Tip Income Deduction, Taxes for 2025, 2026, 2027, 2028

You might have a job where you earn a regular paycheck as a W-2 employee and also get tips on top of that. Alternatively, you could receive tips while working as an independent contractor. Regardless of how you earn it, all income is generally taxable. It’s important to understand what counts as taxable versus nontaxable income. Even money from investments or stocks, which comes from passive sources, is subject to taxes.

Estimate Your Return with the Tip Deduction

Tax Year 2025 Tip Income Deduction under OBBB

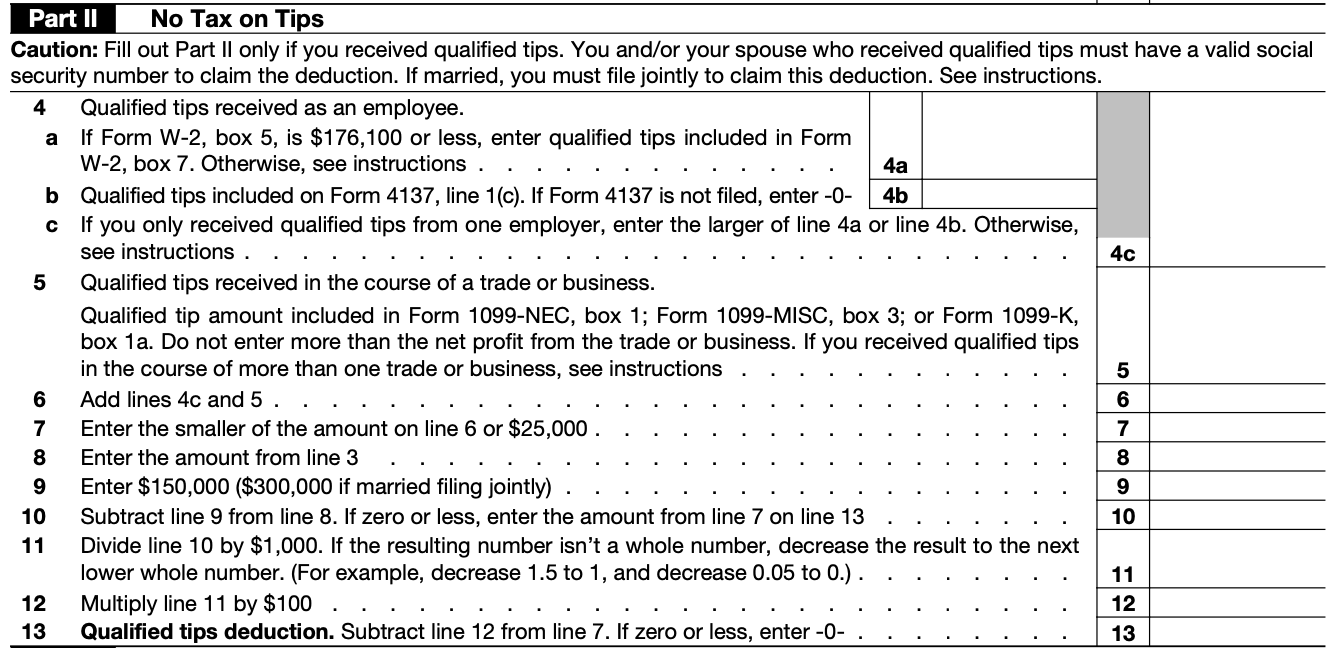

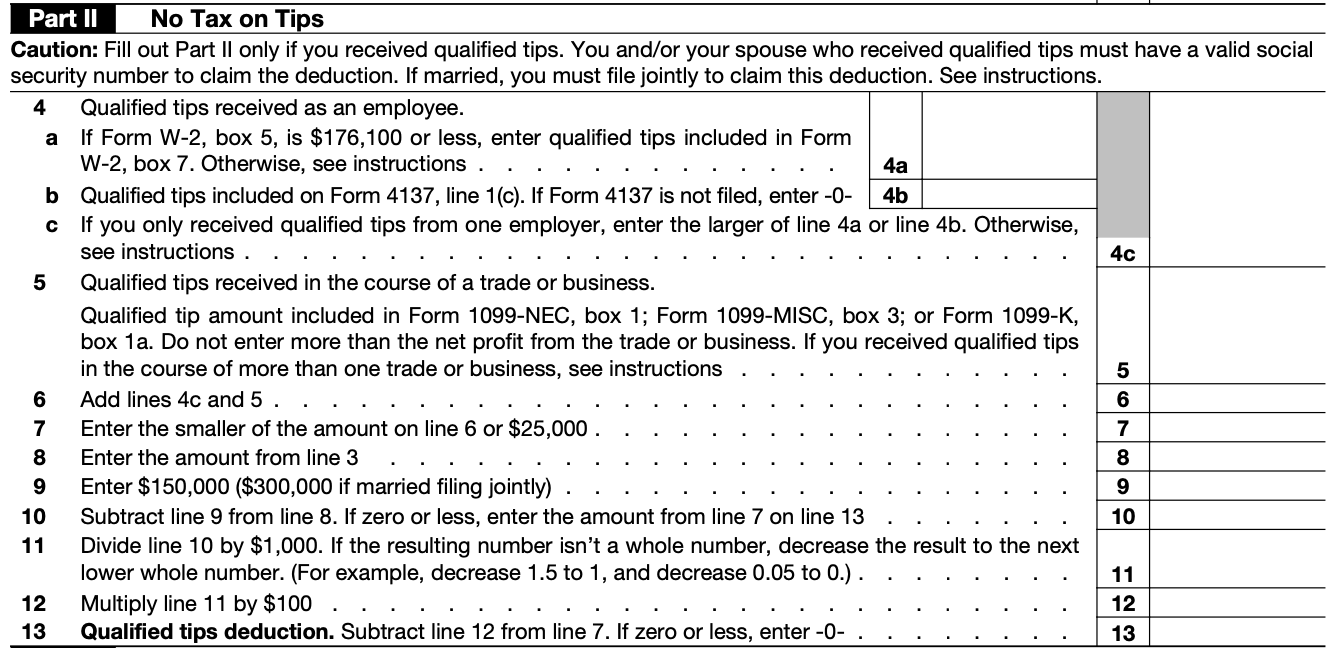

Beginning with tax year 2025, qualified tip income reported via Form 4137 may now be eligible for a federal tax deduction, thanks to provisions in the 2025 tax reform. As of now the tip income deduction is for tax year 2025, 2026, 2027 and 2028 unless Congress extends it. The tip income deduction is reported via the IRS Form Schedule-1-A for additional deductions. The eFile.com tax estimator will calculate the tip income deduction when you estimate your next tax return. Below is the outline as seen on Schedule 1-A for Form 1040.

- Qualified tips include voluntary cash tips and charged tips received directly from customers or distributed through tip-sharing arrangements.

- A tip IRS income deduction of up to $25,000 (per individual, thus both spouses each could deduct $25,000 on qualifying tip income with a married filing joint return) per year is available to employees in traditionally tipped industries. Important: If one spouse on a married filing joint return has more than $25,000 in tip income and the other spouse has no income, s/he can NOT deduct more than $25,000. This differs from the limits on most other married filing joint deductions, which do not depend on who earned the income.

- The deduction is above-the-line and can be claimed whether or not you itemize deductions.

- The deduction phases out for taxpayers with modified adjusted gross income (MAGI) over $150,000 (or $300,000 for married joint filers).

- The eFile tax app will determine for you if your state might still tax you on tip income.

