Form W-2 Page

Learn how to add and enter your W-2 Form(s) to your tax return. See more details about W-2 Forms issued by employers and find out what to do if you did not receive a W-2 or you lost it.

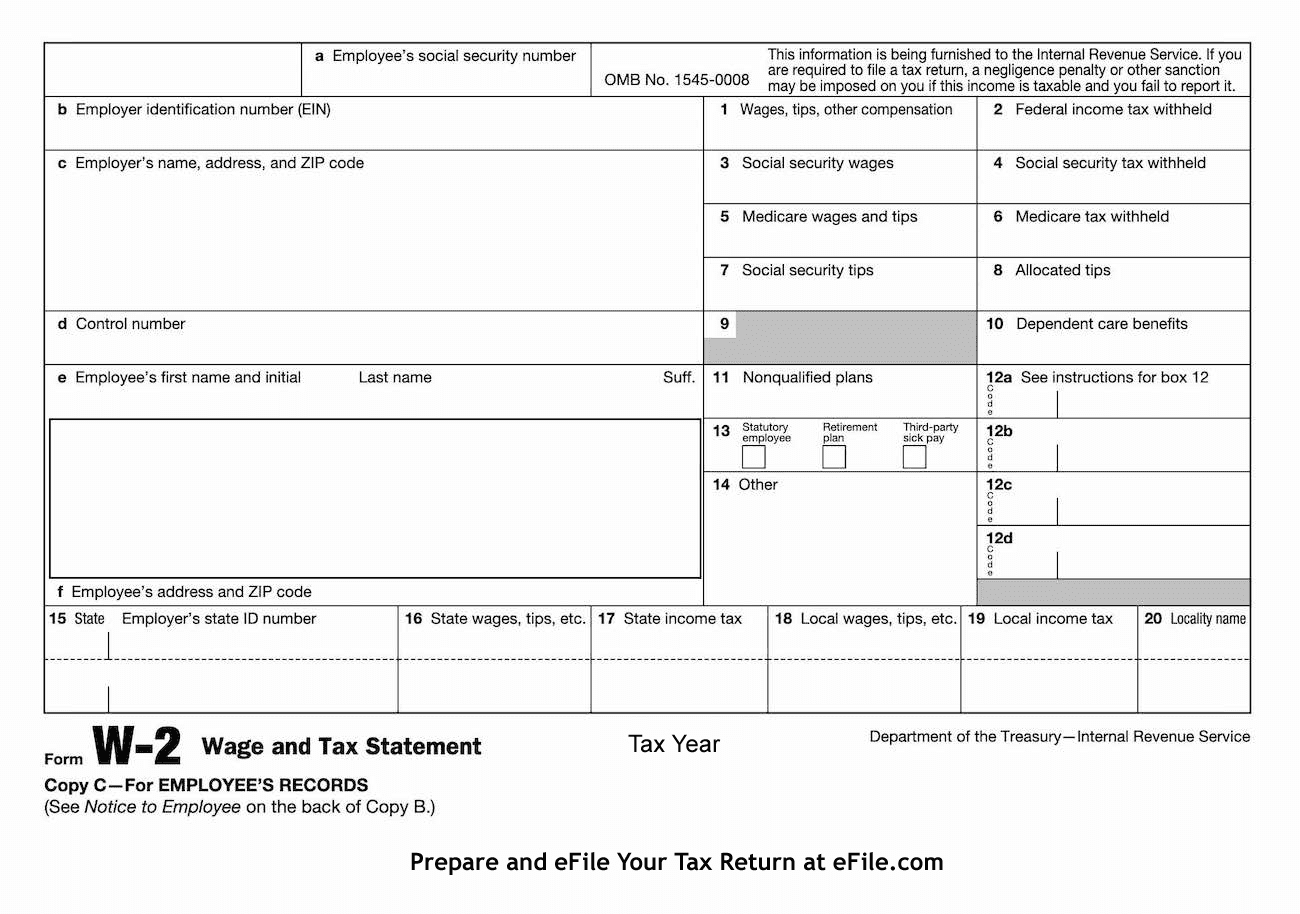

A: Sample W-2 Form You Received

Have your W-2 Form in front of you. The box numbers listed on this Form W-2 correspond to the sections you need to enter on the sections below.

