Form W-4: How to Fill out a W-4 Form for Tax Year 2025

The W-4 Form, officially known as the Employee's Withholding Certificate, is one of the important documents used by employees in the United States to determine how much federal income tax should be withheld from their paychecks. Understanding how to fill out the W-4 Form correctly can help you avoid overpaying or underpaying your taxes.

In this page, we will learn what the W-4 Form is, its purpose, and step-by-step instructions on how to fill out a W-4 Form. Additionally, we will provide information on where to download the W-4 current tax year version and more valuable tips. By the end, you will be equipped with all the knowledge you need to complete the form W-4.

What is Form W-4?

The W-4 Form, also known as the "Employee's Withholding Certificate," is an important IRS tax document that employees need to fill out and give to their employers. This form helps employers figure out how much federal income tax to withhold from each employee's paycheck throughout the year.

In the past, employees could claim allowances on their W-4 to reduce the amount of tax withheld, meaning less money was taken from their wages. However, big changes came with the 2017 Tax Cuts and Jobs Act, which removed personal exemptions.

The updated W-4 Form, introduced in 2020, still asks for basic personal information but no longer includes allowances. Now, to lower their tax withholding, employees must claim dependents or use a deductions worksheet when they fill out the W-4 Form.

How to Fill out a W-4 Form?

Filling out a W-4 Form is essential for managing your tax withholding accurately. Here are the simple steps to fill out a Form W-4:

Step 1: Provide Your Personal Information

Begin by entering your name, address, Social Security number, and tax filing status. Your filing status determines your eligibility for certain tax credits and deductions, so choose carefully.

Step 2: Address Multiple Employment Situations

If you have more than one job or if your spouse works, it's crucial to adjust your withholdings accordingly. For your primary job, complete steps 2 through 4(b) on the W-4 Form. For other positions, you can leave these sections blank. If you and your spouse each hold two jobs with similar earnings, check box 2(c) on both W-4 Forms.

Step 3: Claim Dependents

If your income is below $200,000 (or $400,000 for joint filers), list your dependents. Multiply their number by the applicable credit amount to adjust your withholdings accordingly. You may choose not to claim them if you prefer higher withholdings to manage your tax bill better.

Step 4: Adjust Withholdings

You can indicate any extra amounts you want withheld or if you expect to claim specific deductions that exceed the standard deduction.

Step 5: Submit Your Form W-4

Finally, sign and date the W-4 Form and submit it to your employer’s payroll or HR department. Some companies may allow online submission through their payroll systems.

By following these steps, you can fill out the W-4 Form accurately, ensuring appropriate tax withholding throughout the year.

Common Payroll Deductions You Should Know About

Here are a few examples of deductions that can be taken from your paycheck:

Which W-4 Form Tools is Right for You?

At eFile, we offer two free W-4 Form tools designed to simplify your tax withholding process. Here's a brief explanation of each:

A. Form W-4 Creator: This intuitive W-4 creator tool helps you fill out W-4 Form easily. By guiding you through a series of simple steps it ensures you complete your W-4 accurately without any complicated calculations. Once finished, you can download your customized W-4 PDF– ready to submit to your employer.

B. Paycheck/W-4 Calculator: This tool provides a more in-depth approach by analyzing your current or anticipated paychecks. It calculates your withholding amounts for each pay period, giving you a clear picture of how your taxes will affect your take-home pay. Simply input your expected income, deductions etc. for the year into the tax calculator to see an estimated tax return.

Related Resources

What is the Difference Between a W-2 and a W-4?

When starting a new job, you will likely encounter two forms: the W-4 and the W-2. While they might sound similar, they serve very different purposes.

W-4 Form: This form is essential when you start a new job. It provides your employer with information about your tax filing status and the number of allowances you claim. This information helps them determine the correct amount of federal income tax to withhold from your paycheck.

W-2 Form: This form is a year-end summary of your income and the taxes withheld from your paycheck. It's provided by your employer by January 31st of the following year. The W-2 is crucial when filing your annual tax return as it provides essential details like your gross earnings, federal, state, and local taxes withheld, and any other relevant tax information.

W-4 vs W-2: Key Differences

- Timing: W-4 is completed at the start of employment, while W-2 is received at the end of the year.

- Purpose: W-4 informs your employer about tax withholding, while W-2 provides a summary of your income and taxes withheld.

- Usage: W-4 is used by employees, while W-2 is used by both employees and the IRS.

