Tax Return with Zero Income

When and how do I file a tax return with little or no taxable income?

Follow the instructions below to eFile a tax return if you had little or no earned income during the year. Only then do you follow these instructions below.

Low income or non-filer types of income include:

- Social Security Income

- Nontaxable disability income (SSDI) or Supplemental Security Income (SSI)

- Foreign income excluded 2555 or Foreign Income Tax Exclusion

- Nonresident alien 1040-NR return

- If you need to claim any of the three COVID stimulus payments, follow these instructions.

- Attention: It's very important to know that the zero Income tax return is NOT TO BE used if you did have taxable income. Only follow these instructions if you indeed had zero income in during the tax year.

Follow the instructions below ONLY to e-file a tax return if you had 0 zero income income during the year or are generally not required to file a tax return. In some cases, you can also use these instructions to file your return if you had 0 Income in during the tax year and if your spouse filed a tax return as married filing separately.

You may need to file a tax return or want to, even if you do not have any taxable income. To do so, you can use the instructions below to force the return to generate as not adding any taxable income will not allow you to file.

Follow these steps:

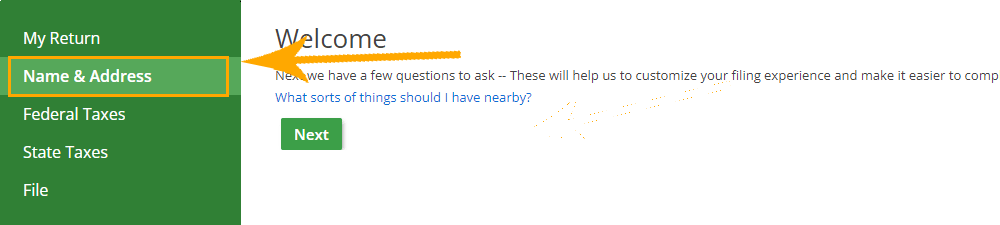

2. Enter your personal details.

Start the tax interview process by entering your personal details on the "Name & Address" screen.

3. Click on Federal Taxes in the left menu.

4. Click on Review under Federal Taxes.

5. Click the link I’d like to see the forms I’ve filled out or search for a form.

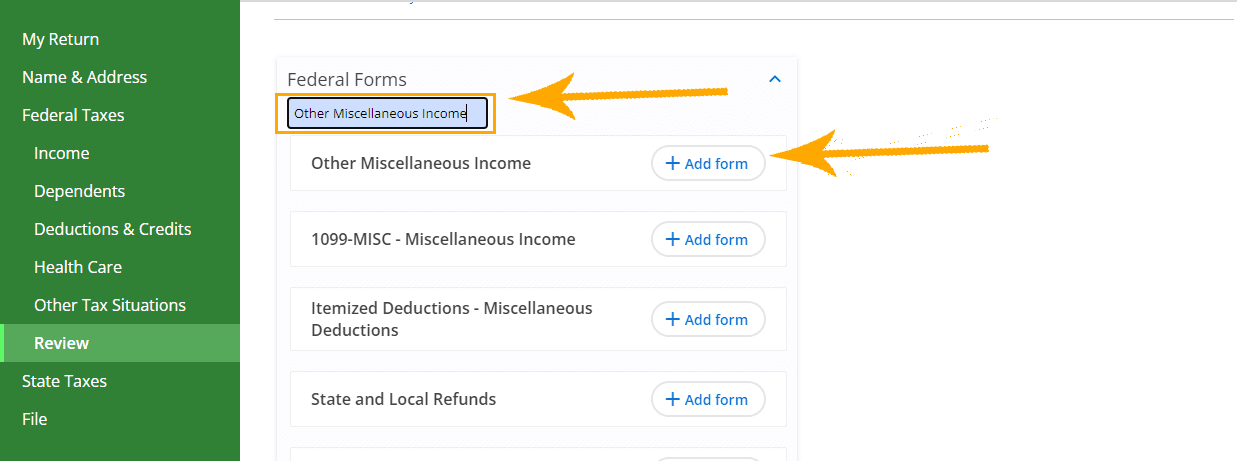

6. Add Form "Other Miscellaneous Income".

In the search field, enter "Other Miscellaneous Income" and then click the "+Add form" button next to the Other Miscellaneous Income heading.