B: Sign in to eFile.com

Select My Account

Step 1: Sign in to eFile.com

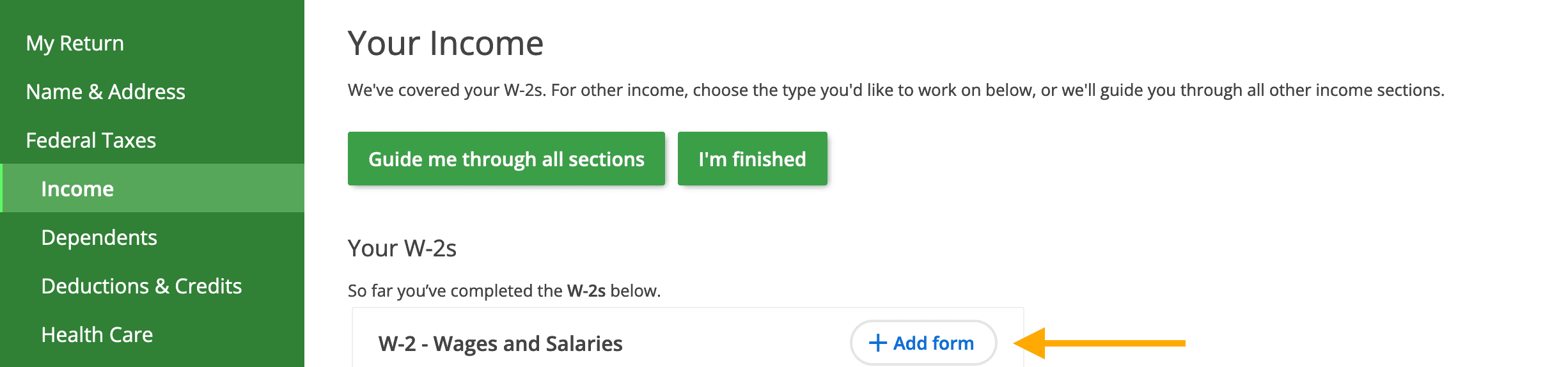

Step 2: Select Federal Taxes (menu on the left) then on Income below that.

Step 3: On the right side, select Add Form in the W-2 section.