For example, if your only income was from tips, you could not deduct all of this income. Let's say your total annual income was only tip income e.g. $50,000. Your W-2 would report $50,000, and you could deduct up to $25,000 (not all $50,000) of your tip income on your tax return. Similarly, if you had $25,000 in regular W-2 income and $25,000 in tips your W-2 would report $50,000, and you would deduct the $25,000 in tips when preparing and filing your taxes.

- This deduction is not available to:

- Self-employed individuals engaged in a specified service trade or business (SSTB), such as those in the restaurant, salon, or hospitality industries.

- Employees whose employers operate as an SSTB under the provisions of Section 199A.

Single, Head of Household

$25,000

$150,000 MAGI

$400,000 MAGI

Married filing jointly

$25,000/each

$300,000 MAGI

$550,000 MAGI

Married filing separately

Not qualified

Not qualified

Not qualified

How to Report Tips on Taxes?

Do you need to file a tax return when your primary income is tips from work?

Generally, all tips received by a taxpayer are classified as income, so it is subject to federal income taxes and any applicable state taxes. As a taxpayer receiving payments or a regular paycheck, you are responsible for including your taxable income as part of your gross income on your tax return. Keep up with tax news in case the taxes on tips is changed.

You may receive tips in a variety of ways, including:

- Tips from customers through work, whether cash, debit or credit card, electronic payment, or gift card

- Direct payment to you through cash or credit, or debit card

- Tips obtained from a tip-splitting arrangement set up by an employer, which is dispersed amongst various employees. Note: in this scenario, only report the amount you personally take home. For example, if you received $200 in tips for the night as a waiter, but gave $50 each to the bartender and busser, then you would only report $100.

As someone who receives tips, report any cash tips to your employer so they can include them on your W-2. This is because Social Security and Medicare taxes need to be withheld for this income, otherwise it is considered unreported tip income, and you may need to file a Form 4137 and owe these taxes. If you receive a noncash tip (passes, tickets, etc.) then this does not get reported to your employer, but the cash value of the item(s) should be reported as income on your tax return.

