The W-2 or Wage Income Form

Each employer reports annual taxable wage or salary based earned income to employees/workers via a W-2 Form by January 31 for the previous tax year ending on December 31. You can generally get your IRS W2 online - ask your employer for details. A copy of this same report is sent for each employee/worker by the employer via the W-3 Form to the IRS by January 31 as well.

Who Is Responsible for Submitting Copy A of the W-2?

In addition, Copy A of the W-2 is submitted by the employer to the Social Security Administration. An employee/worker receives a W-2 if at least $600 was paid during a year. The W-2 reports the income issued as well as the amounts withheld for taxes, healthcare, retirement, or other withholding program through the employer (see box 12 and box 14 codes in the table below). You will generally have to report your earned income as an employee even if you earn less than this and do not receive the form.

KEY TAKEAWAYS

- The W-2 form includes detailed information about an employee's income and deductions, including federal and state taxes, healthcare, and retirement contributions. Employees must report their income using this form, even if they did not receive it for earnings below $600.

- Employees are responsible for verifying the accuracy of their W-2 forms and must request corrections if discrepancies are found. Accurate W-2 forms are crucial for filing accurate tax returns and avoiding potential issues with the IRS.

- Tax withholdings determined by the W-4 form directly impact the final tax owed or refunded at the end of the year. Employees should periodically review and adjust their W-4 to reflect any changes in their financial situation.

- Employers are required to send W-2 forms by January 31, but employees should proactively seek these forms if they have not received them. Delayed W-2 forms can hinder timely tax filing and potentially lead to penalties.

The "W" in W-2 stands for "withholding'" and/or "wage" - we don't know what the "2" means, but we'll update this page once we find out! Or, let us know if you happen to know what the "2" might stand for.

While a W2 is for employers to complete and send to you, you complete and provide a W-4 to your employer to inform them of how much tax you want withheld from your paycheck. Completing your W-4 correctly is in your best interest; visit the extensive eFile.com W-4 calculator and help section to get the most out of your paycheck. Our W-4 calculators show you how much tax to withhold or how much withholding to claim.

The W-2 and W-4 forms go hand-in-hand; the W-4 that you, as an employee, submit to your employer determines what your W-2 will look like. If you withhold a lot of taxes during the year, this will show on your W-2. Your W-4 adjusts your withholding during the year while the W-2 summarizes your withholding after the year. The W-2 is the form you use to prepare your taxes via Form 1040.

Do I need to file taxes if I make $5,000 annually or less then the standard deduction amount for the 2024 tax year? How much do I need to make to file taxes? Find out here:

Start the FILEucator

W2 Vs 1099: What is the difference between a W2 employee and a 1099 employee? Whether it is better to be paid as a 1099 employee or a W-2 employee depends on your specific situation. If you can deduct enough of your self-employment income and expenses, being a 1099 recipient may be beneficial for you since you can no longer deduct job expenses for W-2 income. Generally, working as a W-2 employee is simplest and is the more traditional way of employment. With the rising gig economy, employment may be changing as freelance work gains popularity. As a W-2 employee, your employer pays half of your Social Security and Medicare taxes; as a self-employed person, you are responsible for all of this which is called self-employment tax which adds up to around 15% while a W2 employee only pays around 7.5%.

Note: The term "1099 employee" here is actually contradictory. When you receive a 1099 for work performed, you are generally not employed by the company, but are contracted; these workers are often 1099 contractors or freelance workers. This type of income is then reported on a 1099-NEC for non-employment compensation which is reported on Schedule C and Form 1040 - eFileIT.

Additional Resources:

Information About Your W-2

When you are a W-2 employee, your employer pays your wages via paycheck typically weekly, biweekly, or monthly. The pay you receive is generally not your full hourly or salary rate as different fees or deductions are taken out before you receive your net paycheck. These include FICA taxes (commonly known as federal payroll taxes), federal income taxes, state and local income taxes as applicable, retirement contributions, healthcare payments, and dependent care benefits as applicable.

