Income Tax History

United States

Tax History

What is Income Tax: An income tax is a direct tax which is levied on the net income of private individuals and corporate profits. Income tax systems range from a flat tax to extensive progressive tax systems. Here, we take a close look at the tax history in the United States.

Taxpayer Roadmap: Compare the history of taxes to today's taxpayer roadmap or modern day tax jungle!

Tax History - An Introduction

Taxes have generally been around since the beginning of civilization or history. The earliest known tax was implemented in Mesopotamia over 4500 years ago, where people paid taxes throughout the year in the form of livestock (the preferred currency at the time). The ancient world also had estate taxes and taxes. The earliest recorded evidence of a death tax came from ancient Egypt, where they charged a 10% tax on property transferred at time of death in 700 BC.

Since then, the way we pay taxes has changed significantly. However, some ancient taxes have survived across history and persisted into the modern world. In 2006, China eliminated what was the oldest, still-existing tax in the world. It was an agricultural tax that had been created 2,600 years ago and was only eliminated in order to improve the well-being of rural farmers in China.

Learn about unusual taxes throughout history. Don't stress over all these complicated tax changes and rules; let us do the hard work for you! File your income tax return on eFile.com so you don't have to keep up with tax changes.

A History of Taxes in the United States

It's hard to believe, but America was founded to avoid high taxation.

In the United States, the tax system has evolved dramatically throughout the nation's history. Originally, there wasn't an income tax and tariffs provided the main source of revenue for the government. New taxes were often introduced during times of war to raise additional revenue, but they were generally allowed to expire once the war was over.

Taxation in the United States' history can be traced back to Colonial America when the colonists were heavily taxed by Great Britain on everything from tea to newspapers. In 1765, the Stamp Act even specified that all legal and business documents were required to bear a stamp, showing that the appropriate tax had been paid. Most colonists objected to this form of taxation since they had no political voice or input about the creation of new taxes. This gave rise to the slogan "no taxation without representation." Since the King of England continued to ignore demands by the colonists to abolish these taxes, some colonists participated in protests, such as what became known as the Boston Tea Party.

Income Taxes in America

The history of income tax in America is an unusual one. The first federal income tax was created in 1861 during the Civil War as a mechanism to finance the war effort. In addition, Congress passed the Internal Revenue Act in 1862 which created the Bureau of Internal Revenue, a predecessor to the modern day IRS. The Bureau of Internal Revenue placed excise taxes on everything from tobacco to jewelry. Following the end of the Civil War, the income tax did not have substantial support and was repealed in 1872.

In 1894, Congress passed the Wilson-Gorman tariff which established a tax rate of 2% for annual income over $4,000, but it was overturned by the Supreme Court in 1895. In the early 20th century, the income tax enjoyed renewed support and, in February of 1913, the Sixteenth Amendment to the Constitution was ratified, granting Congress the power to tax personal income. The new system collected the income tax at the source, as it is done today, where taxes are initially withheld before the income reaches the recipient. In 1914 the Bureau of Internal Revenue released the first income tax form, called Form 1040. This still remains the main income tax form and it has been modified and re-issued almost every year since then (learn about the evolution of Form 1040). The first year was a test run where people simply sent in their forms to have them checked by the bureau for accuracy without paying any taxes. By 1915, both members of Congress and the public began to voice concerns about the complexity of the income tax form, stating that it was difficult for some to prepare and file their returns.

The Revenue Act of 1916 began the practice of adjusting tax rates and income scales. The original income tax was 1% for the bottom bracket, which was comprised of income up to $20,000, and 7% for the top bracket, which was comprised of income over $500,000. The Revenue Act raised the top bracket to $2,000,000 and raised the tax rates to 2% for the bottom bracket and to 25% for the top bracket rate.

The Revenue Act of 1916 also created what is widely considered the predecessor to the modern estate tax. At first, the maximum rate was set at 10% for estates greater than $5 million. However, the rate increased the following year to 22% for estates valued at between $8 and $10 million and 25% for estates valued at over $10 million. By 1924, the top rate was 40% for estates valued at over $10 million. The Revenue Act of 1941 set the tax at 77% on estates valued over $50 million. In comparison, the lowest bracket of the estate tax, which was comprised of estates valued under $5,000, only rose from 1% to 3% over the same time period.

Learn about the history of the e-file process.

