Tax Lien, Levy and Wage Garnishment

Tax Levy

Wage

Garnishment

What happens when you owe taxes? Can the IRS take my money? Can they claim my house?

When you have outstanding taxes that you haven't paid for a long time, the IRS can take serious steps to collect the debt. They may seize your bank accounts or even your property. Before taking such actions, the IRS will send several notices about your unpaid taxes, including reminders of late payments, additional penalties, and updated due dates.

These notices are your chance to address the issue before the IRS takes further steps. If you ignore them, the IRS can seize your bank account or even your property, or they might garnish your wages.

To avoid these issues, it's crucial to e-file your taxes each year to keep track of your income and tax obligations. Adjust your tax withholding or make estimated payments throughout the year to ensure you don't owe taxes come tax season.

How the IRS Collects Unpaid Taxes?

The IRS collects taxes through a lien, levy, or a garnishment.

A lien is a legal recorded claim against a taxpayer's property that belongs to the taxpayer, but is held by another person or organization (e.g. salary or wages - see below for more on wage garnishment - retirement accounts, dividends, bank accounts, licenses, rental income, accounts receivables, the cash loan value of your life insurance, or commissions, etc.) to secure payment of the tax debt. A tax levy actually takes the property to satisfy the tax debt. Thus, an IRS levy permits the legal seizure and liquidation of your property (e.g. real estate, vehicles, boats, personal property, etc.) to satisfy a tax debt.

A wage garnishment is a legal procedure in which a person's salary, wages, or earnings are required by court order to be withheld by an employer for the payment of a debt, such as owed taxes or child support. The Consumer Credit Protection Act - CCPA - protects an employee from discharge by an employer because their earnings (e.g. wages, salaries, commissions, bonuses, and income from a pension or retirement program, but ordinarily not including tips and wages) have been garnished for any one debt.

Furthermore, it limits the amount of an employee's wage or salary income that may be garnished in any one week or per pay period. Excluded from wage garnishments are voluntary wage assignments in which an employee voluntarily agrees that their employer(s) may turn over some specified amount of their earnings to the IRS as tax debt payment.

Before we look further into the tax lien and wage garnishment procedures, below are options to pay taxes now or over time.

Options to Pay Taxes Now or Over Time

A taxpayer has many options to settle their debt with the IRS. Whether you are ready to pay now or are looking to pay overtime through an installment agreement, the IRS will generally work with you. These options are:

1. Ready to Pay Now: A taxpayer has the funds required or is okay with paying taxes by credit card now. You can make this payment directly to the IRS online, through the mail, or through a third-party application.

2. Not Ready to Pay Now but Over Time: A taxpayer does not have the funds now to pay taxes on time, but does want to pay over time via tax payment plans. Under certain circumstances, you may be able to set up an installment agreement or payment plan to begin paying off your debt if you do not immediately have the funds.

Also Read: Wages and other Income Amounts excluded from a Levy used to collect delinquent tax.

Requirements for the IRS to Issue a Levy

You may be issued a levy by the IRS if:

- The IRS determined that you owe tax and sent you a tax bill called a Notice and Demand for Payment,

- You refused or have not paid the tax, and

- The IRS sent you a levy notice (or Final Notice of Intent to Levy or Notice of Your Right to a Hearing) at least 30 days before the levy occurs. The notice may be mailed to the last known address via certified or registered mail or left at your home or usual place of business. You may also receive a notice about your state tax refund if the IRS levies your state refund.

When you do not pay your taxes owed to resolve your debt via direct payments now or by making payment arrangements with the IRS and they determine that a levy is the next action to take, they may levy any property or right to property you own or have an interest in. The property can be yours, but is held by someone else. Examples include the following:

- Wages

- Retirement accounts

- Dividends

- Bank accounts

- Licenses

- Rental Income

- Cash loan value of your life insurance

- Commissions.

The IRS could also seize and sell property that you hold, such as your house, car, or boat.

Below is a sample list of IRS notices you might receive which lists the amount due, when it's due, and your payment options. Each notice includes an IRS phone number to call on the top right corner if you have questions or disagree with the notice.

Types of IRS Lien Notices and Letters

You could receive one or more IRS notices based on the status of your unpaid taxes.