Got tips or multiple income sources? Use eFile.com to file your taxes accurately. The eFile Tax App simplifies IRS forms, manages income and deductions, and helps you claim credits.

Prepare and e-file your taxes today!When filing taxes, tips are reported with your gross income on Form 1040. If you earn $20 or more in tips monthly, they will be included in your Form W-2 under Box 1 (Wages, tips, and other compensation) and also affect Medicare (Box 5) and Social Security (Box 7) calculations. Service industry employees don't need to report tips under $20 per month per employer.

- Allocated Tips: In addition, Box 8 on the W-2 form reports allocated tips. Allocated tips in box 8, are tips assigned to an employee by the employer if the tips reported by the employee are less than a certain percentage (below 8% of food and drink sales), commonly in workplaces like restaurants with tip pooling arrangements (allocate tips based on sales or if your reported tips were ).

Important: The amount on the W-2 in Box 8 is not included in taxable wages on the W-2 in Box 1, Box 5, or Box 7. As a result employees must report these allocated tips as income separately when filing their tax returns. Again, allocated tips aren’t included in Box 1 and aren’t subject to Social Security, Medicare, or railroad retirement taxes.

If you receive tips independently or your employer doesn't track them, you must report them accurately. Keeping track of your tips throughout the year is essential for correct reporting.

- Keep a daily tip record - keep a notebook or spreadsheet of tips received each shift. As you collect tips, write these down and report them on your return.

- Report your tips to your employer if they aren’t tracking them. Providing details about your tips can help them include this information on your year-end tax form. You don’t need to report tips under $20 per month per job, applying this limit to each position. Noncash tips, like passes or tickets, don’t need to be reported, but their cash value must be included on your tax return.

- Regardless, report all tips on your income tax return - use your own data or employer's figures to report your tip income with your gross income on your return.

- Unreported tip income will need to be included on your tax return. If you did not report certain tip income to your employer, use Form 4137 to calculate Social Security and Medicare taxes on this income - eFile.com will help you fill in this form. eFileIT now.

Read the IRS publication on Reporting Tip Income for more details.

Frequently Asked Questions

Can I deduct tip income on my taxes in 2025?

Yes, under the 2025 One Big Beautiful Bill (OBBB) tax reform, workers in traditionally tipped industries may deduct up to $25,000 of qualified tip income. This deduction is available even if you don't itemize and is subject to income limits.

What are qualified tips under the OBBB deduction?

Qualified tips include voluntary cash tips, credit/debit card tips, and distributed tips from a tip pool. They must be reported to your employer and/or included on Form 4137 to be deductible.

Is the tip income deduction available to gig workers or independent contractors?

No. If you're self-employed or working as an independent contractor in a specified service trade or business (SSTB), you're not eligible for the tip income deduction under OBBB.

What is the MAGI phase-out for the tip deduction?

The deduction phases out when your modified adjusted gross income (MAGI) exceeds $150,000 for single filers or $300,000 for joint filers. If your income is above this range, you may not qualify for the deduction.

How does the IRS verify my reported tips?

The IRS matches tips reported on Form W-2 and/or Form 4137 with employer records. Underreporting may lead to penalties of up to 50% of the unpaid Social Security and Medicare taxes.

How Is Tip Income Taxed or Deducted?

Tips are typically taxed as regular income and included in your gross income. When you receive tips in cash or debit/credit, this amount is taxed as income. However, when you receive non-cash tips, such as tickets, collectibles, passes, or other items of value, these are also to be reported as income. When you receive an item as a tip, you will need to report the fair market value of this item as income. Included in your gross income are any wages you received during the year as well as other taxable income, such as self-employment income, interest or dividends, or certain retirement withdrawals. Include tips with your gross income so your income tax can be assessed accurately.

Based on schedule 1-a (additional deductions) follow these steps to determine your tip income deduction. You can also use the eFile.com tax calculator to have the deduction estimated for your next income tax return.

Do I pay taxes on surcharges or auto gratuities?

In certain businesses, often restaurants, the business may include a surcharge on the bill for the customer to pay. This is an additional fee for the service of the employees of the business. Because the customer does not choose to add this nor select the amount, these are not counted as tip income and therefore are not reported to your employer by you as the employee.

What if I don't report my tip income accurately to my employer?

There are penalties if you do not report the correct amount of tip income for a given month. If you fail to report tips accurately and honestly, the IRS may impose a penalty of up to 50% of the Social Security and Medicare taxes which were not paid since you did not report the tips properly.

Have tip income? Report your tips and other tax information on eFile.com and get your taxes done easily. Compare eFile.com to TurboTax® or H&R Block® and eFileIT by Tax Day.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.