Coronavirus-Related Distributions; Disaster Distributions

During the COVID-19 pandemic, the CARES Act allowed early withdrawals of up to $100,000 from retirement accounts without the usual 10% penalty. The withdrawn amount was still taxable as regular income but could be spread over three years or repaid within three years to avoid taxes.

For 2020 Returns, the IRS gave favorable tax treatment for up to $100,000 of coronavirus-related distributions from eligible retirement plans (certain employer retirement plans, such as section 401(k) and 403(b) plans, and IRAs) to qualified individuals, as well as special rollover rules with for such distributions.

Related: IRA, 401 retirement plans | how pensions are taxed | required minimum distributions

It also increased the limit on the amount a qualified individual could have borrowed from an eligible retirement plan (not including an IRA) and permitted a plan sponsor to provide qualified individuals up to an additional year to repay their plan loans.

What Was the Penalty for Early Withdrawals in 2020?

This treatment was not continued for COVID distributions for 2021, 2022, or any future returns. If you took a COVID-related distribution in 2020, you would have had to report this on your 2020 Return. You would then use Form 8915 to report repayment information about your 2020 distribution as applicable. This information is found on the 2020 Form 8915-E and the 2021 Form 8915-F if you repaid some of your contributions for those years.

How Do You File Form 8915?

Note: The Form 8915 is still used to reconcile disaster-related retirement distributions which can be filed each year. The COVID-related details are for informational purposes only and do not apply to this year's return.

If you have a 1099-R reporting a distribution due to a qualified disaster, after you have added your 1099-R form reporting your distribution under Federal Taxes > Income > Retirement, on the 1099-R form in your account, click the "Advanced Options" blue link at the bottom of the screen. Then, check the box saying that you want to use Form 8915 (other forms are listed in the checkbox text too) to determine taxable amount - do not double on line 4 (but it also applies to line 5). This will calculate the taxable portion based on other factors, calculated by the app. This form may help exempt the 10% early withdrawal penalty, if applicable.

Then, be sure the 8915-F is present:

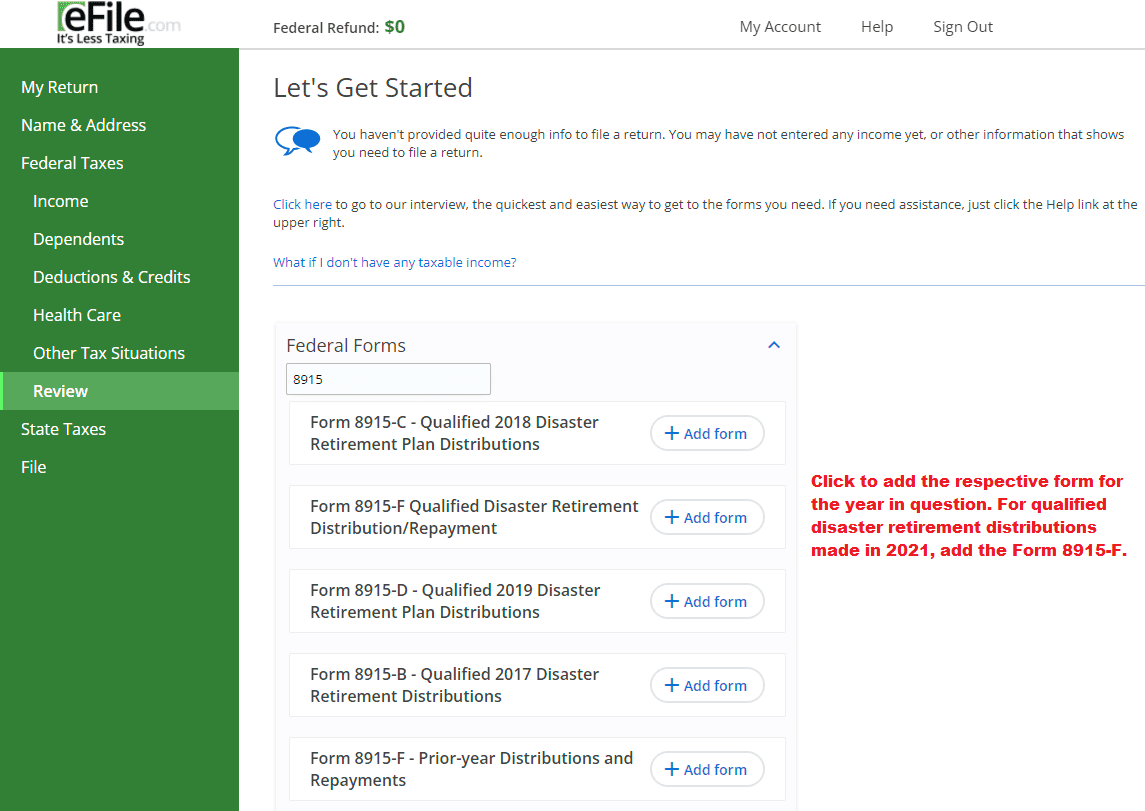

Step 1: Sign into your eFIle account.

Step 2: Click on Federal Taxes on the left, then on Review, then on I'd like to see the forms I've filled out or search for a form on the right side.

Step 3: Enter 8915 and search.

Step 4: For Form 8915-F, select + Add Form

Step 5: Enter the total amount from your 1099-R forms and other information on the 8915 form. Save or Continue.

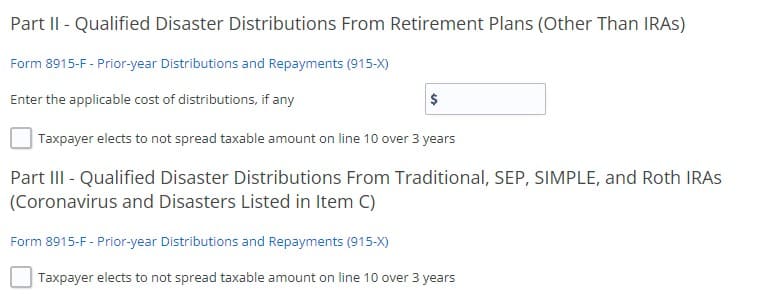

After adding the Form 8915-F, you can then add the needed information in Parts I-V.

Important: you will need to add and complete both the Qualified Disaster Retirement Distribution/Repayment and Prior-Year Distributions and Repayments forms if you had early withdrawals in previous years.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.