How to Get a Transcript of a Tax Return, W-2?

For taxpayers who do not have a copy of their previous year's adjusted gross income or AGI (required as verification to e-file a tax return) during a given tax season, a tax transcript is a fast and convenient way to obtain it.

How does one obtain a transcript? There are three steps outlined below to get yours from the IRS.

Where to Obtain a Transcript Online?

Use or make your IRS Account Registration via ID.me: If you have an ID.me account, you can use the same username/password to sign in to your IRS account. If you do not yet have an ID.me account, you'll need to create one in order to register your personal IRS account.

Get A Free Online Tax Transcript

We at eFile.com greatly encourage taxpayers to create an IRS account for a lot of reasons. Your eFile.com account will give you access to your previous returns and basic information for each tax year, but an IRS account provides many unique tools and resources for taxpayers:

- You can view your transactions (refunds, payments)

- Request documents

- Create or retrieve your IRS IP-PIN

- Make current or advance tax payments (you can do this without an IRS account).

How to Get a Transcript by Phone?

Call and request your transcript (which includes your AGI) from the IRS. Their fully automated phone service can be reached at 1-800-908-9946 any time, night or day.

Can I Request a Transcript by Mail?

If you are unable to create an account with the IRS online, request a transcript of your tax return by submitting Form 4506-T to the IRS by mail.

What Are the IRS Transcript Types?

The IRS provides various types of transcripts which different information. Each can help you plan your taxes, review important data, and view transaction history with the IRS. This information may be useful in applying for a loan or estimating the income on your next tax return.

