credit during the tax interview. Otherwise, see how to add the form and information below.

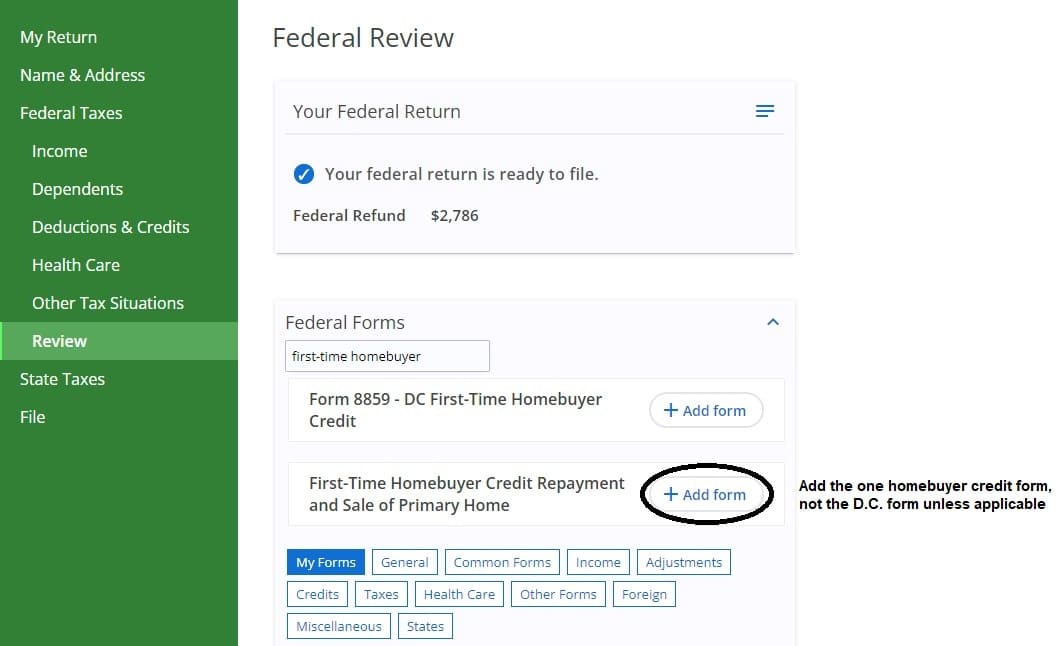

1. Add first-time homebuyer form

Select Federal Taxes > Review >

I'd like to see the forms I've filled out or search for a form > search for "first-time homebuyer" and select the

+ Add Form button next to the First-Time Homebuyer Credit Repayment and Sale of Primary Home form.