Step-by-Step Instructions to Fill Out a W-4 Form

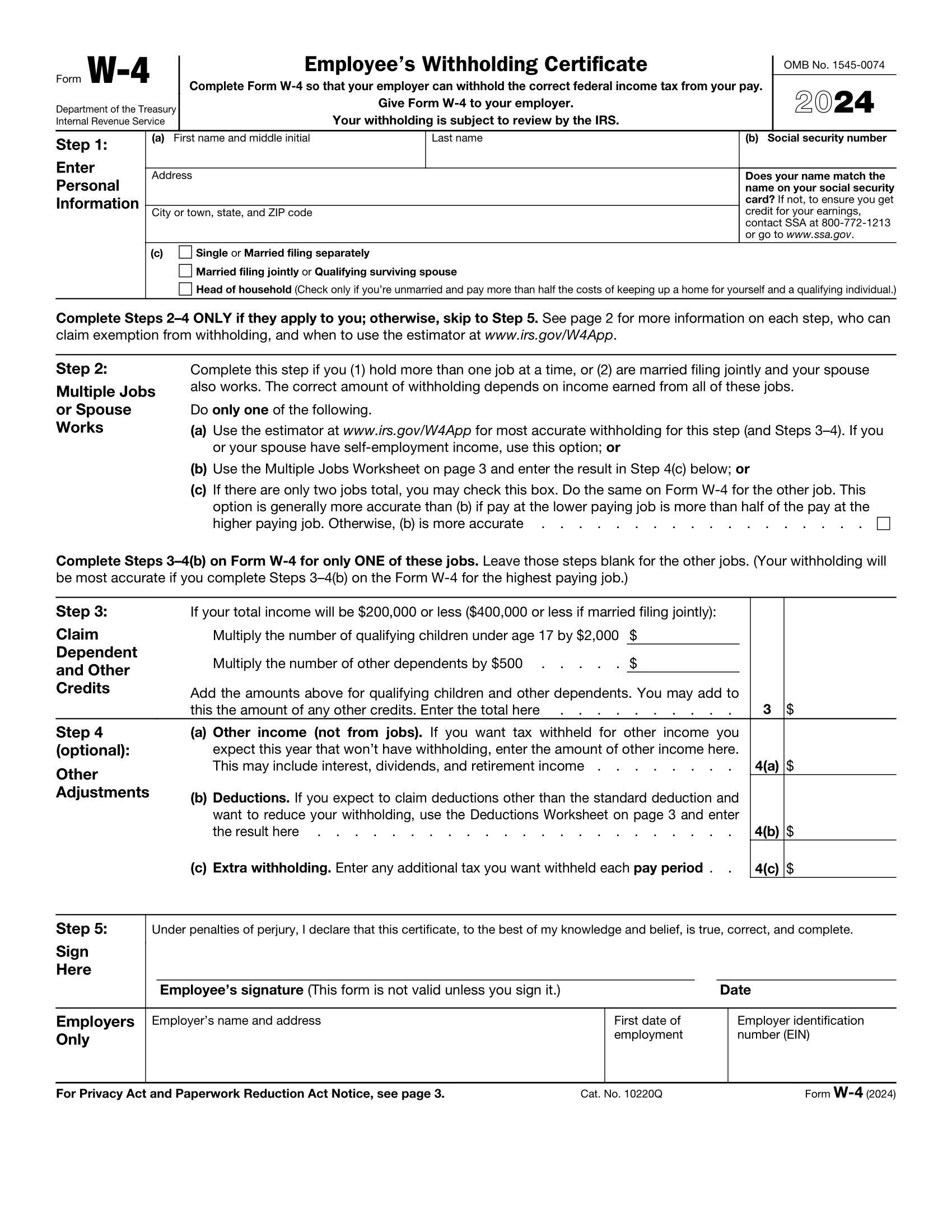

Form W-4: Step 1 Image

Name, Address, SSN

Step 1

Your current address does not have to match your tax return address.

Tax Return Filing Status

Step 1

Select single, married jointly or separately, surviving spouse (previously qualified widow[er]), or head of household.

