Tax Return Refund Disbursement Form

Below are the steps to change tax refund direct deposit method via e-Collect.

Complete, sign, and share the Refund Disbursement Form with EPS/Pathward Bank:

Load or Start the Tax Refund Disbursement Form.

Follow these 3 steps:

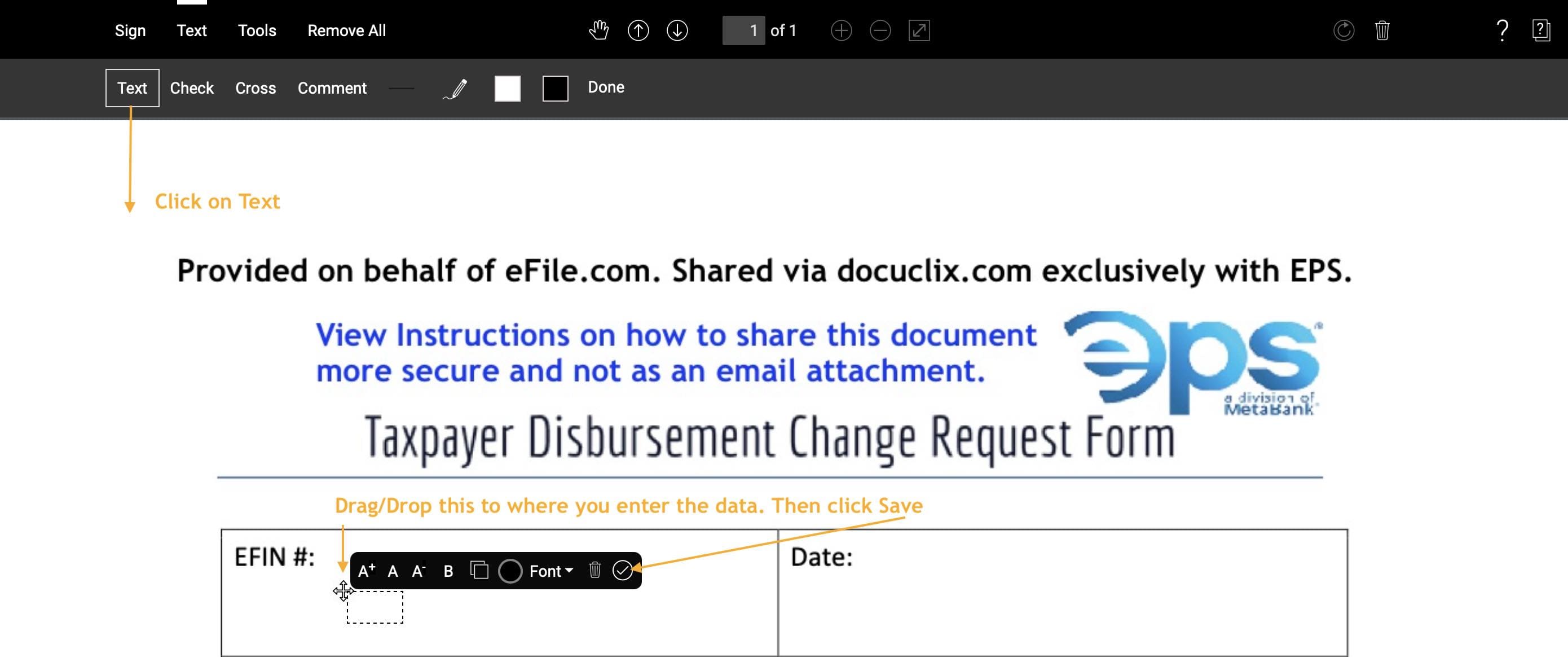

Step 1: Enter Text, Data

- Click on Text

- The Text Edit box will load then Drag/Drop to the Text Area

- Enter your Text (for the EFIN # box, leave this blank).

- Click Save and repeat.