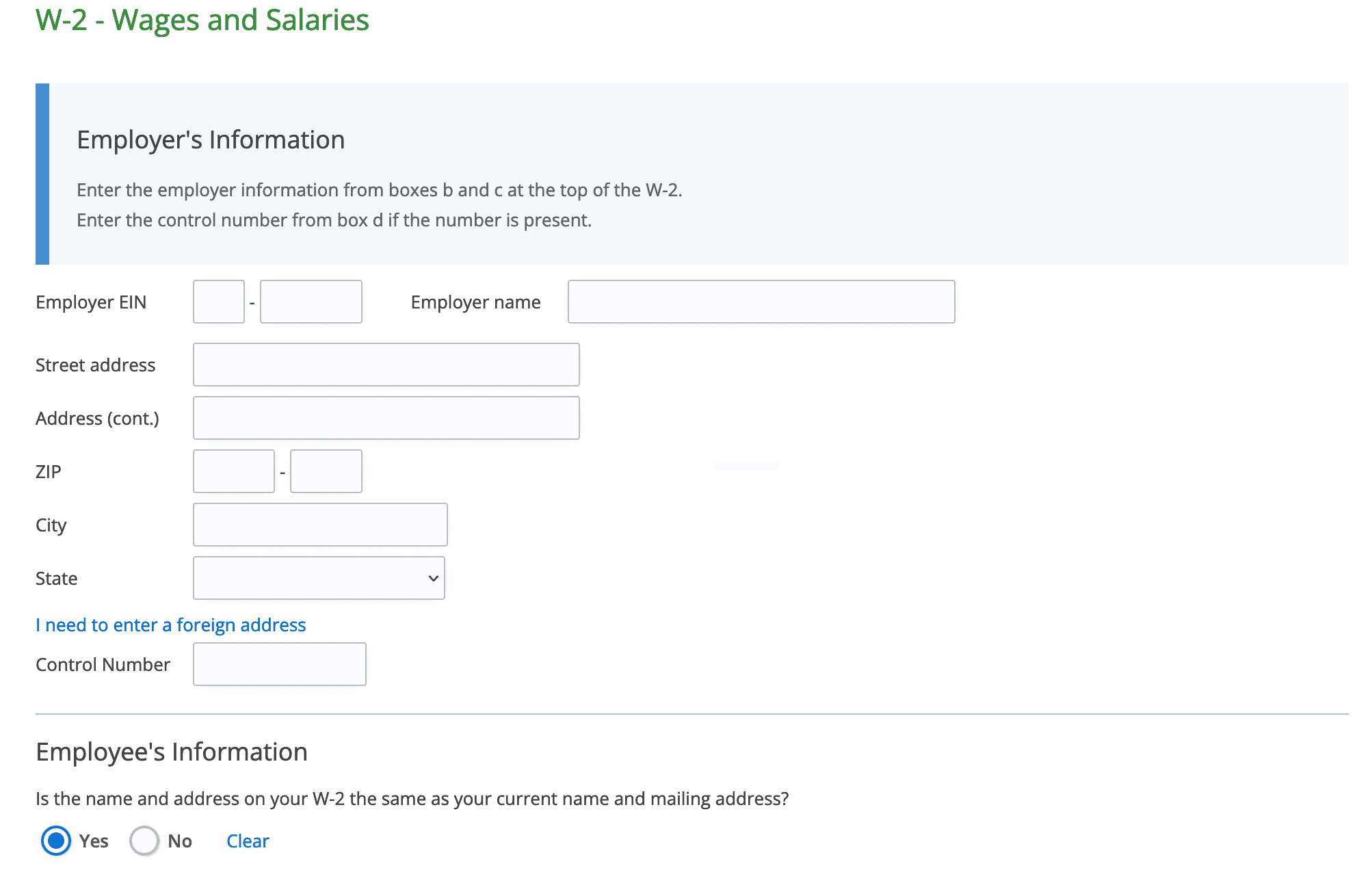

C: Employer Section

Enter the employer information as listed on your W-2. Each W-2 has to be entered separately.