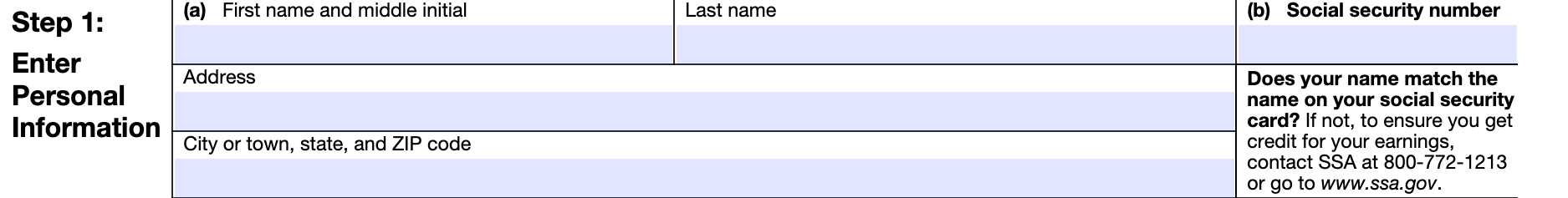

Form W-4: Step 2 Image

Number of Jobs

Step 2

If you only have one job, leave the checkbox under c blank. Mark the checkbox if you either hold more than one job at a time, or you are married and filing jointly with a spouse who also has a job. Logically, this means that together you have 2 jobs and this should be marked as such. The correct amount of withholding depends on the income earned from all of these jobs. If there are 2 jobs in the household, enter your dependent(s) and/or deductions on the W-4 with the highest income. Do not enter the dependents/deductions on each of the two W-4 forms.

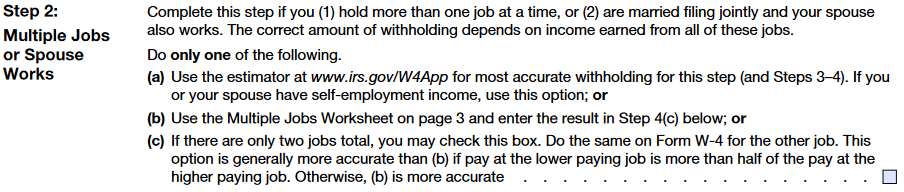

Form W-4: Step 3 Image

Dependents

Step 3

If you do not have dependents, you can leave this blank. Otherwise, enter the number of your

qualifying dependents and other dependents (e.g.

qualifying relatives) you could claim on your tax return. If there are 2 jobs in the household, enter the dependents ONLY on the W-4 with the highest income. Leave the second W-4 blank in Step 3.

Tip: An increased number of dependents would decrease your IRS tax withholding for each pay period. A decreased number of dependents would increase your IRS tax withholding.