Certain types of military pay are taxable income reported on a W-2; most military retirement pay is reported on a 1099-R. To get your W-2 from the military, this should be issued automatically, but you can generally use the Defense Finance and Accounting Service (DFAC) or Military MyPay for tax documents and statements. A W2 is issued for certain military income for active duty and reserve Army, Navy, Air Force, Marine Corps, and Space Force, and federal civilian employees by January 31.

You will generally need to file taxes if you receive a Form W-2 with taxes withheld. As a wage or salary employee, you may qualify for the free basic edition to prepare and e-file your federal taxes for free on eFile.com. If you withheld too much in taxes, get this money refunded to you now! How much you get back on your W-2 is based on many factors; if your withholding in Box 2 is too high for your income level, this will be refunded when you file. Let eFile determine this amount for you.

If you have other tax forms in addition to your W2, such as a 1099 Form reporting other income, you will file one tax return with all of this information. eFile handles the complicated tax forms for you - start for free here.

How to enter a W-2

to Your Tax Return

Detailed steps how to add your W-2 Forms to the eFile tax preparation app.

What Is a W-2?

The W-2 is a form that reports an employee's/worker's annual wage and salary income for a given 2024 tax year. The W-2 Form is generated and issued by an employer after December 31 for the given tax year and tells you how much money you made from this job and reports all deductions, deferrals, and withholdings.

Who Gets a W-2?

For any wage or salary amount you earn as an employee/worker, the employer has to issue a W-2 to you for a given tax year.

Tip income may be included on the W-2. As a nonemployee or independent contractor, you may not receive a W2, but a 1099-NEC instead; a statutory employee will receive a W-2, but is treated like an independent contractor. It is a widespread misconception that wages under $600 aren’t taxed or do not have to be reported. This is true for companies paying independent or self-employed contractors as they are not required to issue a 1099 for jobs less than $600. Workers who receive a W2 from a company with less than $600 in wages are still responsible for reporting it as there is no W-2 minimum amount to file.

W-2 Deadline

The employer is required to send you a copy - Part B and C of the W-2 - either by mail or electronically by January 31 following the 2024 tax year. You should receive the W2 for a Tax Year by January 31 of the following year.