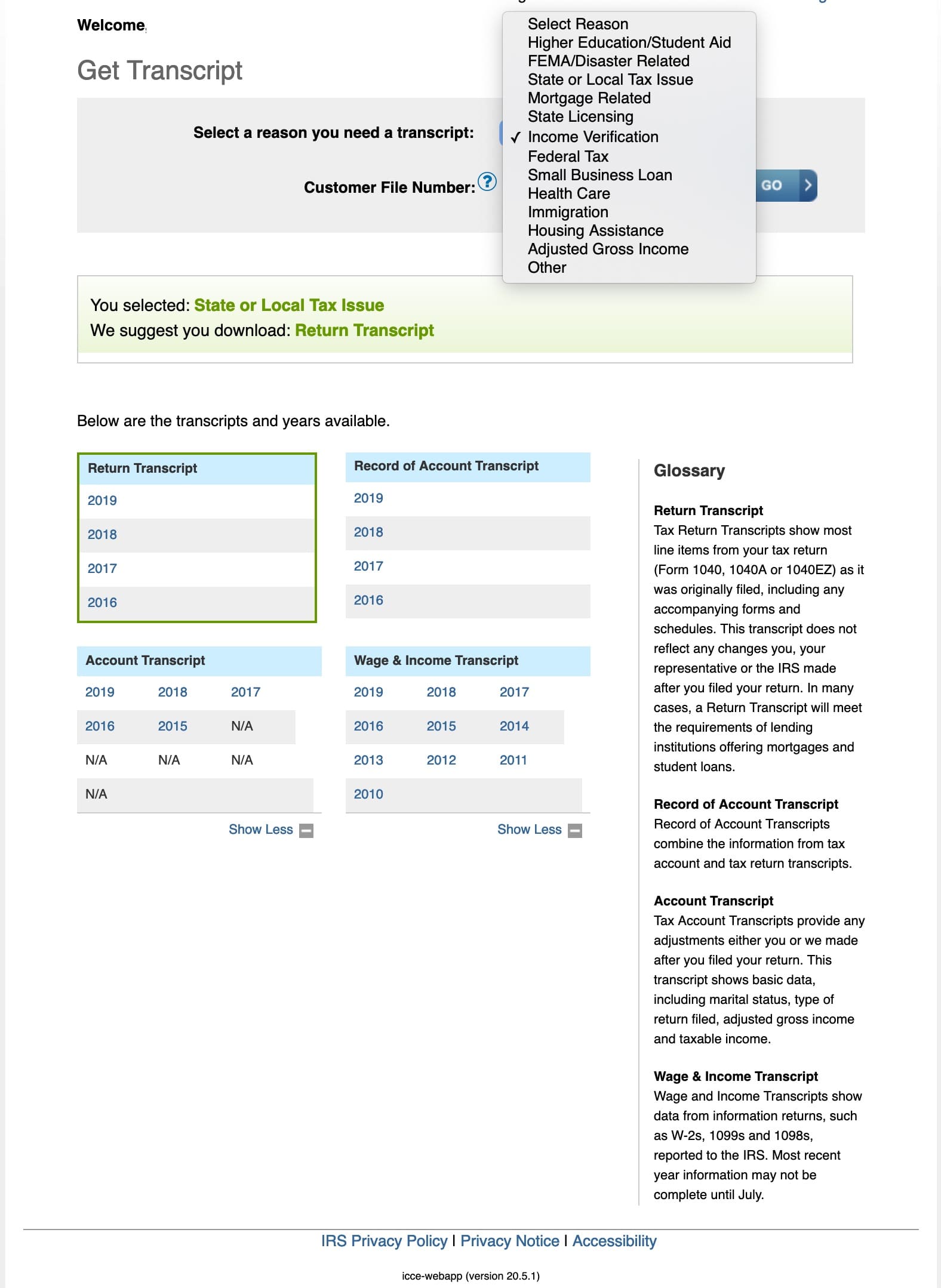

Below is a screenshot of the IRS transcript page which allows you to select the type of transcript you may need.

1. Tax Account Transcript

-Adjusted Gross Income

-AGI

-After-Tax Amendment

Get the Tax Account Transcript for the AGI shows basic tax return data such as filing status, taxable income, and payment types. It also

shows changes made after filing the original return via a tax amendment.The Tax Account Transcript is available for the current and nine prior tax years through

Get Transcript Online and the current and three prior tax years through Get Transcript by Mail or by calling 800-908-9946. These years can also be obtained by

submitting Form 4506-T, and this form is the only way to secure transcripts for years longer than the nine-year cutoff used by other methods.

Note: If you made estimated tax payments and/or applied an overpayment from a prior year's return, you could request this transcript type a few weeks after the beginning of the calendar year to confirm your payments prior to filing your tax return.

2. Record of Account Transcript

-AGI

The Record of Account Transcript combines the tax return and tax account tax transcripts as listed above into one complete transcript. This transcript is available for the current and three prior tax years using Get Transcript Online or

Form 4506-T.

3. Tax Return Transcript

-Original Tax Return

-AGI

The Tax Return Transcript shows most tax return line items from the original Form 1040, 1040-SR, or 1040-NR, including all the forms and schedules.

Attention: This transcript

DOES NOT show changes made after you filed your original return via a

tax amendment; use the Account Transcript for that.

This tax return transcript is available for the current and three prior tax years. A tax return transcript usually meets the needs of financial lending institutions offering mortgages. Note: The secondary taxpayer or spouse on a joint tax return can use

Get Transcript Online or Form 4506-T to request this transcript type. When using Get Transcript by Mail or calling 800-908-9946, the primary taxpayer on the return must make the request.

4. Wage and Income Transcript

-W-2, 1099, 1098, etc.

The Wage and Income Transcript lists tax data the IRS receives from employers, such as Forms W-2, 1098, 1099, and 5498. The tax transcript is limited to approximately 85 income documents. In case you have more documents or forms, complete and

submit Form 4506-T. If you see a “No Record of return filed” message for the current tax year, it means income information has not populated the tax transcript yet. Check back in late May to get the updates. Remember, this transcript is available for the current and nine prior tax years using

Get Transcript Online or

Form 4506-T.

5. Verification of Non-filing Letter, Notice

The Verification of Non-filing Letter will state that the IRS does not have a record of a processed tax return Form 1040, 1040-SR, or 1040-NR as of the date of the request. It does not indicate if you need to file for the given tax year. This letter is available after June 15 for the current tax year or anytime for the prior three tax years using

Get Transcript Online or

Form 4506-T. Use Form 4506-T if you need a letter for older tax years.