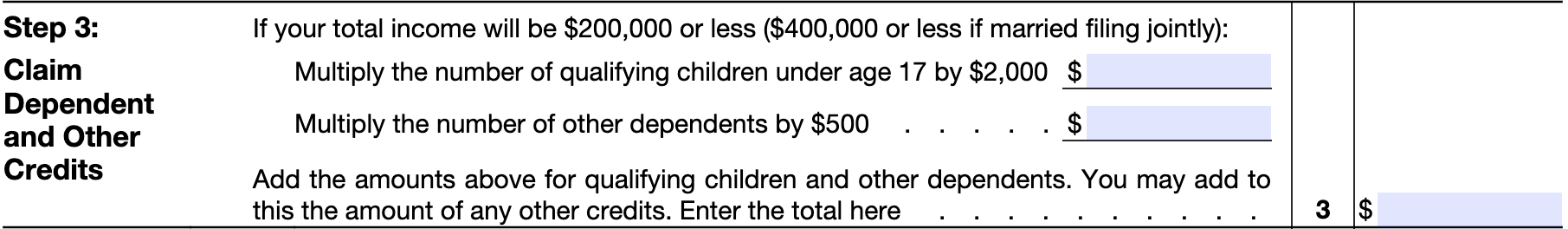

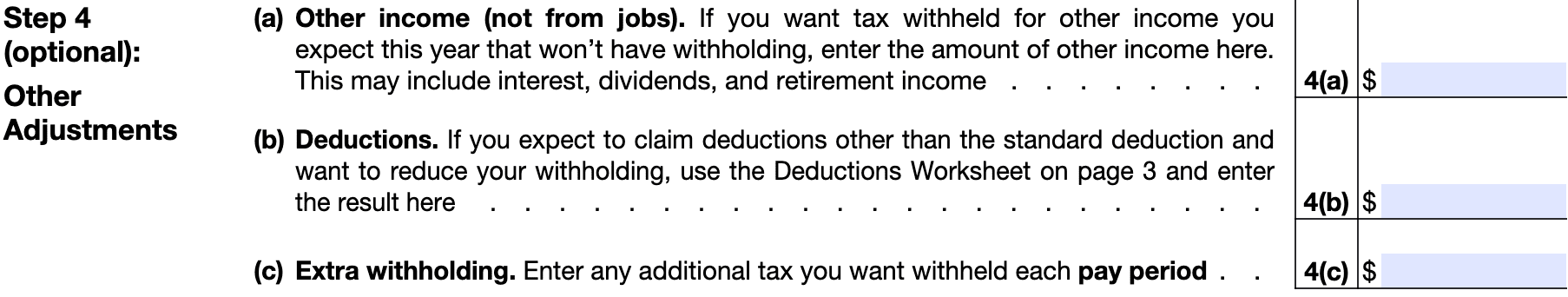

Form W-4: Step 4 Image

(a) Other Income

Step 4

(Optional) Only add this if you have other income and you wish to have taxes withheld for this income. If you are already withholding taxes for this income, leave this blank.

(b) Deductions

Step 4

(Optional) Enter expected tax deductions for the given tax year. Do not list the

standard deduction here. Generally, you would enter an amount here that would exceed your standard deduction or you plan on

itemizing your deductions on your next tax return.

Tip: An increased deduction amount would decrease your IRS tax withholding for each pay period. A decreased deduction amount would increase your IRS tax withholding.

(c) Extra Withholding

Step 4

(Optional) Add a dollar amount of extra income taxes you want to have withheld through your paycheck.

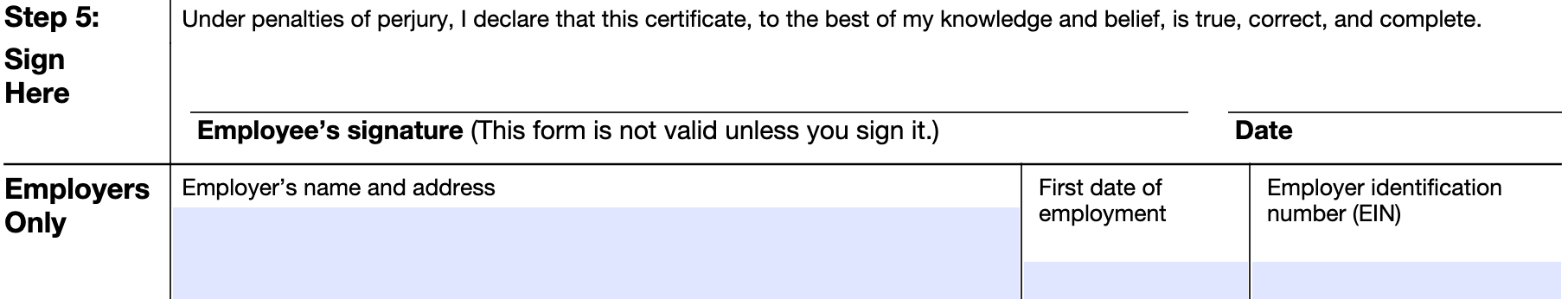

Form W-4: Step 5 Image

Signature, Date

Step 5

Sign the form and enter the date, which would be either the day you're signing the document or the effective date of the Form W-4.

Free Tools to Calculate, Create, And Fill Out a W-4 Form

Frequently Asked Questions

Where to Find or Download a W-4 for 2025?

If you are looking to fill out a W-4 Form for 2025, you can easily find and download it from the IRS website as well as from here. You can also request it through your employer. The IRS updates tax forms annually to improve clarity and reflect any changes, such as adjusted tax credits due to inflation. For this reason, make sure to download the latest version to ensure accurate withholding on your paycheck.

What is the purpose of the W-4 form?

The W-4 Form is essential for employees in the U.S. It informs employers how much federal income tax to withhold from paychecks. By accurately completing this form, you ensure you are not overpaying or underpaying taxes throughout the year. This helps you avoid surprises during tax season.

How to fill out a W-4 form?

To fill out a W-4 Form, start by entering your personal information, such as name, address, and Social Security number. Then, indicate your filing status and any dependents. Adjust your withholding by following the worksheet included to ensure the correct amount of federal tax is withheld from your paycheck. We also recommend you use our free W-4 calculator and other tax calculators to help you accurately estimate your withholdings and avoid surprises during tax season.

What is the W-4 form used for?

The W-4 Form is used by employees to communicate their tax withholding preferences to their employers. It determines how much federal income tax will be deducted from each paycheck, allowing for adjustments based on life changes like marriage or the birth of a child. This eventually ensures accurate tax payments throughout the year.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.