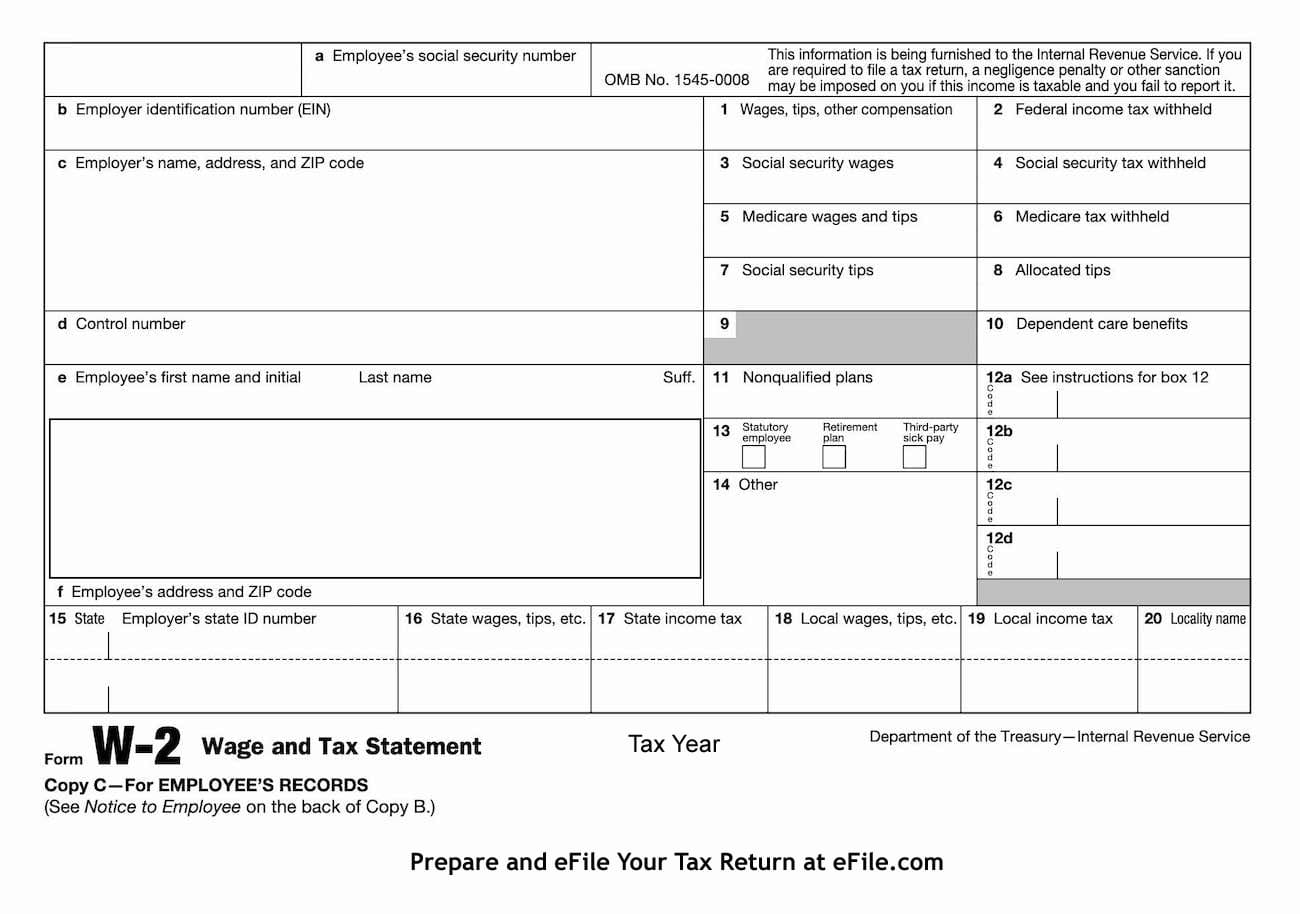

The W-2 is for employment and employee information and summarizes all wages and taxes. From the beginning, listed by box letter or number:

-a: Your SSN

-b: Your employer's identification number (EIN)

-c: Your employer's name, address (may be company's headquarters instead of local address), city, state, and zip code

-d: Control number assigned by company's payroll processing software that identifies your W-2 in your employer's documents (there may not be anything here)

-e: Your full name

-f: Your address, city, state, and zip code

- 1-20: Data for Income, Tax, Medicare,

Social Security,

Retirement, etc.

W-2 Boxes 1-8

The first eight boxes on your W2 report your income, federal taxes withheld, the amount of your wages subject to Social Security and Medicare with taxes withheld, and any tip income. Your federal income tax withheld in box 2 is taken from your wages, tips, and other compensation in box 1; for most, the amounts in boxes 1, 3, and 5 are the same, but this is not always the case.

W-2 Boxes 9-11

Did you know that Box 9 once reported

advance payments of the

Earned Income Tax Credit or EITC? This ended in 2010 and is now just a blank box on the form, though the IRS is testing adding a code here to

combat identity theft. Box 10 reports any distributions from your employer's nonqualified deferred compensation plan (this amount is already included in Box 1). Box 11 reports child and dependent care benefits provided by your employer which may affect your Dependent Care Credit and needs to be reported on your return.

W-2 Box 12 Codes

Box 12 contains amounts and a variety of codes for certain deferred compensation and other compensation or benefits, but do not be surprised if yours is blank. Some of the most common box 12 codes are:

- A: Uncollected Social Security or RRTA tax on tips

- B: Uncollected Medicare tax on tips

- C: Taxable cost for group-term life insurance

- D: Elective deferrals to a 401(k) program

- E: Elective deferrals to a section 403(b) plan

- J: Nontaxable sick pay (information only, do not include)

- Q: Nontaxable combat pay

- AA: Designated Roth contributions under a 401(k) plan.