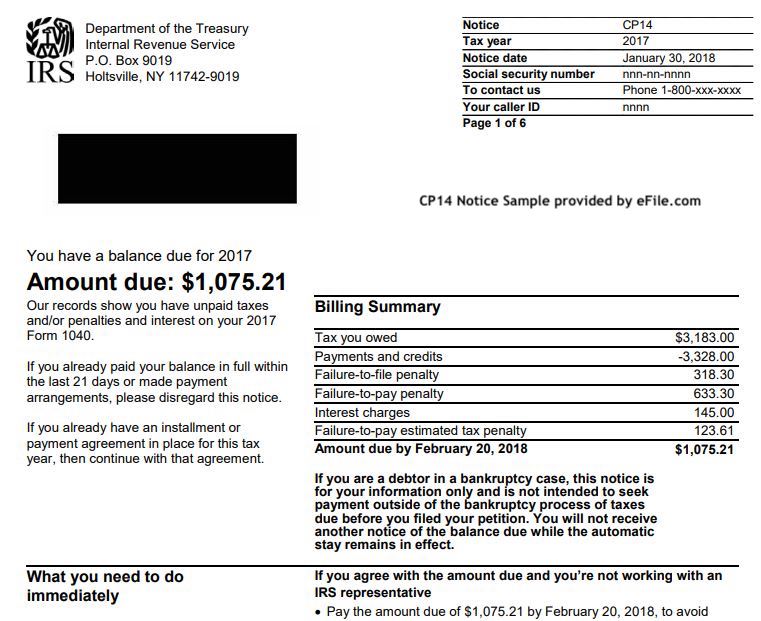

CP14

The IRS sent you this notice because you have a tax balance you have not paid yet. You can disregard the notice if you already paid all your taxes owed within 21 days of the date of the notice or made payment arrangements with the IRS. If you do not pay the amount on the notice within 21 days, you will face additional penalty and interest fees. The notices on CP14 and CP14 IA letters are about unpaid taxes and their payment options. Recently the IRS added QR bar codes in order to assist taxpayers to go directly to the IRS site in order to access tax accounts and arrange for a payment plan or to contact the taxpayer advocate service.

