The Modified Adjusted Gross Income - MAGI for 2025

On your tax return, the Modified Adjusted Gross Income (MAGI) helps decide if you can qualify for certain tax benefits like the Child Tax Credit, or deductions for your IRA contributions. You might come across guidelines that refer to income limits based on your modified adjusted gross income (MAGI), but what does this actually mean? Let’s break down what MAGI is and why it’s important for your taxes.

How the MAGI Is calculated for Tax Year 2025?

The Modified Adjusted Gross Income (MAGI) is used to calculate whether a taxpayer is eligibility or qualified for various tax benefits, deductions, and credits. The basis of the MAGI is the with Adjusted Gross Income (AGI), however certain deductions and exclusings are added back to the AGI.

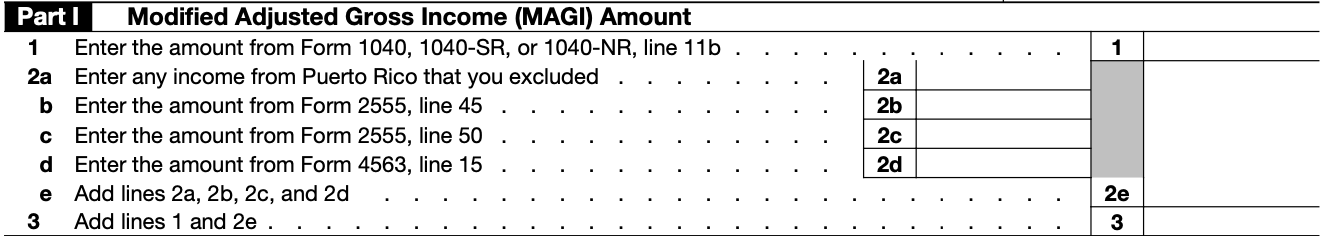

Step 1 on how to determine your MAGI: Get the AGI or adjusted gross income amount from line 11 from your tax return Form 1040 and then add the following amounts (based on what the MAGI is used for - see details below) to your AGI:

- Foreign earned income exclusion and foreign housing exclusion

- Tax-exempt interest income (from municipal bonds)

- Excluded savings bond interest (if used for education)

- Excluded employer adoption benefits

- Non-taxable Social Security benefits (for some calculations)

- Rental losses (if you’re a real estate professional)

- Student loan interest deduction

- Tuition and fees deduction

- Passive income or loss adjustments (in some cases)

MAGI for Specific Tax Benefits for tax year 2025 Returns

- A. IRA Contributions: (You or your spouse must be covered by a workplace retirement plan for this deduction to apply) Your MAGI (AGI plus traditional IRA deductions plus Student loan interest plus Tuition/fees deduction plus Foreign income exclusion plus other tax-exempt income) determines whether you can deduct contributions to a traditional IRA. For 2025, the deduction phases out for MAGI: $79,000–$89,000 (no deduction if above $89,000) for single/head of household. Married filing jointly: (Contributor is covered by workplace) $126,000–$146,000 (above $146,000 there is no deduction). (Contributor is covered by workplace, but spouse it not): Full deduction if MAGI is $236,000 or less and phase-out is from $236,000 to $246,000; no deduction above $246,000. Married filing separately: Partial deduction if MAGI is below $10,000 (no deduction is above $10,000).

- B. Roth IRA: If you can contribute to a and how much of your contributions you can deduct from a traditional IRA or 401(k). The key 2025 MAGI limits for Roth IRA Contributions are: Single filers: Full contribution if MAGI is less than $150,000; phase-out between $150,000 and $165,000 and not deductions if above $165,000. Married filing jointly: Full contribution if MAGI is less than $236,000; phase-out between $236,000 and $246,000; and not deductions above $246,000.

- C: Premium Tax Credit: Related tot he Health Affordable Care Act. MAGI (AGI plus tax-free interest plus foreign earned income exclusion plus Non-taxable Social Security income/benefits) is used to determine eligibility for the PTC. AGI plus untaxed foreign income plus tax-exempt interest, and plus non-taxable Social Security benefits. How much of the Premium Tax Credit (PTC) you are able to claim.

- D: Net Investment Income Tax (NIIT): Applies a 3.8% tax on the lesser of net investment income or the amount by which MAGI exceeds $200,000 for single/head of household or $250,000 for married filing jointly.

