How to File Schedule E

Schedule E may be needed for your income tax return if you generate income or have a loss from renting your property, including real estate, royalties, partnerships, S corporations, estates or trusts, and residual interests in real estate mortgage investment conduits (REMICs). The most common use for Schedule E is real estate rental; if you are a landlord, this form is for you.

Follow the instructions below to generate Schedule E in eFile by reporting your income and expenses from your property.

2. Where Do I Enter Data?

eFile will guide you through entering all types of income. You will be prompted to enter your property under the Other Income section. Answer "Yes" when asked if you own property that produced either real estate rental income or royalty income. This will bring you to the Rent, Royalties, Etc. pages which will allow you to enter all the related information.

3. How to Manually Add Data

To manually add your form, navigate to Federal Taxes > Review > I'd like to see the forms I've filled out or search for a form and enter "Schedule E."

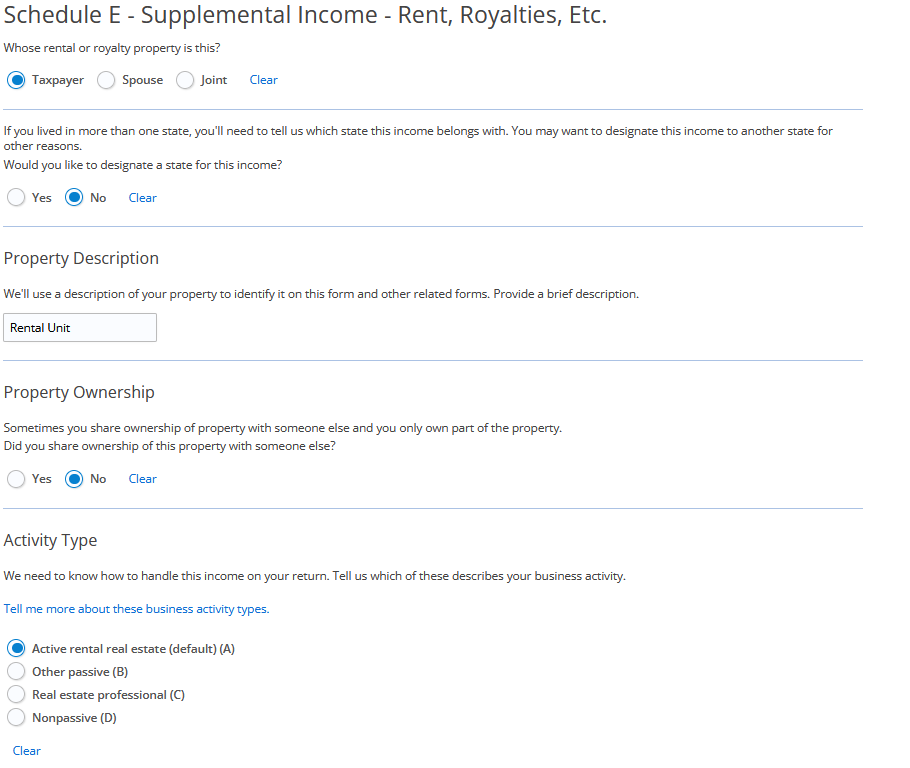

What Does This Form Look Like?

Below is a screenshot of this section.

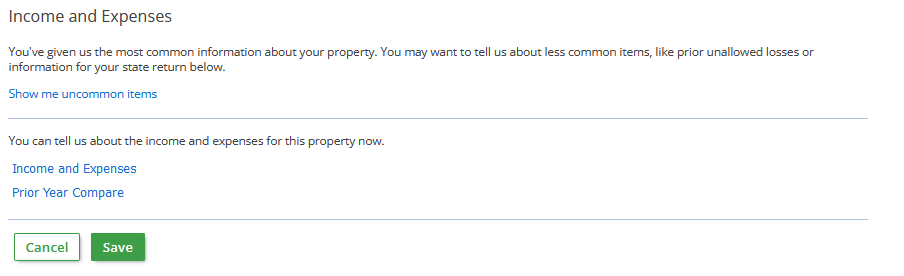

Once you have added Schedule E, you must enter your income and expenses in order to finish - see screenshot below.

5. How to Add, Delete a Form or Page

See also:

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.