Click image to enlarge

Click image to enlarge

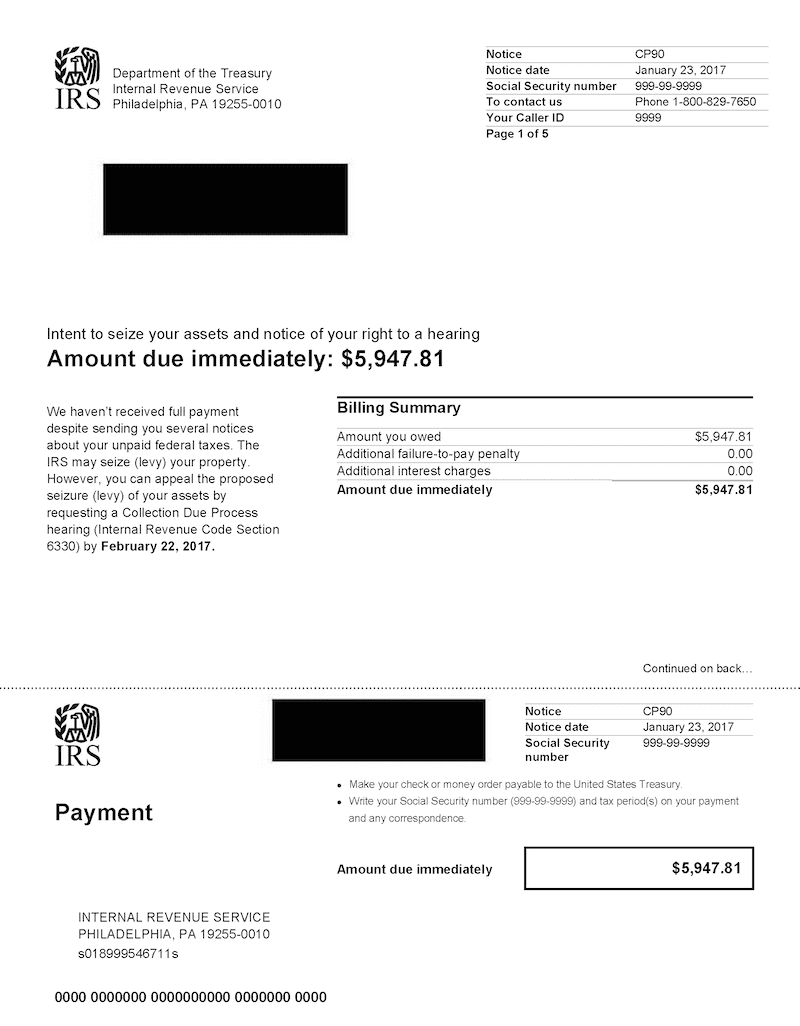

CP 90

Final Notice of Intent to Levy. This notice will inform you about your unpaid taxes and that the IRS plans to levy to collect the amount owed. If you wish to appeal, you need to file

Form 12153.

Click image to enlarge

Click image to enlarge

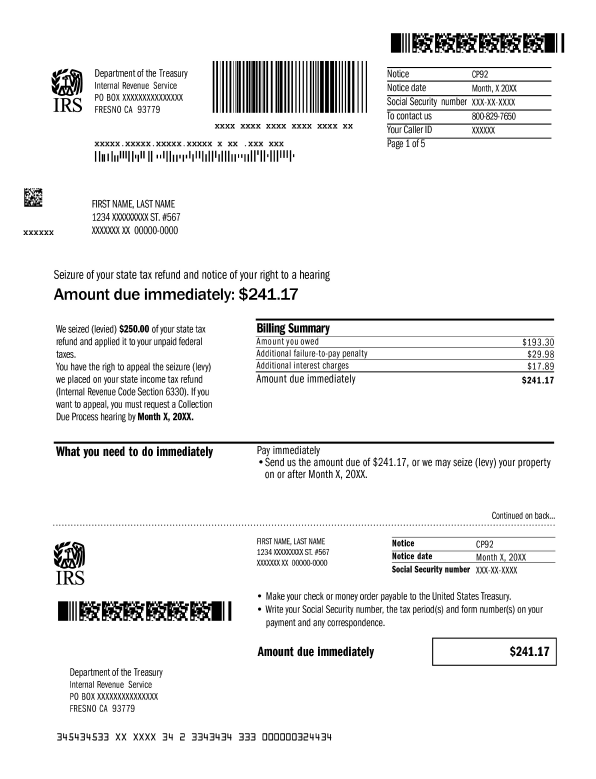

CP92 or CP242

Notice of Levy Upon Your State Tax Refund. The IRS will send this to you if the IRS levied your state tax refund to pay your unpaid federal income taxes. If you wish to appeal, you need to file

Form 12153.