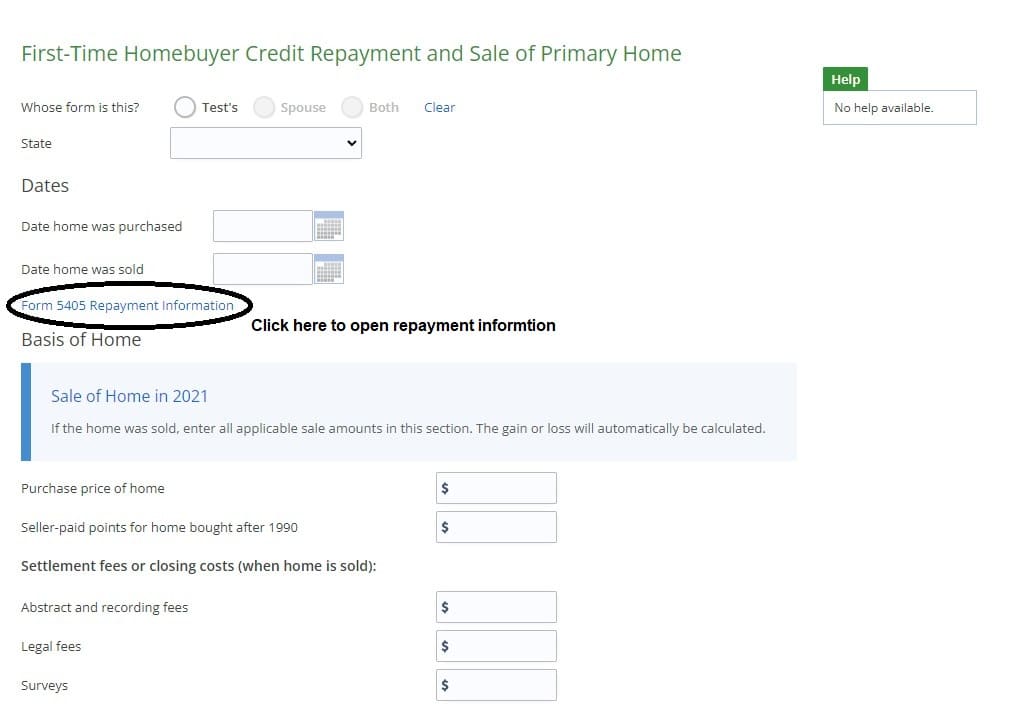

2. Home Sale Information

Fill in all applicable information. The form requires basic home sale information, like the date you purchased the home, the date it was sold, and various costs associated with this the sale and upkeep of your home.

3.0 Repayment Information

If you are required to repay the credit, select the

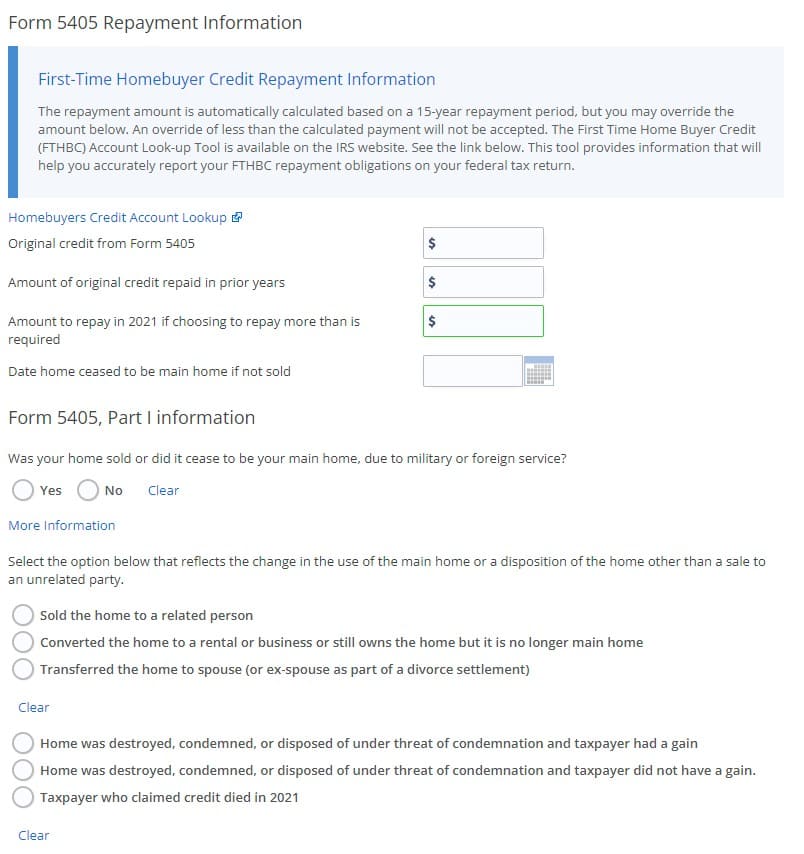

Form 5405 Repayment Information which will expand the form. Add the details here based on your records.

3.1. Homebuyers Credit Account Lookup

If you are missing the information required, click the Homebuyers Credit Account Lookup link to find this information; this will bring you to this IRS link: https://sa.www4.irs.gov/irfof-fthb/notice

4. eFile Your Tax Return

Proceed with preparing and e-filing your return. If you have not yet filed, be sure your return is complete by going through each section and reviewing your return. If you are correcting an IRS rejection, you can select File and go through the

eFile checkout process as you had previously and you will not be charged twice.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.