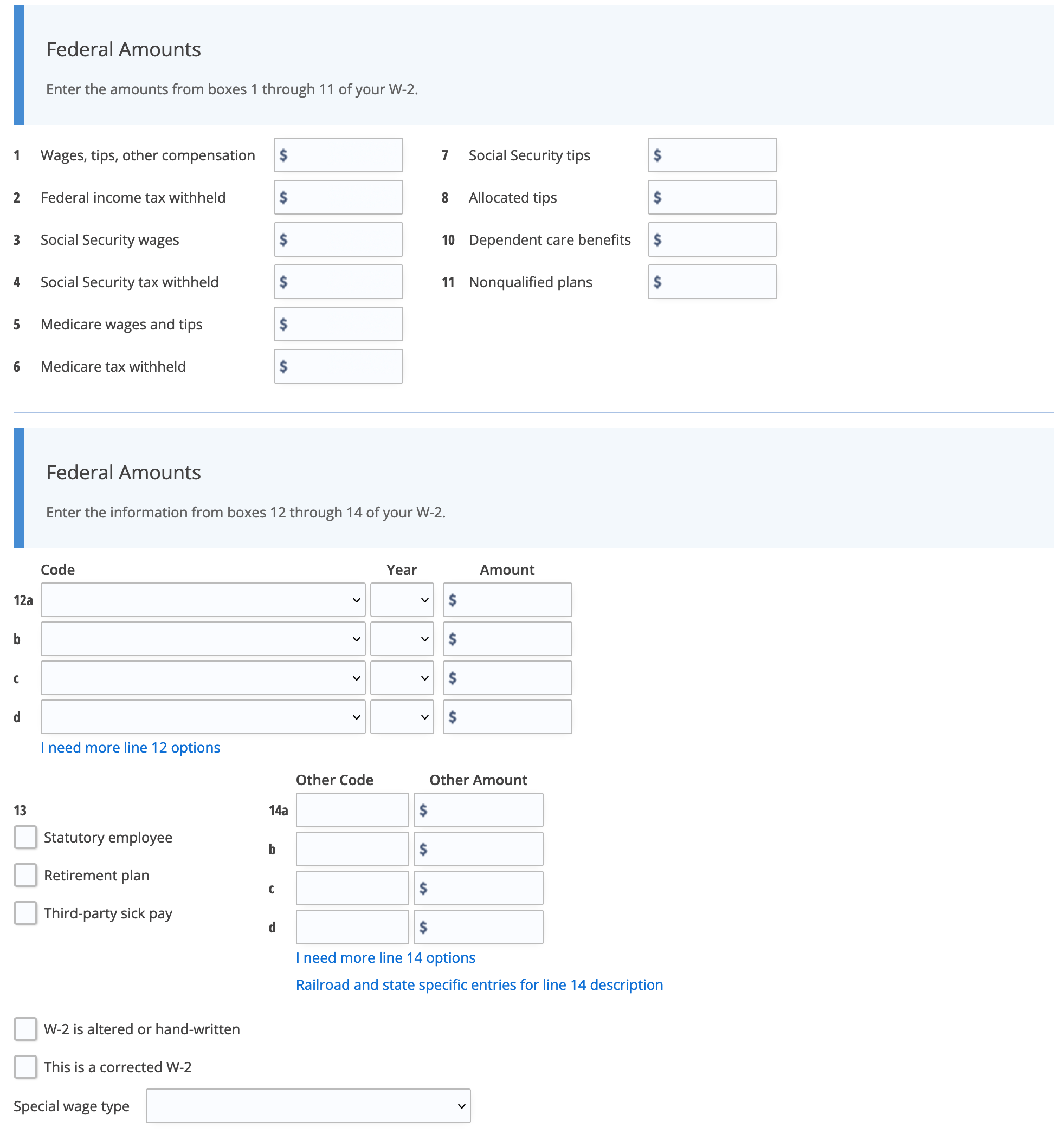

D: Federal Section

Enter the federal information as listed on your W-2. Each W-2 has to be entered separately.