Click image to enlarge

Click image to enlarge

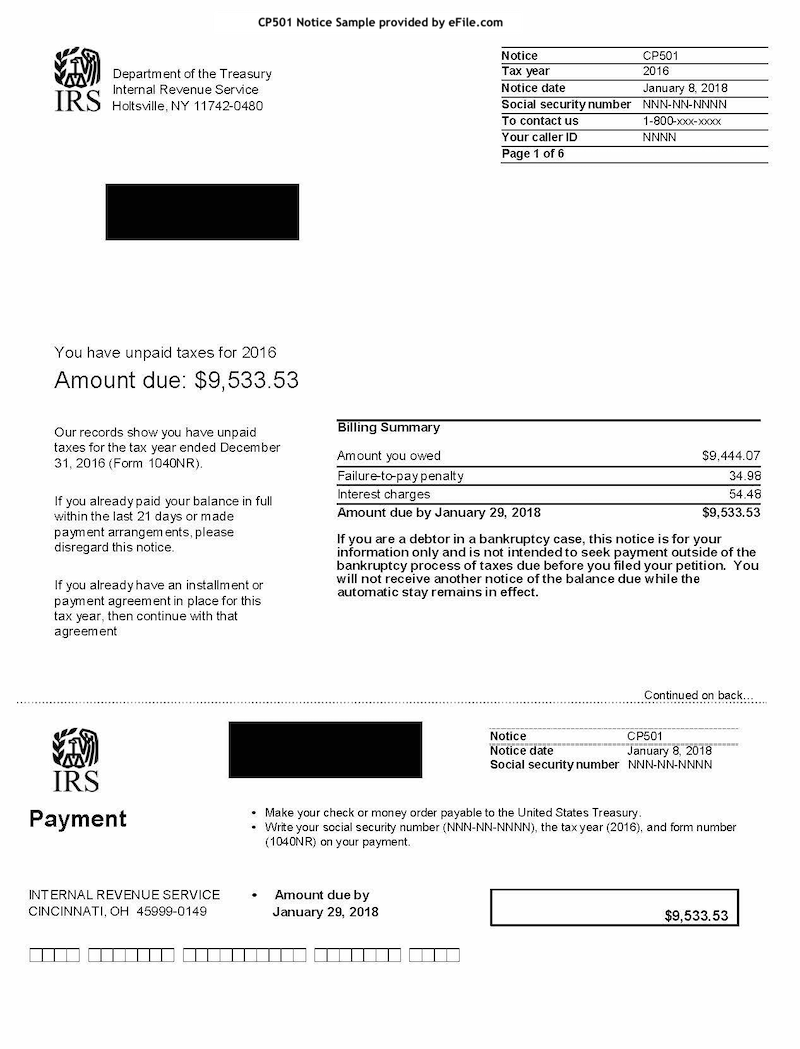

CP501

This notice states that you owe money to the IRS on one of your tax accounts. If the IRS has not done this yet, they can file a Notice of Federal Tax Lien on your property at any time if you have not paid your taxes now or have a payment or installment plan with the IRS. Also, if you don't pay the amount you owe by the due date listed on the notice, additional tax penalties may apply and interest will increase.