All W-2 Box 12 codes are A, B, C, D, E, F, G, H, J, K, L, M, N, P, Q, R, S, T, V, W, Y, Z, AA, BB, DD, EE, FF, GG, and HH. We are unsure why certain letters are skipped and double letters are used - if you have this information, let us know!

W-2 Boxes 13-14

Box 13 is a checkbox section which is not checked for most people, but may indicate that you are a statutory employee, that you participated in the employer's retirement plan, and you received third-party sick pay. Box 14 codes and amounts are used for "additional information" which can be state disability income (SDI, CASDI, etc.), disability insurance taxes withheld, health insurance premiums deducted, educational assistance payments, and more. When you add this information on your eFile account, enter the code, the year for the W2, and the whole dollar amount.

W-2 Boxes 15 - 20

The remaining boxes report your state income and tax figures, including the two-letter abbreviation and ID number, state wages and tips, state income taxes withheld, local wages and tips, local income taxes withheld, and the locality name. Enter all of this information within your eFile account on the W-2 screen for this employer. eFile Tip: If the W2 form you received has no state wages and income taxes, do not select a state nor enter a state tax withholding amount on line 15 of your W-2 screen inside the eFile.com tax preparation app. If you do select a state, lines 16 and 17 on the W2 eFile.com app page will be required. In addition, if there are no local wages or local income taxes on your W2 form, leave those fields empty on the W-2 screen. See the help box for further details within the app.

Multiple Tax Withholding

Your employer might report tax withholding for two states - Box 17 - and localities - Box 19 - on the same W-2. If you are subject to additional state(s) or locality withholding, then the employer should issue an additional W2 for you, but it may also be on one W-2. You can add multiple states and localities within your eFile account by adding additional lines on the W-2 form page.

W-2 Accuracy

Step 1: Check the W-2 immediately for its accuracy: review the employer and employee information as well as all the numerical figures in boxes 1-20. Be sure these match your paystubs, paychecks, or other records.

Step 2: Report any inaccuracy immediately to your employer and request a new and correct copy before you e-file your taxes.

Obtain a Corrected W-2 or Form W-2c

The issuer, in most cases the employer, can create a

form of a W-2c as a result of a W-2 correction. The issuer or employer might provide you with this W-2c in order to correct an error, or you can request the form if you dedected an error on your W-2 on your own. If you received this form after you filed your tax return, you might have to file an

IRS tax amendment and/or

state amendment.

Step 1: Contact your employer to request a copy of the W2 either via mail or electronic submission. Also ask your employer if they submitted a copy of the W-2 to the IRS and state tax agency.

Step 2: If your employer does not respond or is no longer in business, you can call the IRS, request a transcript from the IRS, or select the

IRS Form 4852 on eFile.com when you e-file your taxes for the 2024 tax year as a substitute for Forms W-2, W2c, and 1099-R. Use this form on eFile.com if your employer/payer does not give you a Form W-2 or Form 1099-R, or the amounts on Form W2 or Form 1099-R are incorrect. If you later discover that the data you submitted on the Form 4852 does not match that of your W-2, you will have to file a tax amendment. For previous tax years, you can

complete Form 4852 for the respective tax year and submit it by mail with your tax return.

Did You Get Multiple W-2s?

When you prepare and eFile your taxes on eFile.com, you can add many different W-2s on the W-2 page; simply click Add W-2. As each employer you worked for during a given tax year is required to send you a W-2, you might have multiple W-2s to report on your tax return. Furthermore, you might get two or more W-2s from the same employer if you need to report income in multiple stats or localities.