- E: SALT: The State and Local Tax deduction limits phase out starting at $250,000 (married filing separately) and $500,000 MAGI for married filing jointly taxpayers The threshold amounts will each increase by 1% annually from 2026 to 2029, then the cap reverts to $10,000 starting in 2030.

- F: Senior deduction: (max $6,000) when calculating social security income taxes for 2025 Returns. MAGI for the senior deduction means AGI plus foreign and certain territorial excluded incomes. MAGI phase out starts at $75,000 (ends at $175,000) for singles, head of household, married separate. For married filing jointly it starts at $150,000 (ends at $250,000). Find out your numbers via the eFile.com Social Security Income Tax Calculator.

- G: Medicare premium: The Medicare IRMAA (Income-Related Monthly Adjustment Amount) MAGI (AGI plus tax-exempt interest plus non-taxable social security income plus other untaxed income) thresholds for premiums for 2025 begin to increase for singles/head of household with a MAGI above $106,000 and for married filing jointly taxpayers with a MAGI above $212,000.

- H: The Lifetime Learning Credit is phased out for MAGI above $80,000 (singles, head of household) or $160,000 (married filing jointly).

- I: Child Tax Credit: This credit is available for single, head of household filers if the MAGI is $200,000 or below that amount and the credit phases out between $200,000 and $240,000. For married filing jointly filers if the MAGI is $400,000 or less and the credit phases out between MAGI $400,000 and $440,000.

Your MAGI (Modified Adjusted Gross Income ) isn’t listed on Form 1040, but you can use Line 11 to start with your adjusted gross income. As you can see above, the MAGI various depending on what it's used for. To figure out your MAGI in some cases, you'll need to adjust your AGI by considering certain tax deductions and tax-exempt interest. So, while your adjusted gross income is your total income after some adjustments, the modified AGI is another step further in adjustments.

MAGI for Tip Income, Overtime Pay, Car Loan Interest and Enhanced Senior deduction

The MAGI for the tip income, overtime pay, car loan interest and enhanced senior deduction is enhanced senior deduction is calculated and reported via the IRS Form Schedule-1-A for additional deductions for tax years 2025, 2026, 2027 and 2028. The eFile.com tax estimator will calculate the enhanced senior deduction when you estimate your next tax return and the social security tax calculator will let you know if you have to pay taxes on your social security income. Below is the outline as seen on Schedule 1-A for Form 1040.

- Form 2555 for Foreign Housing Exclusion and/or Foreign Earned Income Exclusion

- Form 4563 Exclusion of Income for Bona Fide Residents of American Samoa

Sound complicated? Don't worry! File online with the eFile Tax App. Our app calculates both your AGI and modified AGI for you. This means you can easily claim all the tax credits and deductions you’re eligible for without needing to be a tax expert.

Prepare and eFile Your Taxes Now

Already have an eFile.com account? Sign In

Your Adjusted Gross Income (AGI) is a crucial number for determining how much of your income is taxable. It’s your income after taking into account specific deductions, known as adjustments to income. These adjustments can include things like student loan interest payments and Health Savings Account (HSA) contributions.

However, the standard deduction and the Qualified Business Income (QBI) Deduction, if you have self-employment income, are not included in the AGI calculation. Instead, these are subtracted later when calculating your taxable income.

To calculate your Modified Adjusted Gross Income (MAGI), start with your total gross income, calculate your AGI, and then add back any above-the-line deductions.

Here’s a simple breakdown using Form 1040 to see how AGI and MAGI are calculated—note that eFile does this for you automatically:

Step 1: Start with Form 1040 for the current year.

Step 2: Add up all your income listed on lines 1-8, which totals on line 9.

Step 3: Subtract adjustments to income from Schedule 1 to get your AGI, shown on line 11.

Step 4: To find your MAGI, add back those adjustments to your AGI.

Step 5: Next, subtract your standard deduction or itemized deductions, and any QBI deduction if applicable, to get your taxable income.

Step 6: eFile will then apply the tax brackets or rates and calculate your total taxes on line 16.

Your AGI is an important figure when it comes to taxes because it is needed as a form of identity verification when you file your taxes next year - learn more about filing with your AGI so you do not need to scramble to find it this year.

Estimate your taxes here to get an idea of your gross income and adjusted gross income. You can then use this to better understand which credits and deductions you qualify to take, though eFile will determine this and calculate it all for you.

Use online tax filing software like eFile.com to handle these complicated calculations for you. eFile will claim all savings you are qualified for based on simple entries so you do not need extensive tax knowledge file your taxes online.

More Help

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.