7. Click the link I still don't see what I'm looking for. at the bottom of the Other Miscellaneous Income screen.

8. Click the link Add another.

9. Click the link I want to add my own income description.

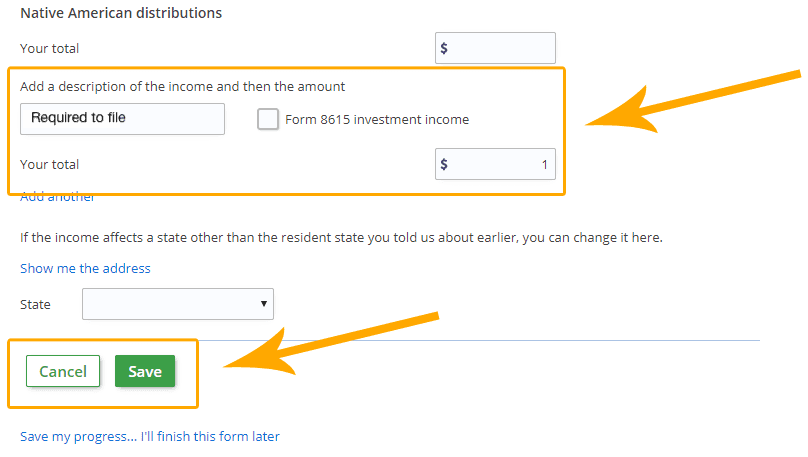

10. Enter Required to file.

Enter "Required to file" in the description box and $1 in the Your total box. Click the "Save" button when done.

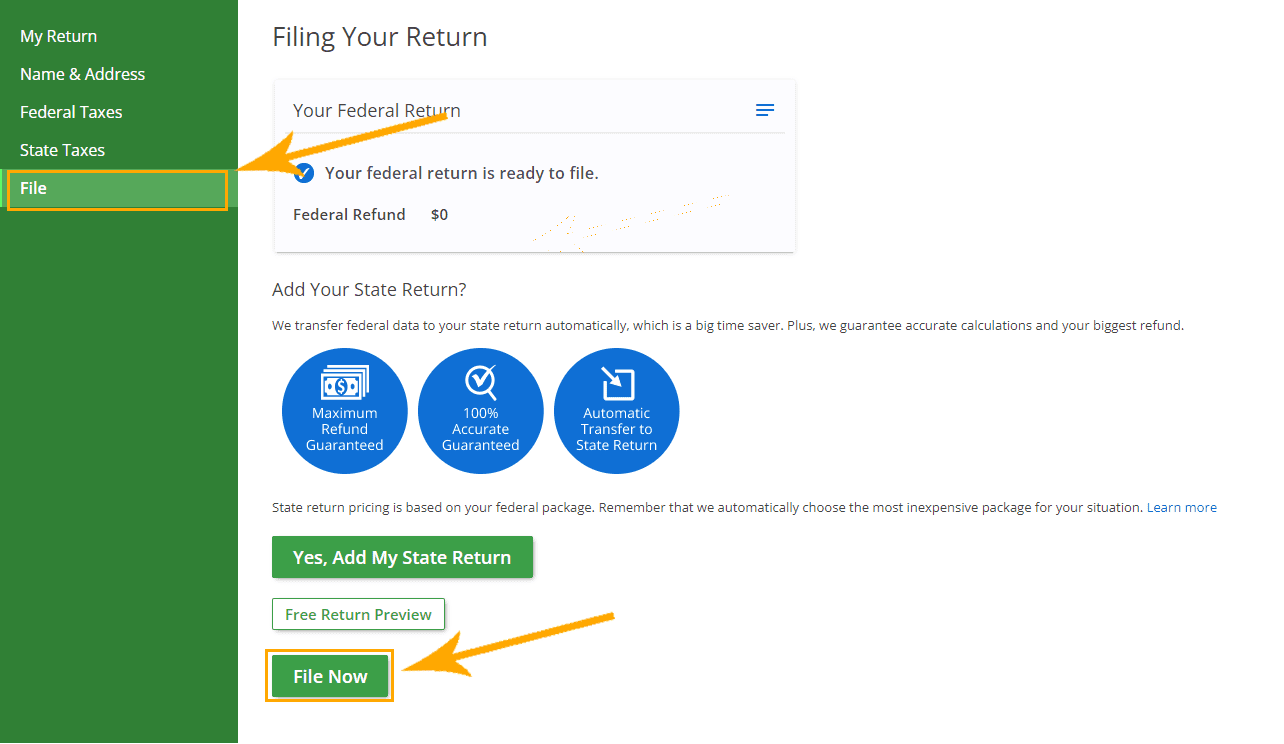

11. eFile your tax return

You can now proceed to file your tax return by clicking File on the left menu of your eFile.com account screen. If you are asked for a payment, contact us for instructions to file for free.

Start Free Now

Already have an eFile.com account? Sign In

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.