Click image to enlarge

Click image to enlarge

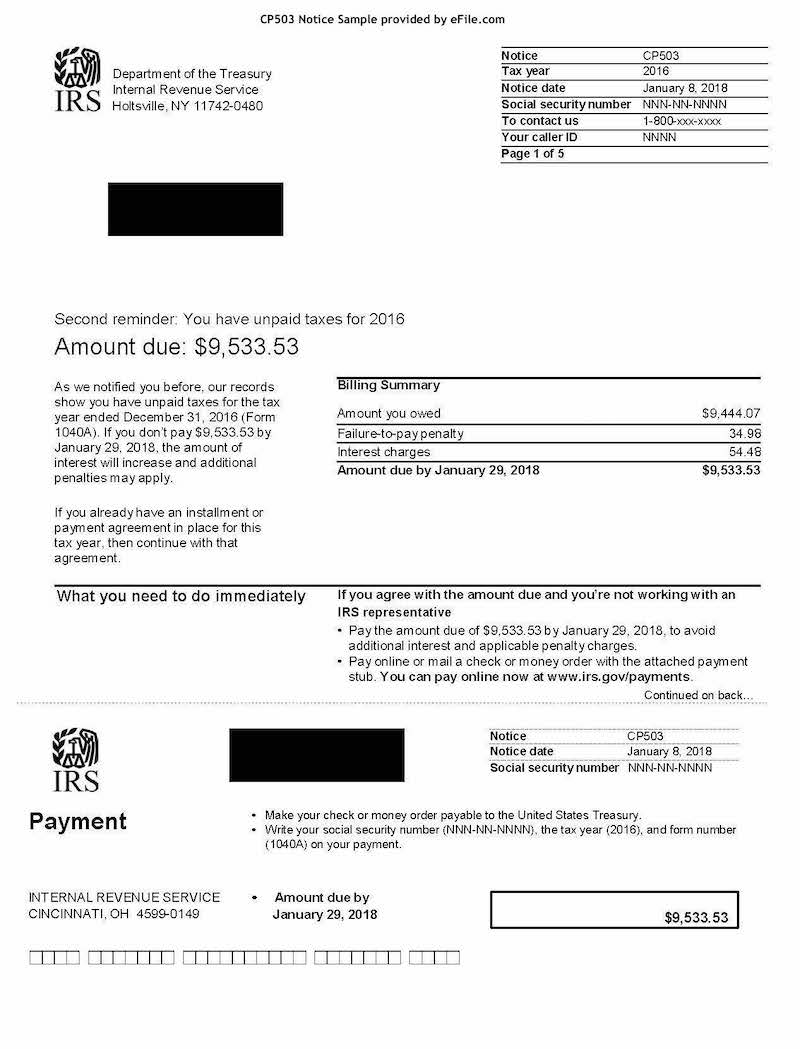

CP503

The IRS sent this reminder notice because you have not responded to any previous notices and you still have an unpaid tax debt. If you do not pay the entire balance owed within 10 days of the date of the notice, additional penalties and interest will be added to the balance you owe.

Click image to enlarge

Click image to enlarge

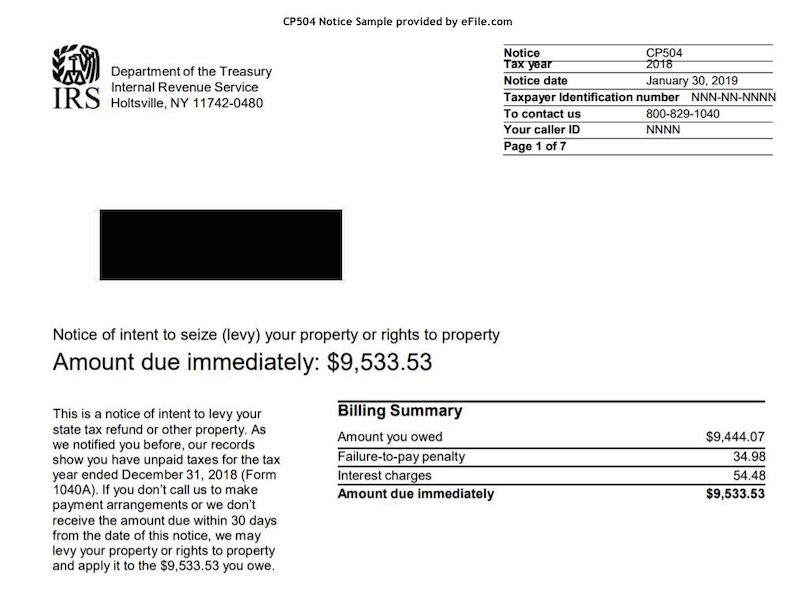

CP504

This notice states that you have an unpaid amount due on your account. If it's not paid immediately, the IRS will seize your state tax refund and apply it to your tax debt.

Click image to enlarge

Click image to enlarge

Letter 3172

You received this letter because the IRS filed a lien on you for unpaid taxes. If you do not agree with the letter, you can request an appeals consideration within 30 days from the date of the letter. File

Form 12153, Request for A Collection Due Process Hearing, and send it to the address shown on the notice in order to appeal the action with the Office of Appeals.

LT11 or Letter 1058

The IRS sent the letter to you because they have not received your payment on overdue taxes. You must contact them immediately since they intend to seize your property or rights to property.

To avoid a levy, file or e-file your tax return on time and pay your taxes when they are due. You can request a tax extension if you need more time to file a tax return. Important: An extension does not give you more time to pay taxes owed penalty free.

If you cannot pay what you owe, you should pay as little or as much as you can or set up a payment plan with the IRS, but always file a return, regardless of whether you can pay your taxes or not as the late filing penalties or interest fees are higher than the late payment penalties. Use the eFile.com PENALTYucator to estimate potential penalties. Then, work with the IRS on the remaining balance via a payment plan or offer in compromise. You should also not ignore any notices from the IRS.

Not sure if you owe taxes at all for a given tax year? Use the eFile.com free tax calculator during a given tax year so you are prepared when tax time arrives.

Tax Refund Calculator

Electronic IRS notices

The IRS is now providing online correspondence for the following CP series notices Taxpayers who receive one of the following notices with the link and access code can choose to upload their documents:

CP04: Relating to combat zone status.

CP05A: Information request related to a refund.

CP06 and CP06A: Relating to the Premium Tax Credit.

CP08: Relating to the Child Tax Credit.

CP09: Relating to claiming the Earned Income Tax Credit.

CP75 and CP75A and CP75D: Relating to the EITC

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.