Gig Economy, Freelancers, and Taxes

The gig economy is made up of freelancers in the United States who take on gigs or temporary jobs through their self-employment business. These are contractors or small businesses who offer their services to different companies and take on jobs rather than being employed at one place. This allows a variation in work, the ability to customize hours, and more freedom on how the job gets done.

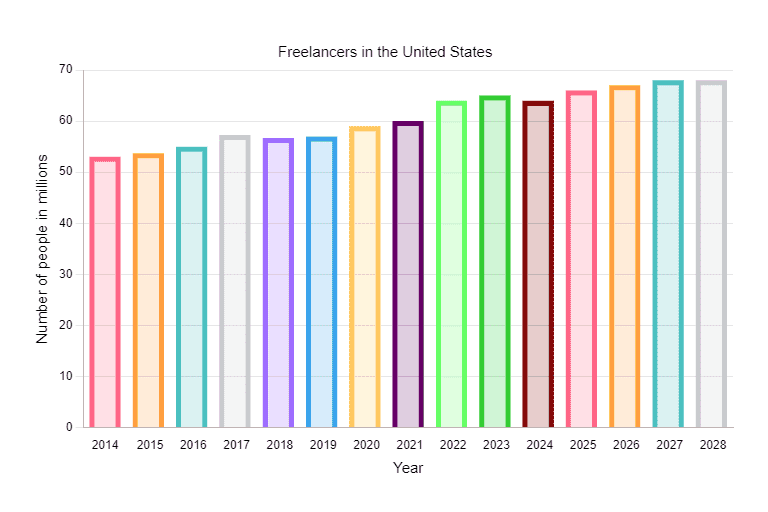

Projected numbers based on current statistics.

Freelancers or gig economy workers have steadily increased over the years; learn more about what defines an independent contractor or a freelancer. Many companies are hiring on contract so that freelance workers can work remotely and claim certain self-employment deductions. This makes it easier to set up employment and to work from home, especially if located in a different state than the employer (for example, they would only file a resident state return and not an additional state return for the company location). Additionally, companies that use freelance workers to deliver goods or provide one-time services are consistently gaining popularity. If you have done freelance work and earned income, you will need to file a self-employed individual income tax return.

Start your return online | Add your business and Schedule C

On this page:

- Rise of Freelancers and Gig Economy: The number of freelancers and gig economy workers has been increasing steadily. These workers often engage in short-term, on-demand work facilitated by digital platforms like rideshare services, delivery apps, and freelance marketplaces.

- Tax Implications: Freelancers and independent contractors must report their income to the IRS, even if they don't receive a 1099 form. Income is typically reported on Form 1099-MISC or 1099-NEC if it meets certain thresholds. They can claim deductions such as mileage and travel expenses and they must pay self-employment taxes.

- Remote Work and Tax Considerations: Many companies hire freelancers to work remotely, allowing workers to avoid additional state tax filings if they work from a different state than their employer. Freelancers are considered self-employed by the IRS, necessitating the filing of a Schedule C along with their tax return.

- Impact and Popularity: The gig economy model is gaining popularity as companies seek flexible staffing solutions. Freelancers benefit from the flexibility of choosing their clients, negotiating rates, and managing their work schedule independently.

Freelancers and the Gig Economy

What is the Gig Economy? How is it affecting or reshaping careers?

Types of gig work or freelance work are often on-demand work, short-term services, or providing goods in a short timeframe. Payment may be cash, check, virtual currency, or through a third-party application or website. Many freelance work providers operate on a digital platform, like rideshare services, delivery services, craft selling marketplaces, on-demand labor services, or property rental platforms.

When small to large businesses rely mainly on freelancers or independent contractors compared to permanent employees, then gig refers to a one-off job a person gets paid to do on an infrequent or casual basis. Thus, the income generated in a gig or sharing economy is treated as taxable income made by an independent contractor or freelancer. The payer issues a Form 1099 for the tax year in which the work took place and submits it to the payee (freelancer, independent contractor) by January 31 of the subsequent year. This form is typically a 1099-MISC or 1099-NEC and is required to be issued if the contractor is paid at least $600, but the contractor needs to report the income regardless of the form if they make $400 or more.

Typically, freelancers do not register a business. For tax purposes, however, according to the IRS, a freelancer declares their self as self-employed. As such, they technically are their own business. Even if you do not receive a tax form for this gig work, such as 1099-K or 1099-NEC, it is required to be reported on your income tax return.

The following factors determine the independent contractor status:

Often, when organizations try to avoid paying benefits, they shift permanent jobs into temporary jobs, thus these employers/employees are also considered part of a gig economy. However, in comparison to freelancers, part-time workers receive a paycheck as payment and the annual income is reported to the employee and IRS on a W-2 form by January 31 of the subsequent tax year.