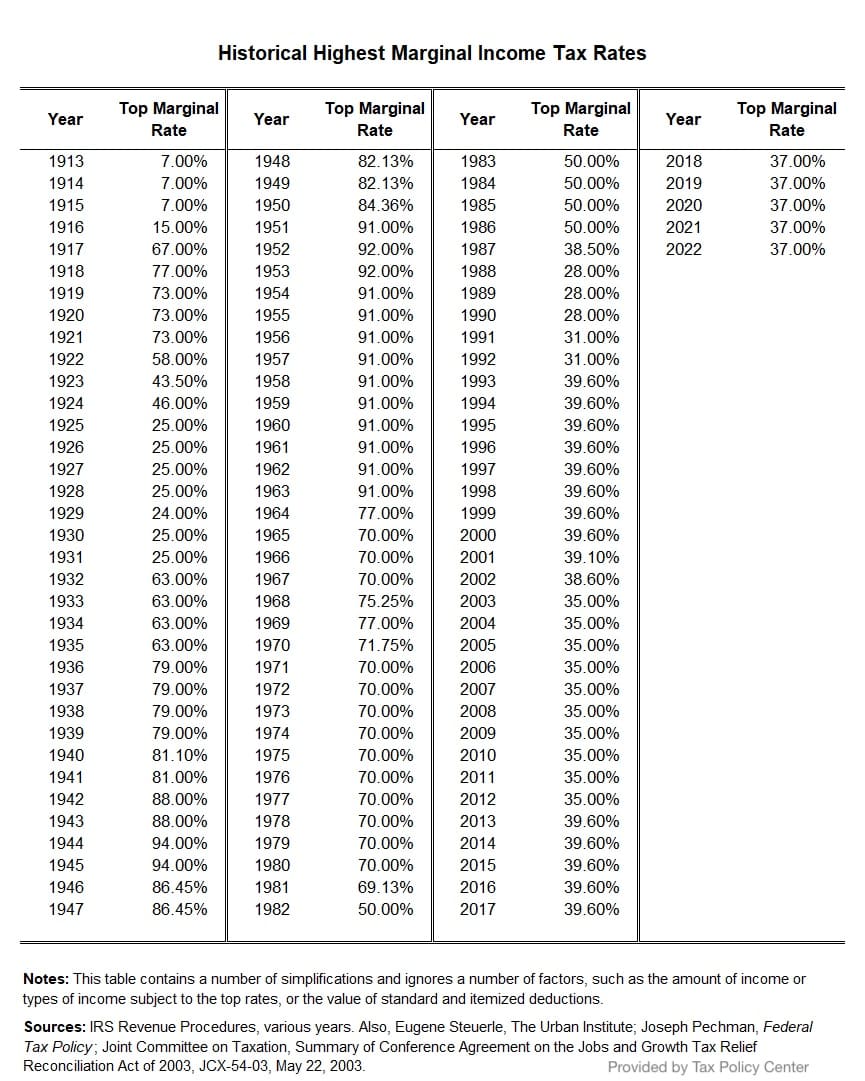

Historical Income Tax Rates

Look at a detailed overview of income tax rates and income tax brackets and you will find that income tax rates continued to change throughout history and decades. The tax rate for the bottom income tax bracket grew, peaking at 22.2% in 1952. However, the lowest tax bracket at that point was comprised of individuals earning up to $4,000. The bracket size itself peaked in 2001 at $45,200. The tax rate for the top bracket also continued to grow, peaking at 94% in 1944 and 1945.

At that time the bracket was for individuals making over $400,000. Over the last decade, the rate for the bottom tax bracket, which is individuals earning less than about $15,000, has been set at 10%. The rate for the top bracket, which is individuals earning around $350,000, is at 35%. Calculate your latest income tax rate based on your income.

