Dependent Qualifications for EITC, CTC, Etc.

In order to claim the full amounts of a few federal tax credits, like the Earned Income Tax Credit and Child Tax Credit, you must complete the Dependent Due Diligence form. To add your dependent and enter this information, follow the steps below.

How to Add Dependent to My Tax Return?

After you have set up your eFile account or signed into your existing account, proceed through the income screen and add all your income. You can then select the Dependents tab to add your dependent(s).

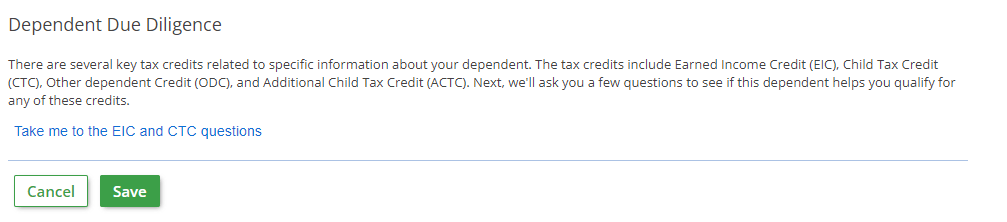

Answer all questions about your dependent by adding their identifying information and entering some other details. Once complete, you will find the Dependent Due Diligence section - see below.

You must select the Take me to the EIC and CTC questions link in order to add this information - selecting Save does not qualify you to claim these credits for your dependent.

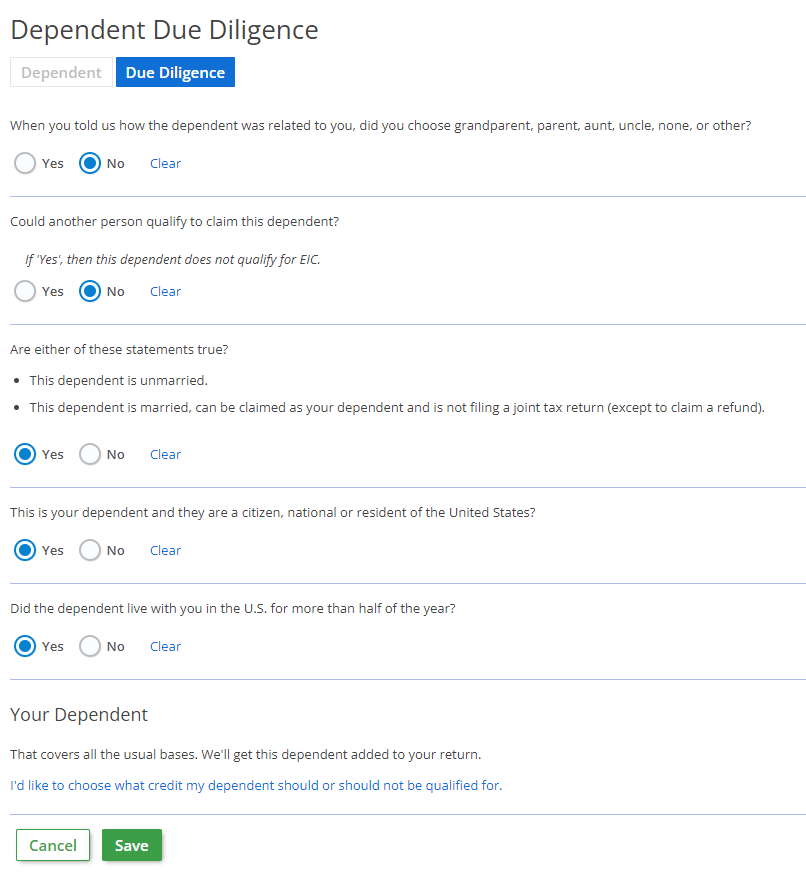

Read each question carefully and answer them honestly - your Due Diligence form may look similar to the example below.

Save this page and proceed with your return by adding more dependents, income, deductions, and more before filing your return. You can view a full copy of your return at any point under My Account and you can view all the forms you've completed under Federal Taxes > Review.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.