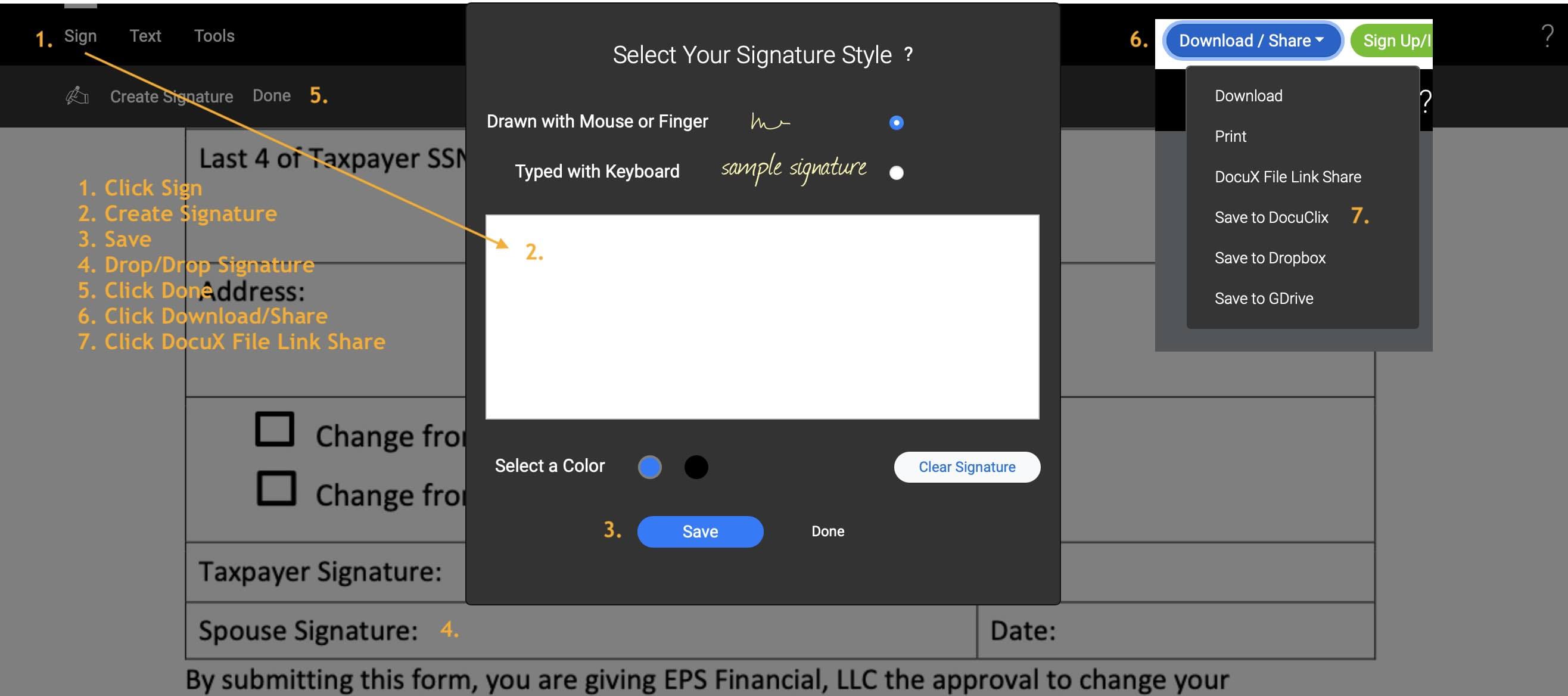

Step 2: Sign the Document/Form

- Click on Sign

- The Create Signature box will load; create signature in the box.

- Save

- Click Drag/Drop Signature to Form and repeat.

- Click Done, then on Tools

- Click Download/Share

- Click DocuClix file lInk share.