Contact the IRS about your missing W-2(s)

If your employer does not respond and you have not received your W-2,

contact the IRS or call them at 1-800-829-1040. You will need the following information:

A: Your name, address, and Social Security number

B: Your employer’s name, address, phone number, and EIN -

see your paystub or paycheckC: The dates you worked for the employer

D: The estimated amount of wages you were paid and federal income tax withheld for the tax year. You could use your last paystub for the tax year to estimate these amounts.

You should also contact your

state tax agency as well.

Details on W-2 IRS Taxes Withheld in Box 2

You control the amount of taxes you have listed in Box 2 on your W2 via the Form W-4 you submitted to your employer who issued you the W2. We strongly encourage you to manage Box 2 or the taxes you withhold going forward through the

eFile.com Taxometer Calculator Tool. It's a free tool that helps you determine the right amount of taxes you should ask your employer to withhold with each of your paychecks. Set your

tax return goals now before you taxercise your paycheck.

What to Do with Your W-2(s)

When you eFile your Taxes on eFile.com, have them with you so you can enter them on the eFile.com W-2 screen or page. Depending on the payroll provider of your employer, eFile.com might import your W2(s) for you.

You will not have to submit the W-2 when you eFile your taxes via eFile.com. However, if you prepare and mail in previous tax year tax returns, you will have to include Copy B of the W2 with your IRS Return and Copy A of the W-2 with your state tax return(s).

Always keep copies of all your tax return related documents, including the W-2(s).

The W2 Form is a common tax form as most people earn income through employment. W-2 income is earned income that may qualify you for the Earned Income Tax Credit or EITC. This is one of many tax credits eFile.com will automatically determine if you qualify for and calculate it for you on your return. Create an eFile.com account and eFileIT while saving up for 60% on tax preparation fees when compared to popular e-filing platforms.

Once you have your eFile account created, enter your W-2 and other tax forms and see how much your refund will be. You may get money from a W-2 if you withheld too much in federal or state income taxes; how much you get back in taxes depends on how much you withheld as shown in box 2. In addition to any over withholding, eFile will add applicable tax credits to your refund and reduce your taxable income through tax deductions.

How Can I Obtain My W-2?

Your employer should issue you a copy of your W-2 and nothing should be needed of you to receive it. Generally, an employer may give you a hard copy, mail you a copy to your address on file, and some may email the copy, potentially upon request. If you are missing a W2 by the end of January, it is best to contact the employer and likely their human resources or HR department to get this issued or reissued.

Handle this through the employer as having an actual copy of the W-2 is better for your own records and preparing your return. When you prepare your taxes on eFile.com, each of the entries corresponds to the boxes on your W2, so having the official copy makes filing your taxes as simple as possible. You may be able to get a copy of your W-2 online if your employee's human resource department offers an online platform. Some use a third-party program where employees have their own login credentials where they can view their paychecks, time logged, tax forms, and more.

If you cannot get a copy of your employer for any reason (the employer is not cooperating, they are out of business, you no longer work there, etc.), you can still file taxes without your W-2 or 1099. You can add Form 4852 to your return on eFile.com by searching for and adding the form - contact us for help with this as needed. Form 4852 is the IRS form for substituting a missing or incorrect W2 or a 1099-R for retirement or pension income.

Tax Tip for the Filing Season: In order to e-File a tax return you will need your prior year tax return AGI or Adjusted Gross Income. Your prior year AGI is on form 1040 line 11 of your last year's tax return. You will need this amount to e-file for personal identification purposes during e-Filing. Details on how to locate the prior year AGI.

If you are missing some or all of your tax year income forms (W-2, 1099, etc.), you can order your wage and income transcript online. To do this, you will have to create an IRS Account which they offer for free. After creating an account or signing into your existing one, select Income Verification and download the transcript. These transcripts report the information on your W-2 as reported by your employer. You may also be able to retrieve a transcript from the Social Security Administration since the employer also reports this information to them as well.

Once you have the income information, prepare and eFile your Tax Return by the Tax Deadline in April.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.