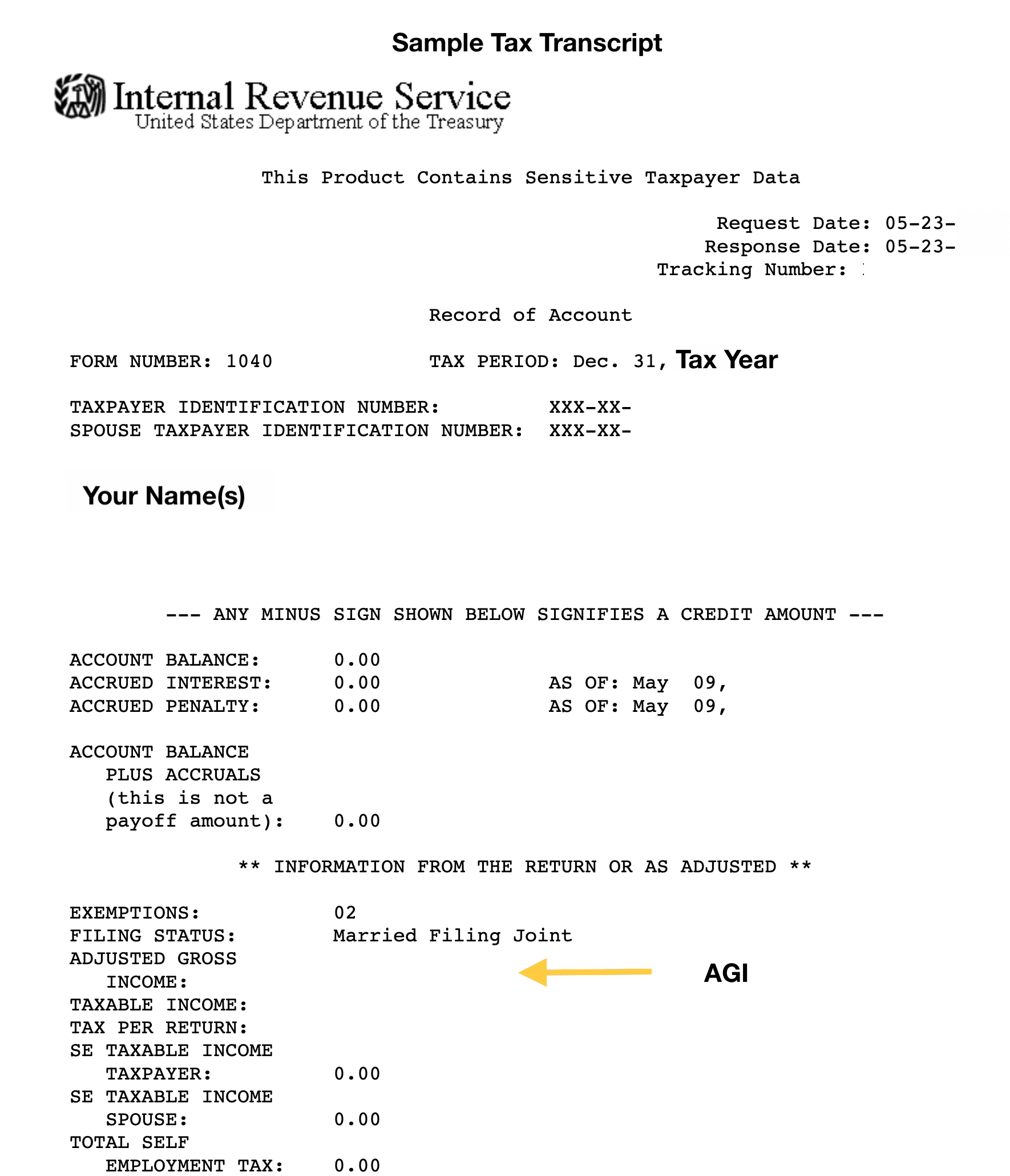

IRS Transcript View

A sample view of an IRS Tax Transcript

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.