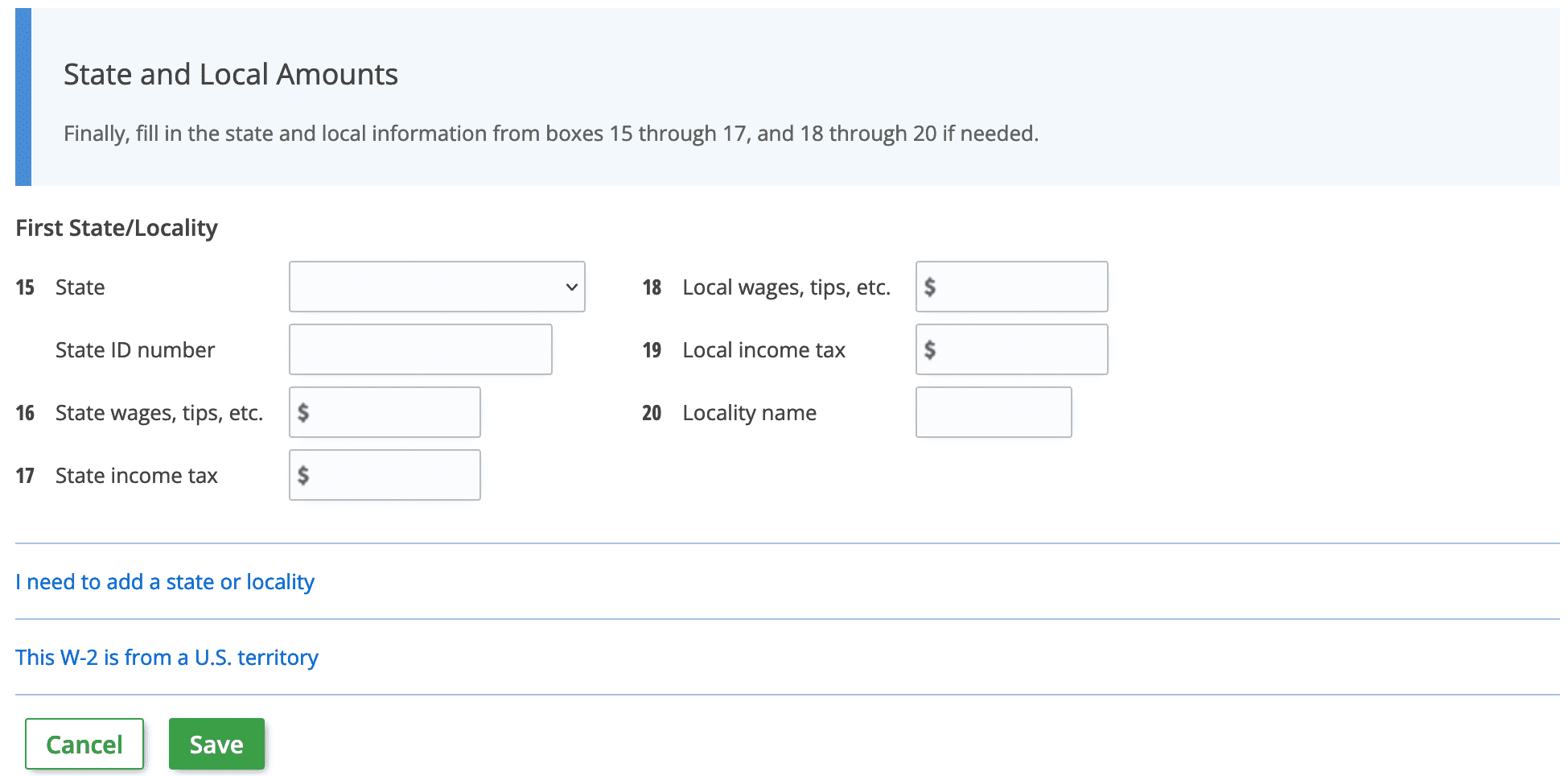

E: State and Local Section

Enter the state and local information as listed on your W-2. Each W-2 has to be entered separately.

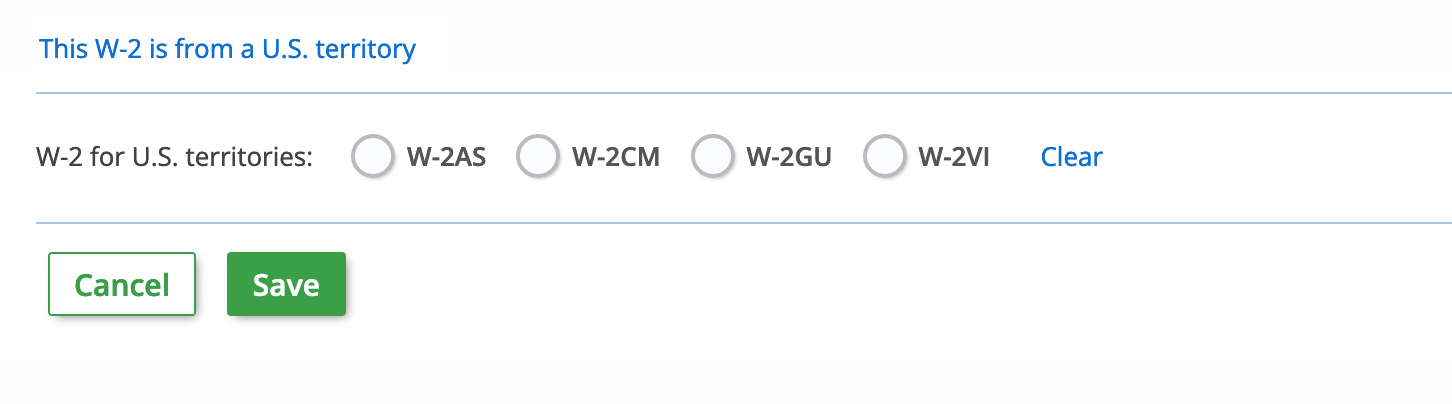

F: W-2 U.S. Territory

If your W-2 is from a U.S. Territory, select this link and select a territory.

Once complete, you can add another W-2 or continue through the remaining sections to add your details and finish your return.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.