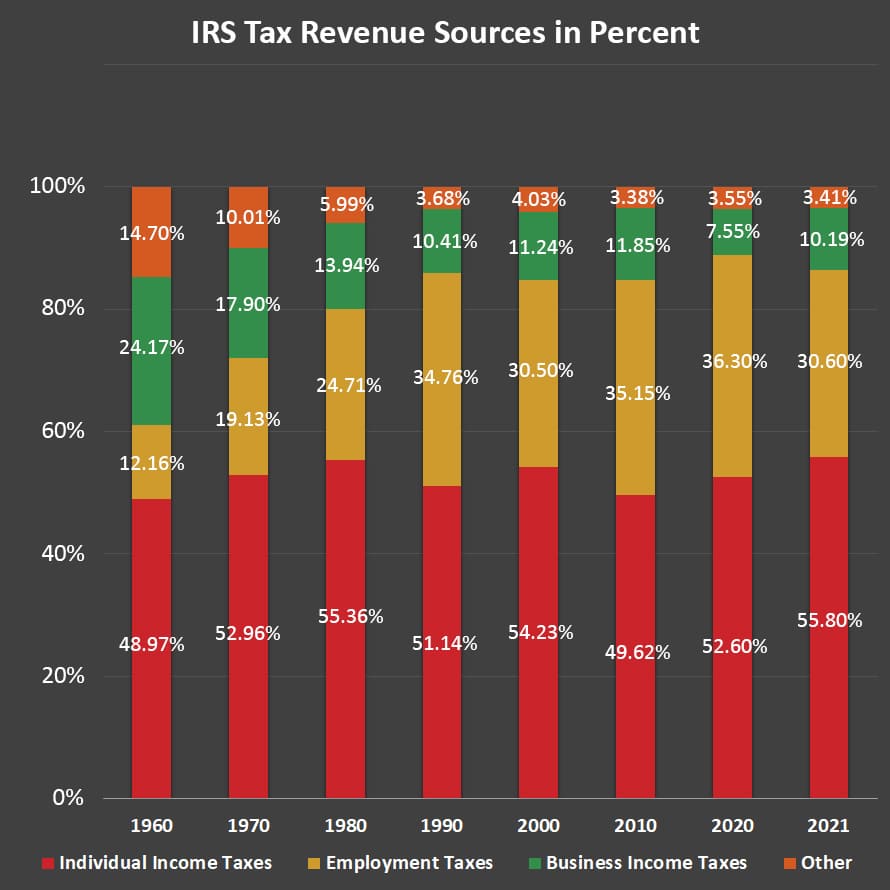

Marginal U.S. Income Tax Rates

Review this historic overview of marginal income tax rates in the United States.

Tax Policy Center

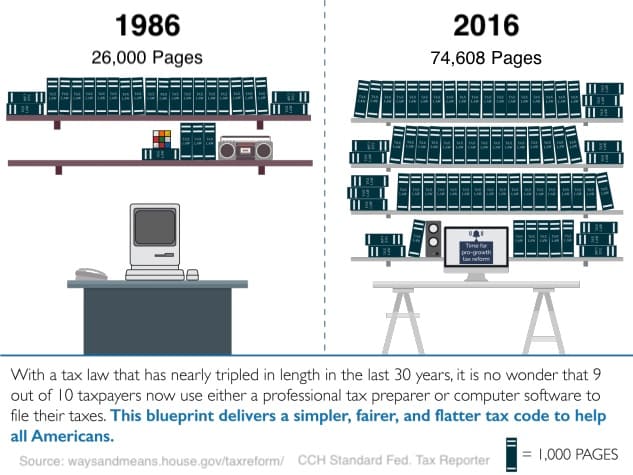

Tax Code History and Tax Law Page Growth

The modern tax code is often described as complicated which is why tax code reform remains a popular issue among politicians. Ronald Reagan, along with Congress, reformed the tax code twice during his two terms in office—once in 1981 and again in 1986. His reform provided the largest tax cut in U.S. history at the time. While Reagan wasn't the first or the last to reform the tax code (nearly every recent president has attempted to reform the tax code in one way or another), his tax reform was considered historic. Bill Clinton also lowered taxes for the middle class in the 1990's and George W. Bush provided another massive tax cut for all income levels in 2001.

Number of Pages in the Tax Code

While these reforms reduced taxes, they did not drastically simplify the tax code, keeping the issue a common topic of conversation among politicians. Despite the complicated workings of the federal income tax, it can provide people with many tax breaks and tax deductions, some of them being quite unusual tax situations.

In 2017, President Donald Trump passed the Tax Cuts and Jobs Act, or TCJA, which was set to last through 2025. This act significantly helped lower income taxpayers while making many other changes, including a single rate change to corporate taxes. This tax reform was the largest overhaul of the tax system in the thirty years prior to its enactment. The act nearly doubled the standard deduction, reformed itemized deductions, increased the Child Tax Credit, and aimed to make taxes simpler for American Citizens.

The U.S. tax code has grown tremendously over the years. Currently, the tax code contains nearly 10,000 sections. The instructions for the Form 1040 alone speak to the expansive growth of the tax code over its history. In 1913, the tax code could be printed on a single page, while modern tax codes can take up to 174 pages. However, the modern tax code is much broader and more complex than its 1913 counterpart, featuring categories for employment taxes, financing of election campaigns, coal industry health benefits, and the trust fund code. This incredible growth can be attributed to both expansions and revisions that are made to patch up tax loopholes. Over the past 10 years, it is estimated that the tax code has been amended or revised over 4,000 times.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.