As a gig worker, you may receive pay for your freelance work over third-party online platforms, like Venmo or PayPal. If you are paid a significant amount over these platforms, then this income will be reported the IRS and you will be issued a 1099-K which will need to be reported on your tax return. Note that the thresholds have been spoken about and changed by the IRS - review the linked 1099-K page for details on this.

Examples of gig work include:

- Driving a vehicle for deliveries or booked rides

- Renting out property

- Shopping for someone or running errands for them in exchange for payment

- Selling goods or collectibles online

- Renting your personal equipment

- Providing any temporary, on-demand, creative or professional service or freelance work.

When you prepare your return on eFile.com, you can report your business/self-employment income and the eFile Tax App will report your income on Schedule C and generate Schedule SE for you. You bring your income and business information and we will help get it reported on the proper forms.

Sharing Economy, Self-Employment Income

Why do people freelance?

Particularly in younger Americans, freelance work is easier to come by. It can be seen as a short-term commitment for both workers and employers and can often be done online without have to relocate the worker. As such, freelance work is most popular among Millennials and Generation Z. Many choose it as a career choice where they base their work off of collecting various contracts or gigs while some only see it as a temporary way to make money.

In a sharing economy, goods and services are distributed differently in comparison to the traditional model of corporations hiring employees and selling products to consumers. Instead, consumers rent or share things like their cars, homes, and personal time to other individuals in a peer-to-peer manner. Sharing might include the following: renting, borrowing, lending, swapping, or bartering. Companies like Etsy, Doordash, Uber Eats, Airbnb, Flipkey, HouseTrip, HomeAway, Lyft, and Uber are just a few that are part of the gig or sharing economy. As a gig worker, your tax situation is different than a traditional employed worker.

Keeping track of the complicated tax implications related contract income can get overwhelming. Begin tax planning for tax season with eFile.com. Prepare your tax return online and let us help calculate your due income tax, self-employment tax, and find all deductions you might be eligible to claim that you may not have known about.

This table organizes and explains various topics related to gig or sharing economy income:

Income Statement

You should generally receive one of these income statements: Form 1099-MISC (Miscellaneous Income) or NEC (Nonemployee Compensation),

Form 1099-K, Payment Card and Third Party Network Transactions, Form W-2, Wage and Tax Statement with the Nonemployee Compensation box checked, or some other income statement, especially if you operate in a foreign country. As a freelancer or contractor, your income is likely reported on one of the

many 1099 forms. Keep detailed records of any payments you receive because even if you don't receive any of these statements, your income is most likely taxable and will need to be reported. See an

overview of taxable income.

Expense Deductions, Depreciation

Expenses must be ordinary and necessary for your work: business-related food, lodging, office expenses,

home office deduction, required equipment or materials, supplies, cell phones, auto expenses, food and drinks for passengers, parking fees, tolls, roadside assistance plans, permit fees, professional education expenses, taxes, and incentives associated with certain

electric and hybrid vehicles. Keep receipts and detailed records of your income and expenses so you can accurately report them on your income tax return. You can also

depreciate certain assets;

depreciation is a business tax deduction for wear and tear or deterioration of property with a life longer than one year. It is an annual allowance that lets you recover, over time, the cost or other basis of certain property you own. The kinds of property you can depreciate include machinery, equipment, computers, buildings, vehicles, and furniture.

Home Rental Rules

Calculating rental Income from home or vacation properties can get complex in the sharing economy. Particularly, short-term accommodations as part of the sharing economy are growing fast. Property owners may use a mutual platform like Airbnb to list their room or apartment while someone looking for a property uses the same platform to purchase nights. This can be land or property owners who, for example, rent their apartment to a group of friends for one night, then the same apartment to a traveling businessman the next night. In this instance, the property is used for short-term trips and vacations rather than long stays like a hotel or resort are often used for. Particularly in millennials, this method of travel is vastly popular.

Have rental income? See the

current home rental rules by tax year plus

instructions for rental income.

Do You Need to File a Tax Return?

eFile.com makes it very easy for you to

find out if you have to file an IRS income tax return. Visit

the FILEucator page for a free and simple tax tool to get the right answer for your tax question without having to read a lot of complicated tax mumbo jumbo.

You can prepare your freelance, independent contractor, gig or shared economy tax return—together with W-2 income you or your spouse might have—here on eFile.com. We offer Premium Taxpert® support at a significantly lower price than you would pay with a tax professional, TurboTax®, or H&R Block®. Simply click the Start button below or contact one of our Taxperts® with your gig questions.

Start Your Tax Return Now

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.