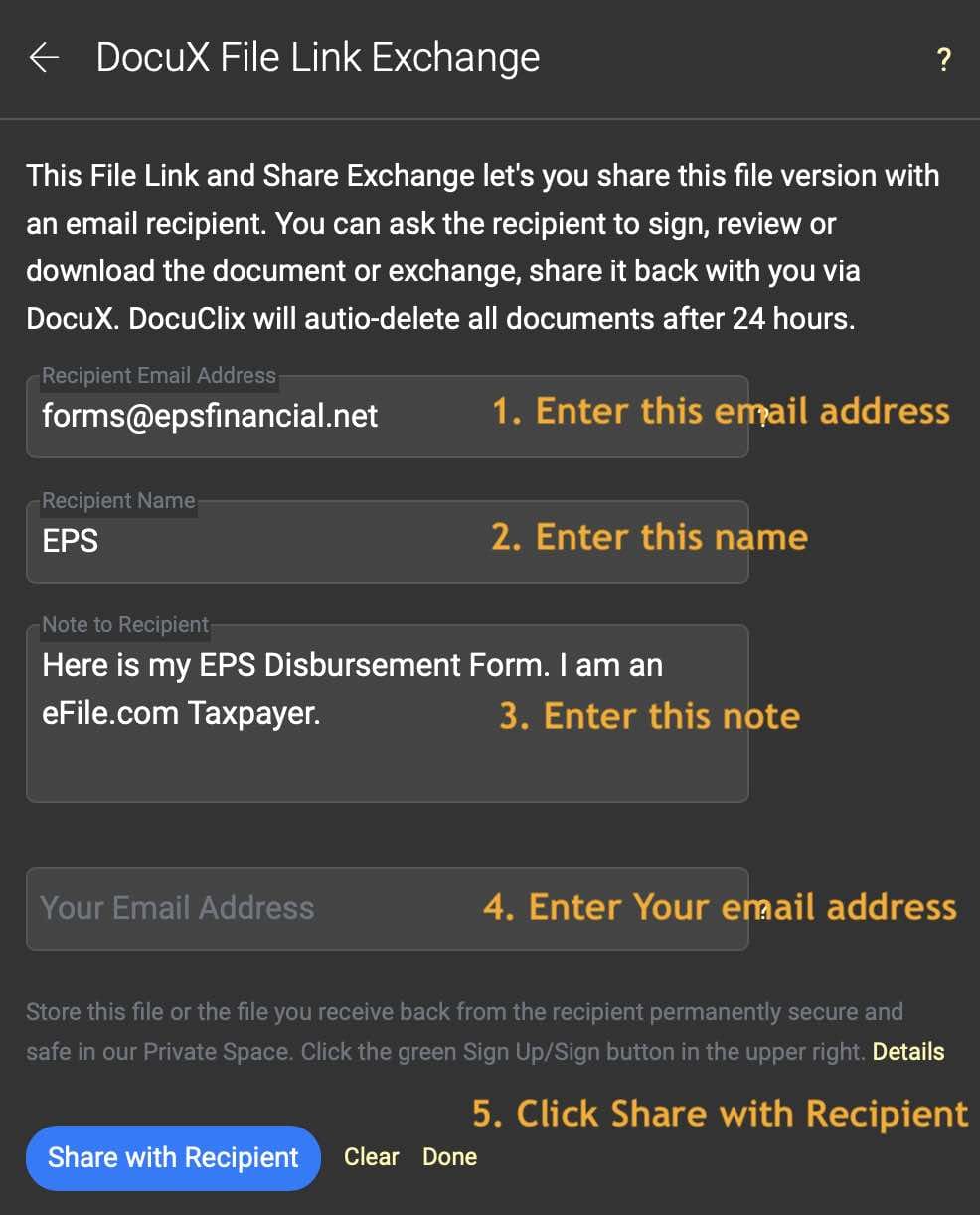

Step 3: Send/Share the Document via DocuClix with EPS

- Enter or copy/paste taxpayersupport@pathward.com

- Enter or copy/paste EPS

- Enter or copy/paste Here is my EPS Disbursement Form. I am an eFile.com Taxpayer. (Optional: When done, select share it back to me via my email address.)

- Enter Your Email Address

- Click Share with Recipient.

Optional: Download/share the document for your record by clicking at the blue Download/Share button at the upper right.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.